Nearly $2.8bn was raised by RegTech companies last quarter

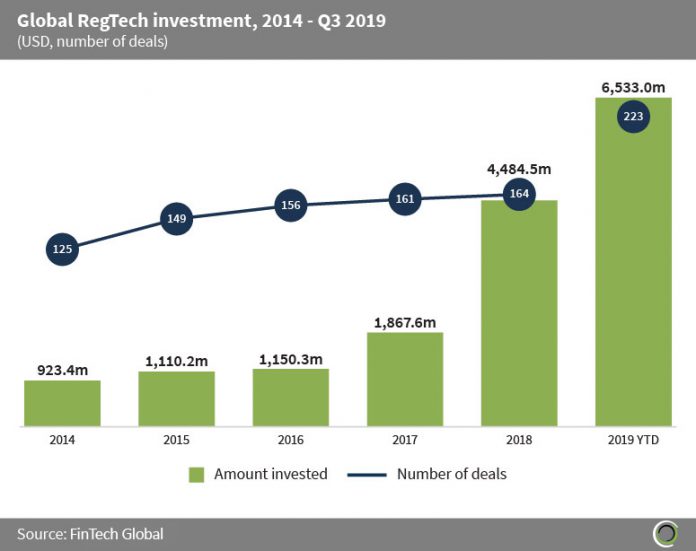

- RegTech companies have raised over $16bn since 2014, across almost 1,000 transactions, yielding an average deal size in the sector of $16.4m, with nearly 70% of this funding raised in the past seven quarters.

- Investment has been in an uptrend over the past five years, growing almost five-fold between 2014 and 2018, as funding increased from $923.4m in 2014 to $4,484.5m last year.

- More than $6.5bn has been invested in RegTech companies during the first three quarters of 2019 across 223 deals, the strongest year for RegTech deal activity to date.

- Of the more than $6.5bn that was invested in the first nine months 2019, almost $2.8bn was raised in Q3 2019, with 68 transactions completed during the quarter. This is a new record, surpassing the $2.4bn that was raised in Q2 2019.

