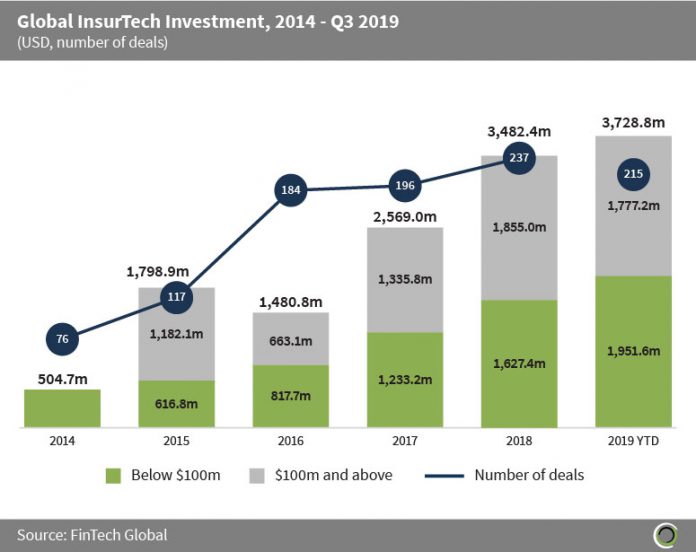

Almost $4bn was raised by InsurTech companies globally in the first nine months of 2019

- There were more than 1,000 InsurTech deals completed globally between 2014 and Q3 2019, with over $13.5bn invested across these transactions.

- Investment increased at a CAGR of 49.2% between 2014 and Q3 2019, with half of the capital raised during the period invested in deals valued at $100m and above. Consequently, the average deal size increased from $6.6m in 2014 to $17.3m in the first three quarters of 2019.

- InsurTech companies have raised more than $3.7bn across 215 deals so far this year, which is 7% higher than what was invested in full year 2018, setting strong expectations for the remaining three months of the year.

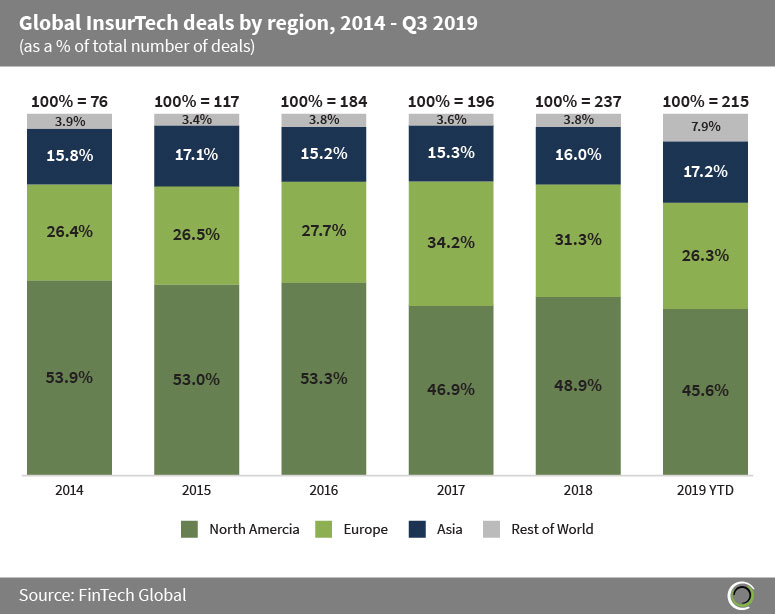

Companies outside of Europe and North America captured a quarter of InsurTech deals in the first nine months of the year

- Growth in the InsurTech space has been felt internationally which, according to Accenture, has been driven by investors responding to global consumer appetite for incumbent insurance companies to engage in digital transformation.

- North American InsurTech companies have dominated deal activity relative to other regions, capturing 49.5% of the deals that were completed between 2014 and Q3 2019 however, North American companies’ share of deal activity did drop from 53.9% to 45.6% during the period.

- The share of deals has been shifting towards Asia and the Rest of the World, with the proportion of deals involving companies in the Rest of the World more than doubling from 3.9% in 2014 to almost 8% in the first three quarters of 2019.

- Investors and corporates are now recognising the opportunities of funding digital transformation, as part of a broader innovation strategy, in less established markets of the world. Huddle Insurance, an AI-powered provider of car, home and travel insurance based in Sydney, raised $19.3m in Q4 2018 to take on industry heavyweights in the Australian market. This is the largest InsurTech deal involving a company outside of North America, Europe or Asia to date.

