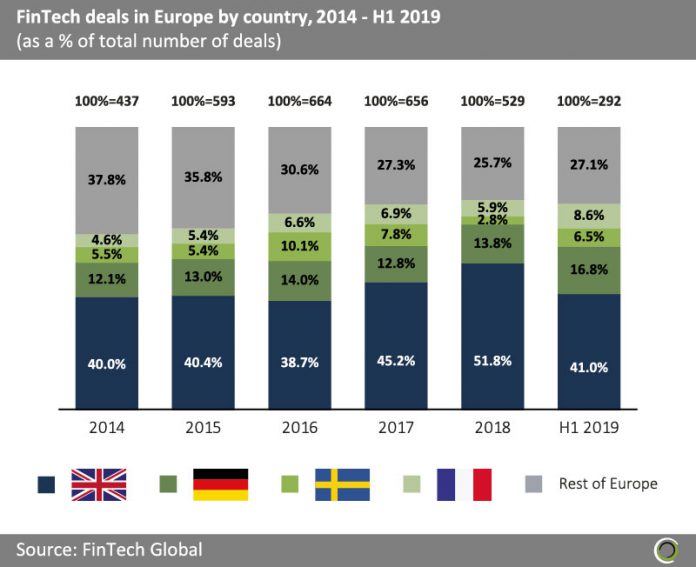

Germany, France and Sweden play catch-up to the UK which has dominated the FinTech landscape in Europe since 2014

- There have been over 3,000 FinTech deals completed across Europe since 2014, with companies in the UK, Germany, Sweden and France dominating deal activity in the region over the past five and a half years.

- The dominant role that these countries play in the European FinTech landscape can be explained by the fact that they are the largest economies and populations in the region and have established financial centres, with Paris and Berlin vying to dethrone London as the FinTech capital of Europe.

- Although not the largest economy or population, Sweden has been a major hub for technology and innovation in Europe, with the Wharton School of Business referring to the country as a “unicorn factory” in a 2015 study.

- The UKs share of deal activity averaged 42.9% between 2014 and H1 2019, with the vote to leave the EU having only a marginal effect on the share of deal activity, which dipped to 38.6% in 2016 from 40.4% the previous year.

- Switzerland, the Netherlands and Spain have been the next most active destinations for deal activity on the continent, with 157, 118 and 114 deals completed respectively between 2014 and H1 2019.

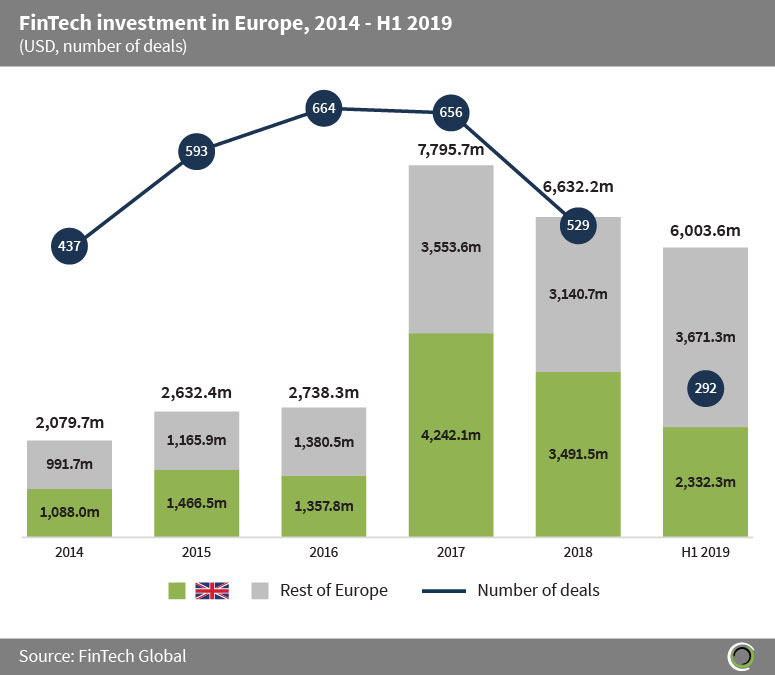

More than 90% of the capital raised last year has been invested in the first half of 2019 already

- FinTech Investors injected more than $27.8bn into companies in Europe between 2014 and H1 2019, with 3,171 deals completed in the region during the period.

- FinTech companies based in the UK captured half of the capital invested in Europe between 2014 and H1 2019, followed by German companies which received a 17.5% share of the funding in the region during the period.

- Funding almost trebled between 2016 and 2017, driven by larger deals, with 17 transactiions valued at $100m and above in 2017 compared to just one in this deal size range in 2016. BGL group, a digital distributor of insurance products based in the UK, raised $695.8m of private equity funding from Canada Pension Plan Investment Board in Q3 2017, in what was the largest FinTech deal in Europe that year.

- Funding in H1 surpassed $6bn, equal to 90.5% of the total capital raised in 2018, setting strong expectations for the rest of the year.

