HMBradley is the latest US challenger bank to enter the fray, differentiating itself from competitors by offering consumers rewards for positive financial behaviours.

The company was founded by former portfolio management service Cyndx CTO Zach Bruhnke and principal software engineer Germain Cassiere, and Dmitry Gritskevich, the former director of business operations and finance at wearable tech builder Doppler Labs.

Supporting the company’s establishment is PayPal founder Max Levchin as well as other FinTech players.

The company recently closed a $3.5m seed round led by Accomplice Ventures and Walkabout Ventures to help growth. Other backers included Mucker Capital, Index Ventures, HVF Labs and several others.

To separate itself from competitors, HMBradley is providing customers 3% APY when they direct deposit 20% of their income into savings. Even though the platform is still yet to launch, consumers can join the waitlist and grow their sign-up bonus to earn the 3% APY.

Company co-founder Max Levchin said, “HMBradley presents an entirely new experience that will change how consumers think about banking. Aside from its digital-first design that makes sense for the way people handle money today, it was developed to help consumers be more responsible with their money.”

Mood Analytics research states the average person under the age of 35 is spending more than they earn (-1.8%) which the overall average personal savings rate is around 7.7%. The goal of HMBradley is to improve financial awareness and reward people for saving more.

While 3% APY is the top interest rate bracket, there are four tiers in total. Consumers can earn 2.25% APY if they save 15% of their income, 1.5% on 10% and then 1% on 5%. If a consumer saves less then 5%, they do not qualify for a tier.

In addition to interest rates, the company will release an everyday rewards credit card which will boost their APY tier when they save their cashback into their bank account.

HMBradley co-founder and CEO Zach Bruhnke said, “After I sold my first company, I realized how the banking experience changed once I had achieved financial success. Perks designed to make me feel good, like I had ‘made it,’ had the opposite effect. I wondered why anyone couldn’t have access to the same service and benefits.

“With HMBradley, it doesn’t matter how much money you make. We built this banking platform to put our customers in a strong financial position while prioritizing their needs and providing the features they want.”

Aside from interests, HMBradley offers a range of account features for consumers.

Its combined checking and savings accounts ease the process of saving money, with them also being FDIC insured up to $250,000. The company also offers 55,000 no-fee ATMs to help consumers withdraw money when they need it.

The platform is set for an early 2020 launch.

Challenger banks are quite the hot topic at the moment. Recent research from Market Research stated that the global challenger bank market could grow by a compound annual growth rate of 46.5% between now and 2025. This would see the market worth around $394.64bn by 2025.

Just last month, Rho Business Banking was the latest challenger bank to launch in the US.

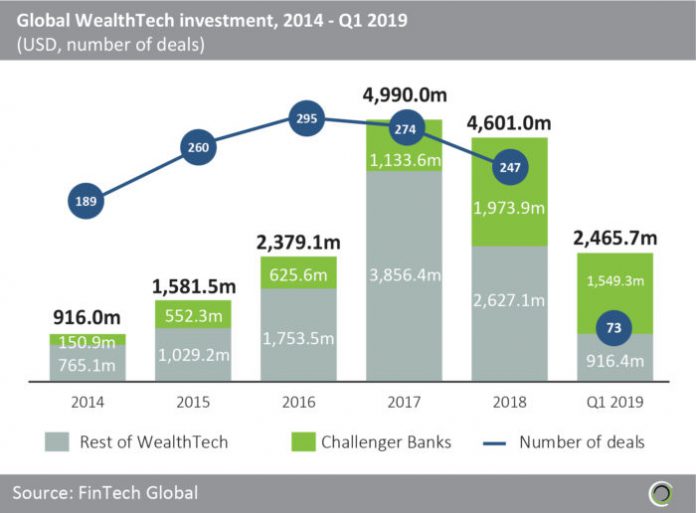

The challenger bank space is driving the WealthTech space. Last year, $4.6bn was invested in WealthTech globally, of which, $2.6bn was deployed to challengers.

Copyright © 2019 FinTech Global

Copyright © 2019 FinTech Global