It is common knowledge Latin America is an emerging market, but with FinTech itself being a new ecosystem, it begs the question if the region’s sector is ripe for its adoption.

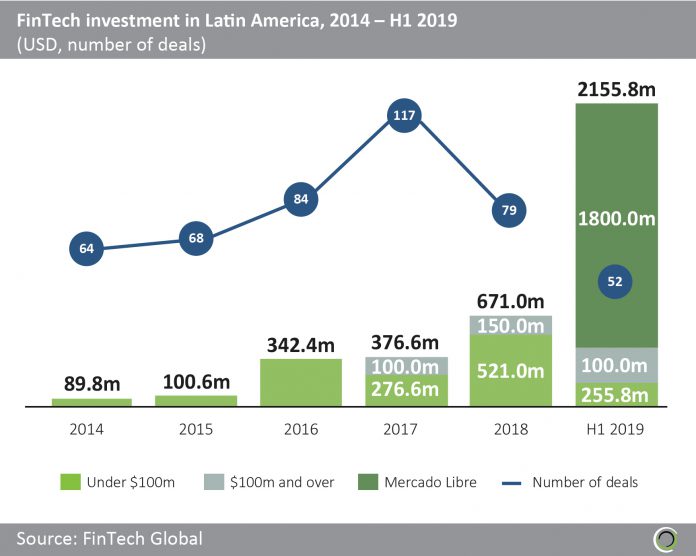

If the amount of venture capital being invested into the space is anything to judge by, then it would appear the market is warming up to financial technology. Funding levels in Latin America’s FinTech sector have risen from $89.87m in 2014 to $671m last year. This represents a CAGRR of 65.3% during this period.

Further highlighting the growth of LatAm’s budding FinTech scene is larger deal sizes. In 2017, a total of $376.6m was invested into 117 companies; however, the $671m deployed in 2018 was only split between 79 transactions, indicating businesses were raising larger transactions.

While this funding might pale compared to the levels in North America and Europe, these regions have already established strong technology hubs which have aided quicker digitalization of financial services. It is only a matter of time before the same happens in Latin America and they can begin to capitalize on the large community of unbanked.

While this funding might pale compared to the levels in North America and Europe, these regions have already established strong technology hubs which have aided quicker digitalization of financial services. It is only a matter of time before the same happens in Latin America and they can begin to capitalize on the large community of unbanked.

PayU regional manager LatAm Andres Fuentes said, “So-called exponential technologies, such as data analytics, open source platforms, or APIs, are those that have the most market penetration and account for the largest number of changes in the financial system. Latin America has only recently started to work with these solutions and is still in the process of building technology centres to take advantage of new capabilities.

“Unlike what we see in more mature markets like the US, in Latin America, these centres have not yet reached their full potential. But with a population of over 560 million people in need of better financial services, and a fast-paced innovation process, Latin America will soon reach its maturity point.”

Latin America’s FinTech market is already maturing and is beginning to attract the sights of established players in the market as well as the creation of its own giants.

Last month, Brazil-headquartered payments processing platform EBANX reached unicorn status after it closed a funding round from the growth equity firm FTV Capital. The platform offers 100 local payment options and connects 1,000 merchants to more than 50 million consumers in the region. Latin America’s digital bank space is thriving, with Nubank become recently becoming a “decacorn”, which means it is valued at $10bn.

One aspect which may have initially held the region back, is the large percentage of unbanked. This has created a heavy cash-based society, making it harder to draw consumers to start using FinTechs services. However, it’s not all doom and gloom. The unbanked have left a big opening for companies that can finally give them access to such services

Pointing at research that classifies more than half of Latin America’s population as the unbanked, Fuentes says, “In Mexico, Colombia and Peru, this number exceeds 60%. Most critical is that amongst this population are entrepreneurs, merchants and individuals with high buying power who simply do not have access to financial services. And those who do find that these services don’t reach their needs.

“In response, the fintech ecosystem in Latin America has been emerging and growing exponentially to fill these gaps.”

The large population of unbanked has not quelled appetite for digital services. According to data from Statista, the e-commerce market in Latin America is set to rise from $49.8bn in 2016 to $79.7bn by the end of this year. Desire is clearly there for FinTech. Looking at the FinTech Global data again shows how much appetite there is. In the first six months of 2019, $2.1bn has gone to FinTechs raising money. This was largely down to a colossal $1.8bn post-IPO of MercadoLibre, an e-commerce and auction platform.

The unbanked population and newer state of its digitalised banking system could work in the favour of local FinTechs. UK financial institutions are largely held back by their outdated, legacy systems, making it harder for them to incorporate the new services. Whereas, financial institutions in LatAm are typically not as old and can more easily integrate the latest solutions. The unbanked can also just bypass traditional institutions, which have not catered to their needs, and move to a mobile-only solution, easing their access to these services.

PPRO director of product, payment networks and business development Jack Ehlers said, “Latin America still has much to overcome, especially when it comes to payment processing. In Latin America, access to secure, credit card-based payment methods are limited. In fact, many people in the region do not use a formal banking system. Amongst the logistical nightmare of a cash-based society for ecommerce providers targeting the region, merchants have found ways to manage this reality. eShopWorld reported that 36% of online consumers prefer to utilise PayPal, and 35% use Cash on Delivery.”

Opportunities to improve the local population’s digital savviness are being noticed by established FinTechs, with many making a move to the region to capitalize on the opportunities. Last month, payments unicorn Stripe opened an office in Mexico City, to support its move into the region. Fellow unicorn Revolut also recently revealed plans to launch its banking services into eight new countries, including Brazil.

This might be good for consumers and competition, but it might make things tougher for local FinTechs to get their feet off the ground. PayU’s Andres Fuentes said, “The growth process is arduous in the face of a complex ecosystem of more experienced companies, with global know-how and local expertise. Additionally, regulations are maturing, meaning FinTechs have more to consider when testing new products or preparing to launch.”

He went on to state that coming up with a new idea is not enough to make a startup. There are too many offerings coming to play, which means they need to have something to differentiate themselves. Having local market knowledge and an infrastructure which meets the needs of consumer preferences will do this, he stated.

Latin America’s FinTech scene is clearly on the rise and will only get bigger from here. Village Capital manager Daniel Cossio told FinTech Global, “We’re going to see a lot more FinTech startups look to scale beyond their borders, to access new markets. Communication and collaboration between countries in Latin America is starting to take off, after years of having a divided region – most notably in the case of Brazil. Funds, investors and entrepreneurs are starting to look towards the opportunities a new market in Latin America might bring. We’ve recently seen some high-profile examples of this, such as Cornershop and Nubank. In our accelerators, a lot of entrepreneurs have questions about this.”

Copyright © 2019 FinTech Global