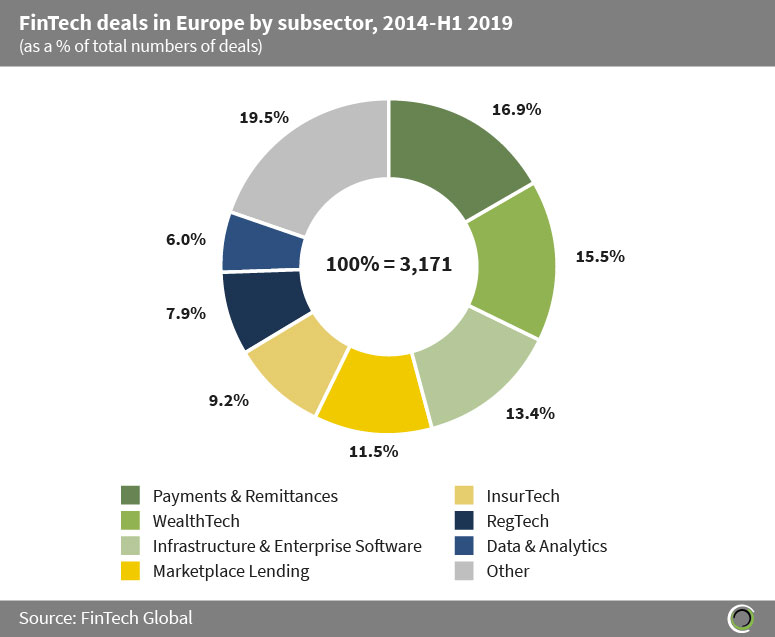

Investors in Europe have been active across a wide variety of FinTech subsectors since 2014

- Investors in Europe have been attracted to all subsectors within FinTech, with no dominant subsector, with regards to deal activity, emerging over the past five and a half years.

- The landscape in Europe for innovation can be felt right across the FinTech value chain but Payments & Remittances and WealthTech companies have taken a slight lead over other subsectors, capturing 16.9% and 15.5% of total deal activity in Europe respectively, between 2014 and H1 2019.

- The WealthTech subsector in Europe has been heavily driven by the introduction of digital and neo banks which look to cater to a more tech savvy millennial population that is currently present in Europe. The largest deal involving a B2C digital bank was the $300m Series D round raised by N26, a challenger bank based in Berlin, in Q1 2019. The challenger bank, which has a full European banking license, operates across 24 markets and expanded to the US in June 2019.

- Almost a fifth of all deals in Europe involved companies in the ‘Other’ category of FinTech subsectors which include Funding Platforms, Blockchain, Crypto, Institutional Investments & Trading and Real Estate.

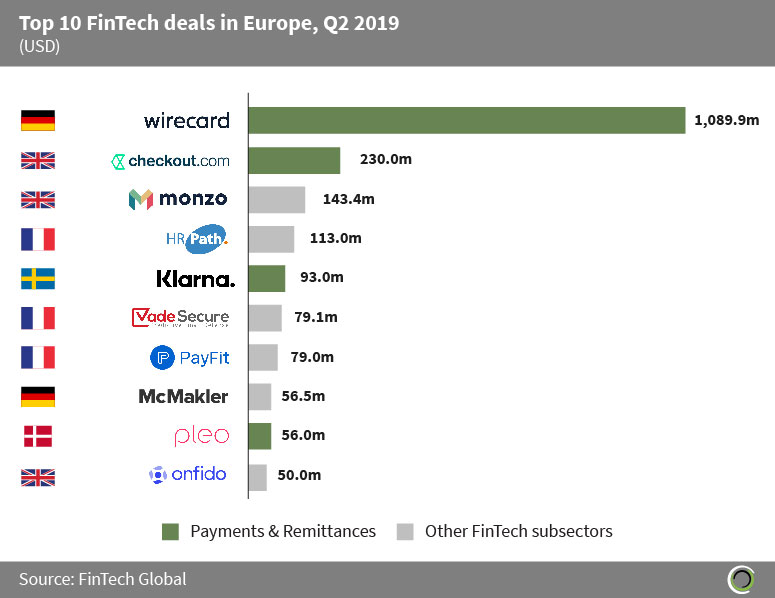

Almost $2bn was raised in the top 10 deals in Q2 with Payments & Remittances companies leading the way

- Almost $2bn was raised across the top ten FinTech deals in Europe in Q2 2019, with companies based in the four most dominant countries in Europe for FinTech deal activity present.

- The list consists of companies that operate right across the FinTech value chain including RegTech (Cade Secure, Onfido), WealthTech (Monzo), Infrastructure & Enterprise Software (HR Path, PayFit) and Real Estate (McMakler) but, Payments & Remittances was the most represented with four deals.

- WireCard offers electronic payment transaction solutions worldwide, in addition to issuing and processing physical and virtual cards. The Berlin-based PayTech company, which already has offices in parts of Asia, raised almost $1.1bn in a post-IPO equity round in order to fund further expansion into Japan and South Korea.

- Pleo, a smart payment card for employees based in Copenhagen, was the only company involved in one of the top ten deals last quarter not located in the UK, Germany, France or Sweden. The company raised $56m in a Series B round led by Stripes Group in May 2019, valuing the company at $450m.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global