Point of Sale (POS) is a subcategory of Payments & Remittances which enables online and offline retailers to facilitate payments. POS companies captured 20.6% of Payments & Remittances deals in Europe between 2014 and H1 2019.

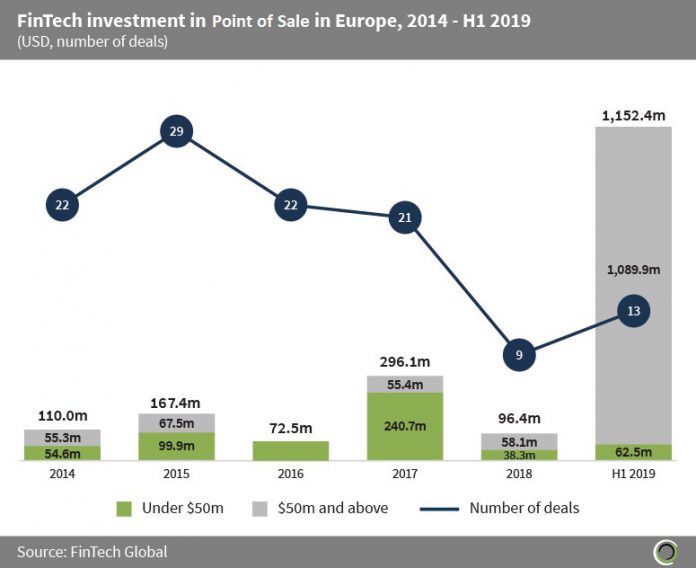

Nearly $1.9bn was invested in POS companies in Europe between 2014 and H1 2019 across 116 transactions. Funding grew at a CAGR of 60% during the period to a record of over $1bn in the first six months of the year. This record year was driven by Wirecard’s $1bn post-IPO Equity round in Q2 2019 led by Softbank. Wirecard offers electronic payments solutions worldwide and is looking to use the capital to expand further into Japan and South Korea.

Deal activity is also up with 13 deals completed in the first half of 2019 compared to only seven completed in H1 2018. The increase in both total funding and deal activity is unsurprising due to the worldwide move towards becoming a cashless society and as such, merchants who traditionally only accept cash are looking to accept payments in a different way.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global