Sharpfin, a Stockholm-based provider of wealth management software, will boost its delivery capacity after closing its latest crowdfunding round according to CEO and founder Markus Alin.

Just weeks after deciding to extend its equity crowdfunding round on Invesdor, the startup has raised more than SEK2.7m from 67 investors, beating its initial SEK1.65m target.

Sharpfin’s mission is to automate the wealth management administration process with ‘the vision to be the first portfolio management system ever to run completely administration free’ according to Alin.

The company offers a front, middle and back office portfolio management system for banks, asset managers and family offices.

Its database has ‘full traceability’ regardless of the action in the system, and offers a AI book keeping algorithm and a market unique compliance rules engine. This means its customers can program the system themselves to ensure pre and post trade compliancy.

“We are driven by efficiency and are based on the same highly scalable platform that e.g. WhatsApp and Klarna uses in their core”, Alin added.

“There is strong focus on quality, flexibility and usability both for our customers and our customers’ customers.”

With more than 20 years of business experience behind him, Alin’s decision to launch Sharpfin was grown out of how ‘tidy and old fashioned’ existing portfolio management systems are.

“If you are interviewing wealth management firms hardly no one shares the same passion for their system as the common Apple product users does for their iPhone or MacBook. On the contrary they are all quite unsatisfied with their systems. We find this a huge market opportunity and focus strongly on providing as solution which wealth managers actually like to use.”

The new money will be used to hire additional developers to increase its delivery capacity. However, boosting the sales is currently not an issue according to Alin, due to a lot of ‘promising customer requests’.

Shapfin’s decision to peruse a crowdfunding round with Invesdor was down to its desire to target many small investors.

“First and foremost we believe in diversification. Having many small investors is basically better for them since they can be more diversified in their investments”, Alin added.

“The common intelligence is also shown to be more successful than having a small number of investors. By reaching out to a crowd we are more likely to get many followers on our social media channels which will be increasingly important for our sales in the future.”

Swedish FinTech

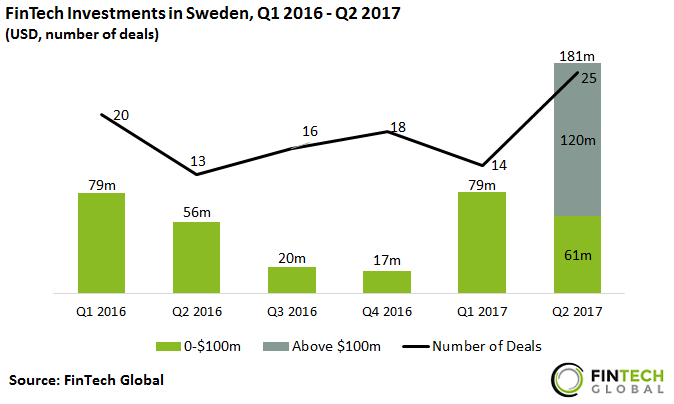

Total FinTech investments in Sweden picked up in the first half of 2017 as deal activity hit record levels in the second quarter of the year according to data by FinTech Global.

Swedish FinTech companies received $181m in funding across 25 deals in Q2 2017, which is more three times the $56m invested in Q2 2016. The 25-deal haul also made Q2 2017 a record quarter for FinTech investments in Sweden.

Copyright © 2017 FinTech Global