Online payments and subscriptions developer FastSpring has picked up an undisclosed majority investment from Accel-KKR.

California-headquartered FastSpring provides subscription-based platforms for digital commerce companies around the world. The company offers payment processing, recurring billing, and management solutions.

The SaaS-based platform also takes care of the back-office processes like tax compliance, reporting, chargebacks and analytics.

This partnership will provide capital and resources for continued investments in to the company’s technology and its go-to-market strategies.

FastSpring CEO Chris Lueck said, “FastSpring has exhibited strong growth over the last several years by building an end-to-end platform that makes it easy for our customers to sell digital products around the world. We are excited about the opportunity ahead, and we believe Accel-KKR’s experience partnering with software businesses will be valuable to us as we enter our next stage of growth.”

Last year, Accel-KKR formed a partnership with UK-based Reapit, which gives real estate and letting agents with software that supports sales, lettings, property management and client accounts. The partnership was formed to support the expansion of Reapit’s solutions and develop its existing ones.

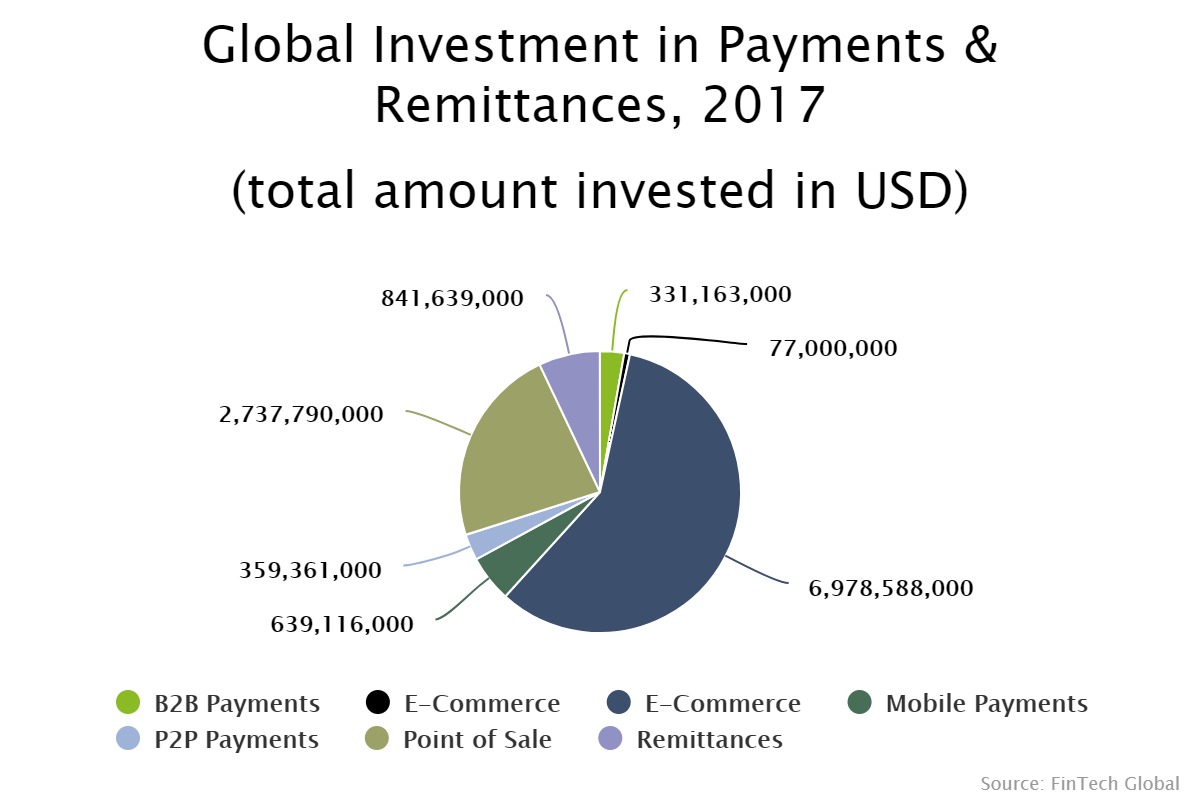

E-commerce companies received the biggest proportion of capital deployed to the payments and remittance sector, picking up 58 per cent of the investment total. The sub-sector saw $6.9bn invested, with POS solution developers collected a total of $2.7bn, making it the second most funded sub-sector.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global