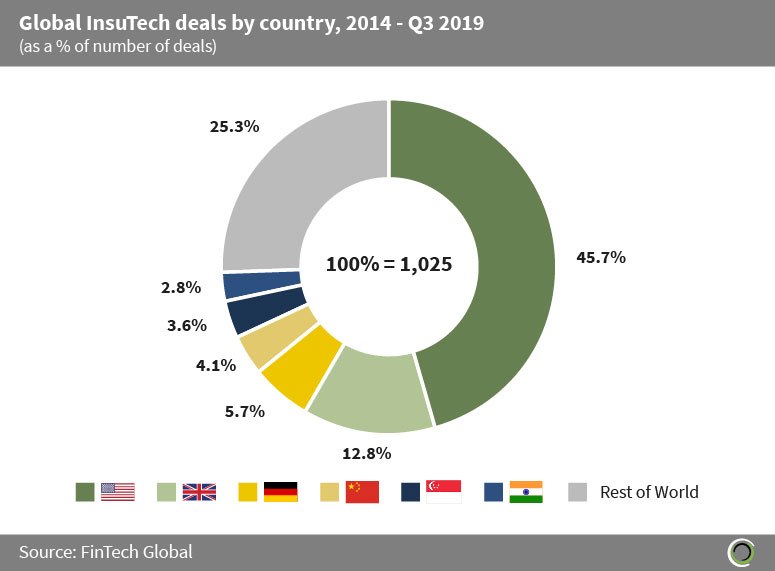

US InsurTech companies have captured almost half of all global deal activity in the sector since 2014

- If we drill down further into the regional distribution of InsurTech transactions, companies based in the US, UK and Germany captured 64.2% of InsurTech deals between 2014 and Q3 2019.

- The InsurTech landscape in the United States is abundant with companies looking to provide technology-first solutions to tackle the bureaucracy associated with the claims processes of the Medicaid and Medicare programs.

- Oscar Health, a provider of health insurance plans to families and individuals in New York, New Jersey, California, and Texas, is one of the most well-funded InsurTech companies in the world having raised $1.3bn since its founding in 2012. The New York-based company most recently raised $375m from Alphabet (Google’s parent company) in August 2018, with aims of bringing its product to more cities and allowing it to start selling to seniors through Medicare Advantage.

- InsurTech companies in the UK were involved in 131 deals, the second largest number of transactions after their US counterparts between 2014 and Q3 2019, which is equal to more than one in eight deals globally during the period. Zego, a London-based provider of flexible insurance targeting operators in the gig economy, raised $42m in Q2 in what was the largest InsurTech deal in the UK this year so far.

- Companies in Singapore were involved in 3.6% of deals, which is the second largest share in Asia after China, where InsurTech companies in the country captured 4.1% of deals. Digital life insurance provider Singlife raised $90m from Sumitomo Life Insurance Company in July. This is the largest InsurTech deal in Singapore this year and one of the largest InsurTech deals globally in Q3 2019.

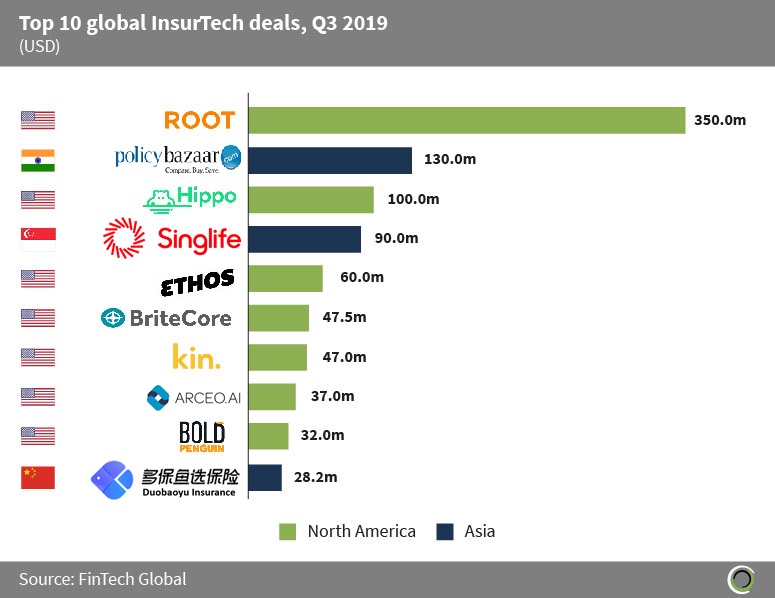

Large InsurTech deals help drive Q3 funding above $1.1bn globally

- Almost $922m was invested in the top 10 InsurTech deals globally in Q3 2019, with all ten deals involving InsurTech companies based in North America or Asia. The funding raised in the top 10 deals in Q3 was equal to 79.8% of the total capital raised during the quarter, compared to 74.1% in Q1 2019 and 77.8% last quarter.

- Root Insurance provides auto insurance by tracking drivers and rating how well they drive, The Columbus, Ohio-based InsurTech raised $350m in a Series E round led by DST Global and Coatue Management in August 2019. This is the largest InsurTech deal of the year to date and Root, which is now valued above $3.6bn, will use the funds to continue product innovation and build upon its growth strategy

- Policybazaar is India’s largest and leading insurance aggregator website. The company was founded in 2008 and has raised almost $500m of funding since 2011. Policybazaar raised $130m from Tencent Holdings, at a $1.5bn valuation, in September, which was the second largest InsurTech deal globally in Q3 2019. Post investment, Tencent will acquire anywhere between 7% and 10% equity in Policybazaar.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global