The majority of buy-side firms are still a way off from being MiFID II compliant; however, RegTech will be pivotal to the industry in the future according to Craig Wallis, partner and head of trading at OSMO Partners.

The second Markets in Financial Instruments Directive (MiFID II) will be officially implemented on 3 January 2018. It offers more protection to investors in trading, covering a wide range of areas such as transparency of costs and research payments.

However, for many investment firms this is the first time they have seen such in-depth regulatory intervention, presenting challenges right across a broad spectrum for the buy-side according to Wallis.

“It touches the core of any investment manager from the systems they use (OMS, PMS and EMS) through to how they store trade data and the requisite data points needed to meet regulatory obligations”, he said.

Firms are facing a host of challenges in the next few months, with most still some way off where they need to be in terms of reaching their regulatory reporting obligations.

Wallis said, “In my opinion only the very largest of asset managers will be completely ready for MiFID2 given their extensive budgets and resources thrown at regulation for January 2018. Medium to small sized investment managers, to some degree, will still have gaps in their readiness for MiFID2 and that’s where OSMO can help by plugging those gaps.”

With MiFID II aiming to protect investors and ensure transparency, visibility in record keeping and reporting is essential. As a result, transaction reporting is arguably the most disruptive MiFID II requirement in terms of technology and compliance.

Is RegTech the answer?

As the challenges to compile with ever-changing regulation mount up, RegTech is seen by many as a highly reliable technology solution for the compliance landscape.

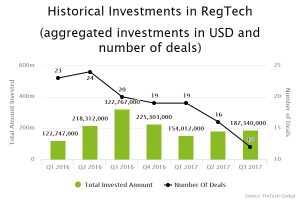

In the first three quarters of the year, more than $523m has been invested across the global RegTech industry according the data by FinTech Global. E-commerce fraud protection provider Signifyd has scored the biggest deal of the year to date, nabbing $56m in a Series C funding round in May. With the final quarter of the year to go, 2017 could match the record high of 2016, which saw a total of $888.7m invested across 86 RegTech deals.

With FinTech and InsurTech having already marked their presence, RegTech has the potential to follow suit and simplify the entire financial services industry.

With FinTech and InsurTech having already marked their presence, RegTech has the potential to follow suit and simplify the entire financial services industry.

As older and more established tech companies fail to deliver new solutions that are relevant to today’s world, ‘new RegTech companies are stepping in to service the market with excellent new, fresh looking products’ according to Wallis.

“RegTech startups are pivotal to the industry and will play a huge part in years to come. Development of new products and solutions is what drives innovative approaches to solving the ever-growing regulatory burden that investment managers face”, he added.

Earlier this month, London-based OSMO Partners and Hedgd launched a new full service Approved Reporting Mechanism (ARM) offering in order to satisfy MiFID II Transaction Reporting obligations.

Under the partnership, OSMO Partners will provide the regulatory reporting operations to ensure that reporting obligations are met, while Hedgd will act as a post-trade aggregator to collect trading data, map identifiers and output the data to an ARM.

By reporting all transactions to a single ARM, the reporting obligations are streamlined and the liability of transmitting personal data to a broker is removed.

“Data management and technology hold the key to successfully meeting MiFID2 requirements from Transaction Reporting to best execution and Venue Reporting for RTS28”, Wallis added.

“We perform extensive data validation and enrichment to ensure that the ARM specifications are met right across the asset class range. OSMO’s operational staff will perform daily exception management with the ARM on behalf of clients, making the process as painless as possible for our clients.”

Copyright © 2017 FinTech Global