The high level of capital raised in H1 2019 was due to five deals over $100m

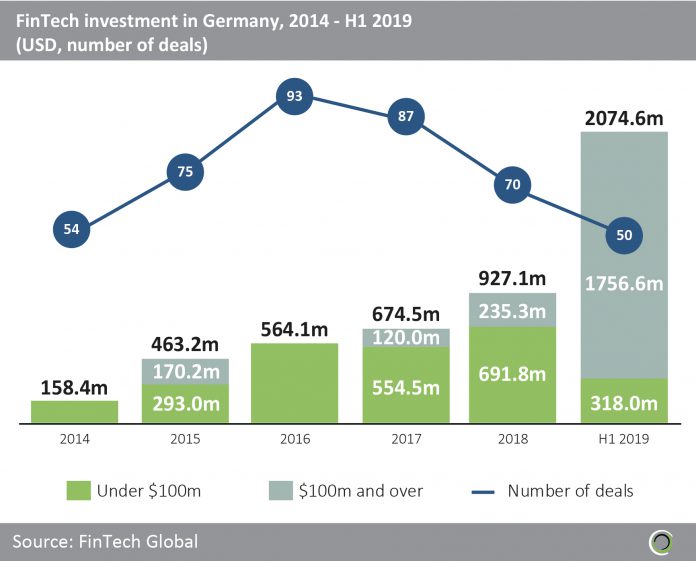

- Total value invested in German FinTech companies topped $2.07bn across 50 deals in the first six months of 2019. The capital raised so far is equivalent to 74% of total investment between 2014-2018.

- The strong start to the year can be credited to five large transactions, each valued at over $100m. These five funding rounds made up 84.7% of total investment in H1 2019.

- The largest deal so far this half was Wirecard’s $1bn post-IPO equity round, accounting for 52.5% of funding raised in the first half of the year. The company offers electronic payment transaction solutions worldwide, as well as the issuing and processing of physical and virtual cards. Wirecard, which already has offices in Europe, Australia and parts of Asia, is looking to expand further into Japan and South Korea using this funding.

- Although deals in excess of $100m are the main driver of the growth in FinTech funding in Germany, deal activity was also elevated in H1 2019 with 50 deals, compared to 35 deals in H1 2018, indicating the increased interest from investors.

The proportion of FinTech deals in Germany valued above $50m has almost quadrupled between 2015 and H1 2019

- The German FinTech landscape has witnessed a shift over the last 5 years from investors predominantly backing smaller deals towards making more late-stage investments.

- The proportion of deals valued below $1m fell from 43% in 2014 to just 10% in 2018, indicating the growing maturity of the landscape. Previously, many FinTech companies in Germany were in their infancy and therefore mainly attracted small deals, but as the landscape matures, investors are willing to invest more. Further to this, investor appetite for FinTech is increasing and as Germany establishes itself as a large FinTech hub, companies in the country are of interest to investors.

- The share of deals valued above $25m increased by 30 percentage points (pp) from 3% in 2014 to 33% in H1 2019.

Five of the top deals since 2014 in Germany happened in the first six months of the year

- There have already been five funding rounds this year that have entered the top 10 deals since 2014.

- Of the top 10 deals, there was investment across five subsectors: Infrastructure and Enterprise Software (Deposit Solutions), InsurTech (FRIDAY and wefox Group), Marketplace Lending (Auxmoney and Kreditech Holding), Payments and Remittances (Wirecard), and WealthTech (N26 and Raisin).

- The second largest funding round from H1 2019 was N26’s $300m series D round, which constituted 14% of the total amount invested during the period. This funding round pushed N26 to become one of Europe’s most valuable FinTech startups, with a value of $2.7bn. N26 is looking to use the funding to expand into the US to challenge the biggest US retail banks such as JP Morgan and Bank of America, who have recently launched their own mobile-only banking offerings.

- The top 10 FinTech deals in Germany have collectively raised $2.5bn, making up 51% of total amount invested since 2014. In comparison, top deals in the China only make up 31% of total amount invested since 2014. As deal activity in China since 2014 is similar to Germany (408 vs 429 deals), this exemplifies the impact large deals are having in Germany.

Capital raised by WealthTech and Payments & Remittances companies has contributed nearly 50% of FinTech funding in Germany since 2014

- Transactions completed by German WealthTech companies have been a significant driver of investment in the German FinTech space. Companies in this subsector have attracted the most deal activity, securing 89 deals since 2014 and making up over one in five deals during this period. Additionally, the WealthTech subsector has attracted a high level of investment, securing more than $1bn since 2014, 22% of total investment during that period.

- Companies in the Payments & Remittances subsector are also driving investment in the country, securing more than $1.3bn since 2014 and making up over a quarter of funding across this period. Despite high levels of capital, deal activity in this subsector was not dominant, making up only 12% of total deals. The previously mentioned $1bn raised by Wirecard makes up 82% of the total investment attracted by companies in this subsector since 2014, explaining the discrepancy.

- The other category, which accounts for 23% deals, includes Institutional Investments & Trading, Blockchain, Data & Analytics, Funding Platforms, Cryptocurrencies, RegTech and Real Estate subsectors. Despite nearly one in four deals coming from one of these subsectors, they only account for 8% of total investment, indicating smaller, early-stage ventures within these subsectors.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global