Venture capital investor Luge Capital is looking to give Canadian FinTech startups a power boost through its new $85m fund just as the country is experiencing a FinTech explosion.

Luge Capital is a startup in some ways itself, having only launched back in 2018. Nevertheless, this budding enterprise aims to use its new financial muscles to inject between $150,000 and $2m into seed-stage startups, TechCrunch reported.

The VC firm is backed by iA Financial Group, BDC Capital, Caisse de dépôt et placement du Québec, Desjardins Group, La Capitale, Sun Life Financial and Fonds de solidarité FTQ.

Luge Capital has already made five investments. That includes leading app and bank account connecting company Flinks’ $1.75m fund back in July last year. Founded in 2017, the company is connecting around 200 FinTechs and banks across Canada, US and Europe to more than 250 million Canadian financial accounts.

Other recipients of its money include customer onboarding firm Owl and InsurTech firm Finaeo. And it is planning to tap into more of the Canadian FinTech scene, although it is also interested in startups in the US.

“We’ve seen growth in terms of absolute numbers of FinTech companies,” Karim Gillani, co-founder of Luge, told TechCrunch. “We think it’s because there’s new access to capital. Companies can now find themselves getting funded and there’s a bigger appetite for larger companies to partner with these startups.”

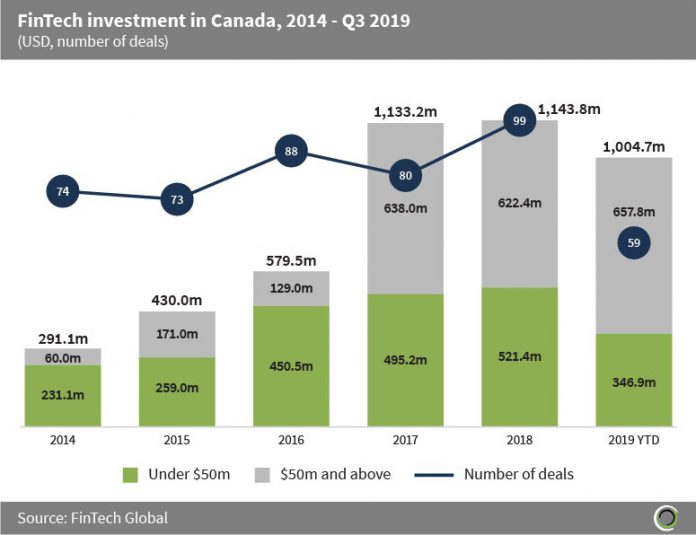

The news about Luge Capital’s new fund comes as the Canadian FinTech scene is having a bit of a moment. For instance, the investment into the country’s FinTech scene has grown tremendously in the last six years.

Back in 2014, FinTech businesses residing in the Great White attracted $291.1m of investment, according to FinTech Global’s data. That number jumped in the following years, reaching $1.14bn in 2018.

And 2019 could be another record year, with $1bn having already been invested in the Canadian industry. In total, Canada’s FinTech sector has attracted nearly $4.6bn since 2014.

Moreover, new data from the professional services firm EY estimates that 78% of Canadian consumers are using at least one FinTech solution in their daily lives.

Commenting on the report, Ron Stokes, EY Canada FinTech Leader, said, “FinTech adoption has evolved significantly in Canada over the past two years alongside the evolution of customer priorities and the rise of money transfers and payments. FinTechs are no longer seen as just disrupters to the traditional financial services industry – they’re sophisticated competitors, ready to meet the changing expectations and needs of customers.”

Copyright © 2019 FinTech Global