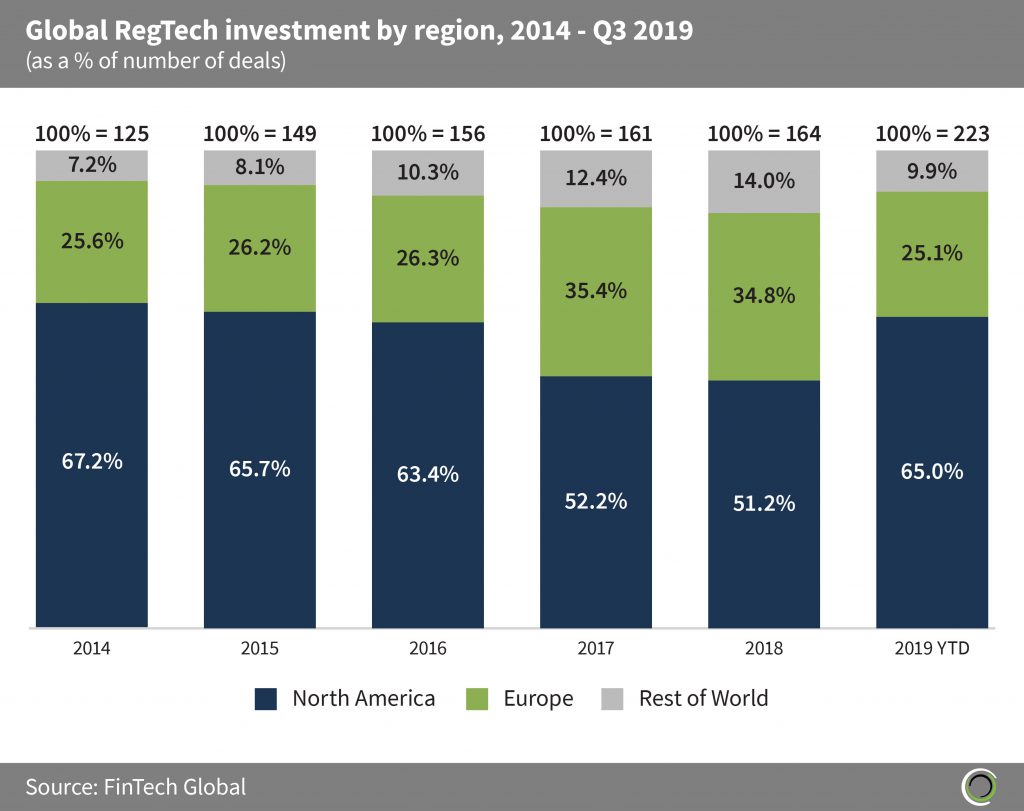

More than one in ten RegTech deals globally since 2014 have involved companies based outside of North America and Europe

- There was a shift in the concentration of global RegTech deal activity from North America to other regions of the world between 2014 and 2018. Although North America has dominated the global RegTech landscape with 594 transactions completed between 2014 and Q3 2019, the region saw its share of total deal activity drop from 67.2% in 2014 to just over half of all deals 2018.

- However, the proportion of deal activity involving companies in North America rebounded this year, accounting for almost two thirds of transactions in the first three quarters of 2019.

- Prior to 2016, the ‘Rest of World’ category was defined purely by Israel, Australasia and Asia, however, three RegTech companies in Africa; ThisIsMe, DocFox and Intergreatme raised capital in May 2016, May 2019 and June 2019, respectively.

- Israeli RegTech companies captured 4.3% of global RegTech deal activity between 2014 and Q3 2019, with $543.2m raised across these deals during the period. Aqua Security is a cybersecurity and compliance solutions provider based in Tel Aviv. The company raised $62m in a Series C round led by Insight Partners in April 2019, which is the largest RegTech deal in Israel to date.

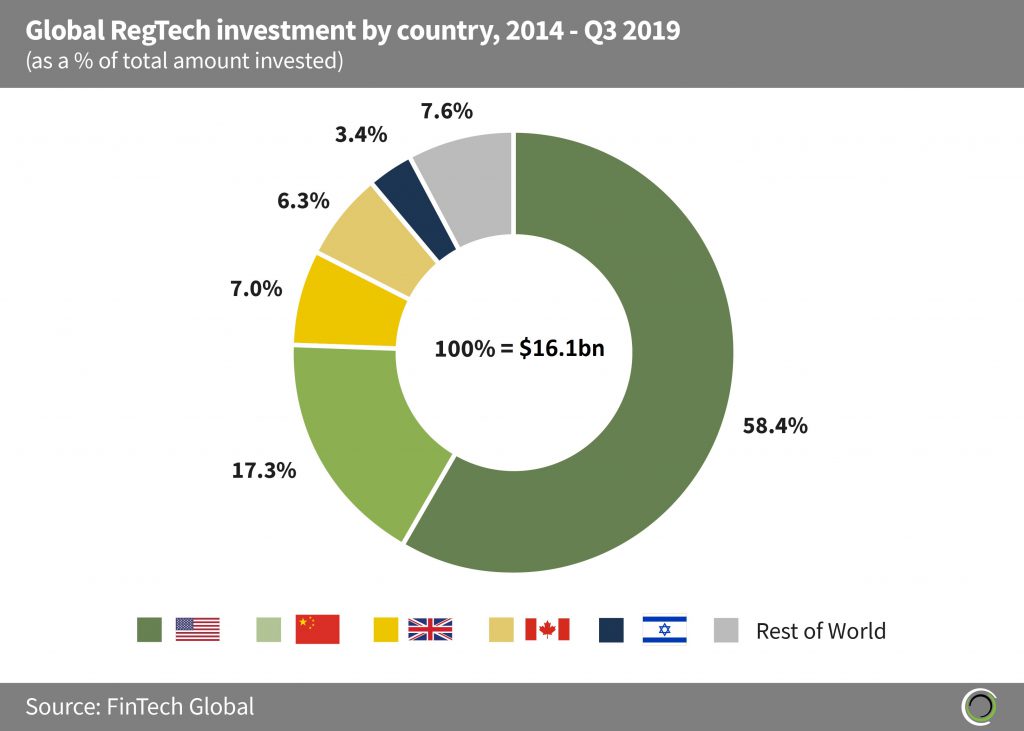

North American RegTech companies have captured almost two thirds of the capital invested in the sector globally since 2014

- Investors poured $16.1bn into RegTech companies globally between 2014 and Q3 2019, with companies in the US, China, UK, Canada and Israel capturing 92.4% of the capital invested during the period.

