Blueground has closed a $50m funding round co-led by Prime Ventures and WetCap Investment Partners.

The ProptTech startup will use the Series B round to expand upon its proprietary technology, product design, guest experience and further expand its presence in both the US and Europe.

Blueground’s concept is based around the idea of leasing ideally located properties and upgrading them to fully furnished and thoughtfully equipped apartments that people can rent conveniently.

“For property owners, partnering with Blueground is an ideal solution,” said Alex Chatzieleftheriou, co-founder and CEO of Blueground. “We offer a steady yield, 100% guaranteed occupancy and manage all the work to enable a seamless guest experience. We are excited to expand our relationships with leading developers and property managers across the world.”

Nick Kalliagkopoulos, principal at Prime Ventures and new member of Blueground’s board of directors as part of the deal, said, “Through leveraging the power of technology, Blueground has developed a unique value proposition and approach to this emerging space in the market. We are impressed by what the team has achieved to date and look forward to helping lead this new chapter of the real estate industry.”

The venture capital firm also participated in small business lender iwoca’s £150m Series D funding round in February this year.

The startup also announced that it will launch its London portfolio by the end of 2019 and that it plans to offer 250 flats in central London by the end of next year.

Blueground has the ambition of expanding into 50 cities by 2023. It is currently running a portfolio of over 2,800 flats in nine cities around the world, including New York, San Francisco, Los Angeles, Boston, Washington D.C., Chicago, Athens, Istanbul and Dubai.

“We are very pleased to be launching in London and to begin operating in a recognised business hub for so many,” said Chatzieleftheriou. “London is an excellent addition to our existing locations and we are really confident that it will become our largest European market soon.”

“In preparation for our launch in London, we looked closely at the city’s current rental market and the demand for our services, assessing the potential to provide top quality ready-to-move-in apartments with the ultimate goal of transforming our guests’ London living experience. As with all of our cities in operation, we are building a dedicated team in London.

“We are excited to see how our operation in London will shape the future of our company and prepare us for further expansion.”

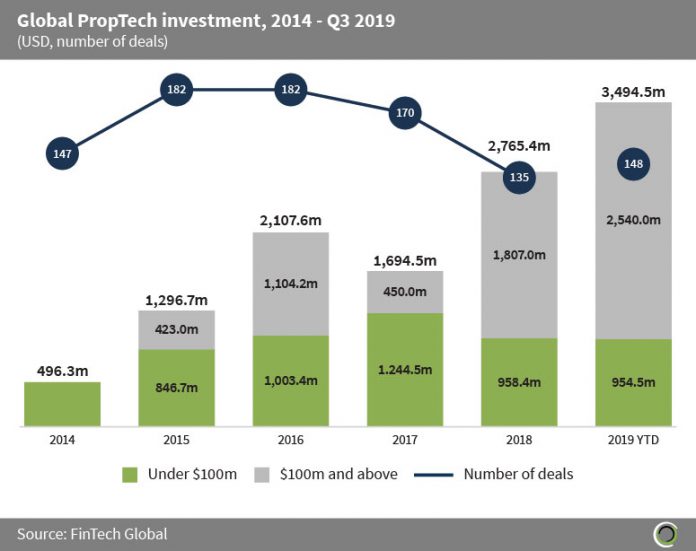

PropTech investment around the globe has grown significantly over the past six years. Between 2014 and September 2019, the sector had attracted $11.8bn worth of capital, with US and Chinese companies taking home the biggest rounds, according to FinTech Global’s data.

That represents a significant increase of annual investments into the industry. In 2014, only $406m was invested in the real estate technology sector. But by 2018, that number had jumped to $2.76bn. That figure was in turn eclipsed by the third quarter of this year, with £3.49bn having been invested in PropTech businesses around the world.