- The US, as a world leader in capital markets and regulatory compliance, has dominated the RegTech investment landscape, with $9.4bn invested in RegTech companies in the country between 2014 and Q3 2019.

- Cybersecurity companies in the US raised over $1.6bn in the first three quarters of the year, which is equal to 38% of the total capital raised by RegTech companies in the US this year, as investors and cyber solution providers front run the potential introduction of GDPR like regulation being implemented in North America.

- Companies in Canada, despite only capturing 3.5% of deal activity, raised over $1bn between 2014 and Q3 2019, with two companies; Verafin (fraud detection solution provider) and Element AI involved in two of the largest RegTech deals globally in Q3 2019.

- Element AI provides cybersecurity and insurance underwriting risk management solutions, and is headquartered in Montreal. The company raised $150m in a Series B round in September 2019 from investors including McKinsey, valuing the company at $650m.

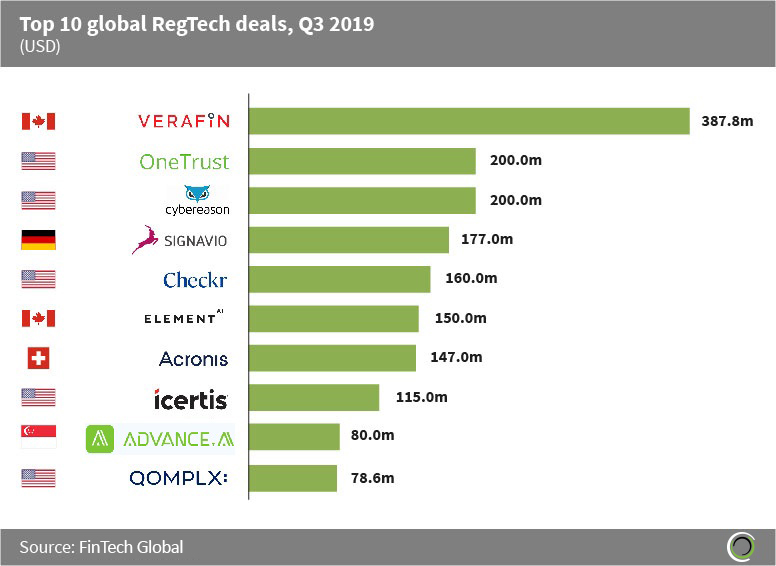

Just under $1.7bn was raised in the ten largest RegTech deals globally last quarter

- Almost $1.7bn was raised in the ten largest RegTech deals globally in Q3 2019, which is equal to 61% of the total capital raised in the sector last quarter.

- North American companies dominated the list with two Canadian companies and five US companies represented.

- Verafin is a Canadian cloud-based cross-institutional software platform for fraud detection and management, serving more than 2,600 banks and credit unions. The company raised $387.8m in a private equity round led by Spectrum Equity and Information Venture Partners in September 2019, in order to aggressively pursue growth plans. This was the largest RegTech deal of Q3 2019 and the largest RegTech deal in Canada to date.

- Signavio is a business transformation suite offering solutions for compliance and risk management. The German RegTech company raised $177m in a Series C round, at a $400m valuation, led by Apax Digital in July, making it the largest RegTech deal in Europe between 2014 and Q3 2019.

- ai provides e-KYC and ID recognition solutions to financial institutions across the APAC region. The company, which is headquartered in Singapore, raised $80m in a Series C round led by Pavilion Capital and Gaorong Capital to spur growth in Asia. This investment which came from additional investors such as GSR Ventures and Unicorn Ventures was the largest RegTech deal in Asia last quarter.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global