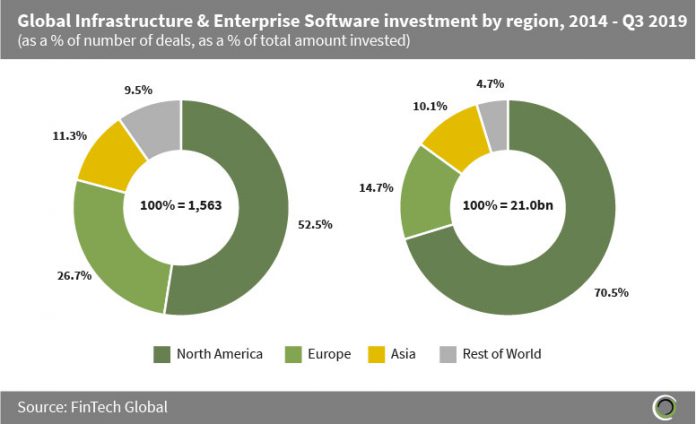

Almost 70% of the capital invested in the sector between 2014 and Q3 2019 was raised by US companies

- North American companies captured more than half of the deal activity in the sector between 2014 and Q3 2019, with 96.2% of the capital invested in the region raised by Infrastructure & Enterprise Software companies based in the US.

- This was driven by large transactions, as US companies were involved in 33 of the 41 deals in the sector between 2014 and Q3 2019, that were valued at $100m or more.

- Companies in Asia captured 11.3% of deal activity and just over 10% of the total capital raised globally in the sector, and the region was also home to the largest Infrastructure & Enterprise Software deal to date.

- OneConnect provides financial technology solutions to small and medium-sized banks and has served over 400 banks and 2,300 financial institutions. The Shanghai-based company, which is a subsidiary of Chinese financial conglomerate Ping An, raised $650m in a Series A round led by SoftBank Vision Fund in February 2018. This is the largest Infrastructure & Enterprise Software deal to date, and the company is exploring a New York IPO in addition to applying for a banking license in Singapore.

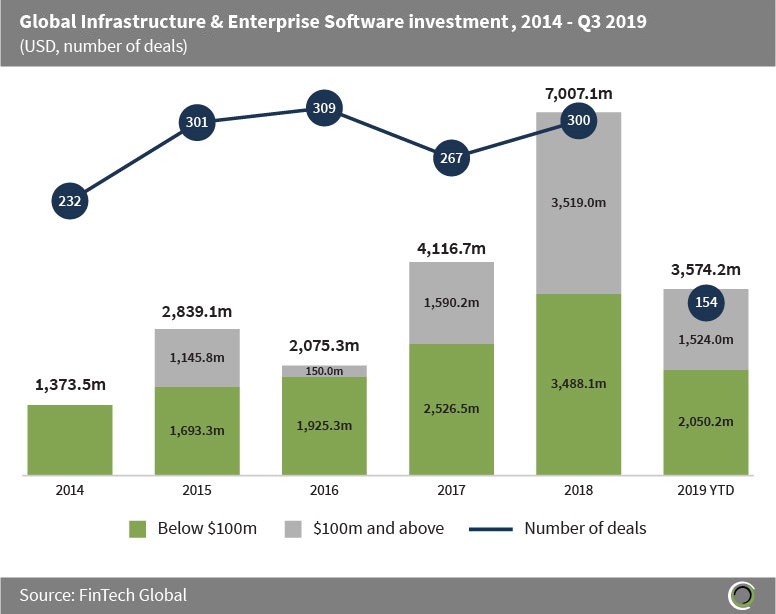

Almost half of the capital raised by companies in the sector since the start of 2018 has been invested in deals valued at $100m and above

- Just under $21.0bn was raised by Infrastructure & Enterprise Software companies globally between 2014 and Q3 2019, with 1,563 deals completed during the period.

- Investment increased at a CAGR of 50.3% between 2014 and 2018, with annual investment peaking last year at above $7.0bn.

- Almost $10.6bn was raised by companies in the sector during the last seven quarters alone, with 47.7% of this capital invested in Infrastructure & Enterprise Software transactions valued at $100m and above.

- There were 25 deals valued at $100m or more during the period, with Snowflake Computing, an enterprise cloud and data solutions provider servicing financial services companies such as Capital One, raising the largest deal in North America last year; a $450m Series F round led by Sequoia Capital in October 2018.

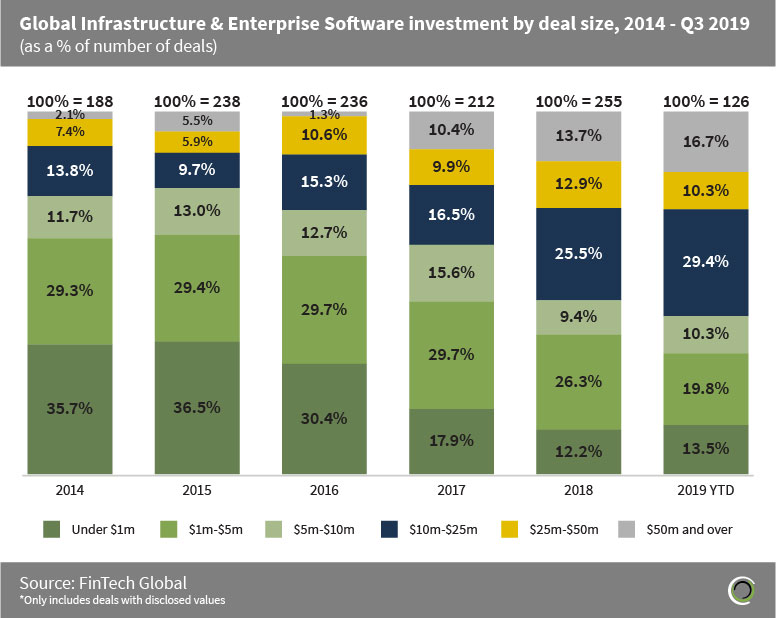

More than a quarter of the Infrastructure & Enterprise Software deals globally this year have been valued at $25m or more

- The Infrastructure & Enterprise Software subsector has shown continued signs of maturity, evidenced by the proportion of transactions valued below $5m falling from 65% of deals in 2014 to a third in the first three quarters of 2019.

- Concurrently, the share of later-stage transactions witnessed a significant increase, with the share of deals valued above $25m increasing from less than 10% in 2014 to more than a quarter of deals during the first nine months of this year.

- This year on year shift in the composition of transactions over the past five years from early to more later-stage, has seen average deal sizes in the Infrastructure & Enterprise Software subsector increase from $5.9m in 2014 to $23.2m in the first three quarters of 2019.

- HR Path provides HR and payroll outsourcing solutions, and raised $113m of Private Equity funding from Andera Partners in April 2019, which was the largest deal in the subsector in Europe this year to date. HR Path now has over 1,200 customers, employs 800 people and has a turnover of over €95m.

US companies dominate the list of largest Infrastructure & Enterprise Software deals during the first three quarters of 2019

- More than $1.7bn was raised in the ten largest Infrastructure & Enterprise Software transactions in the first nine months of 2019, which is equal to almost half of the capital raised in the sector globally during the period.

- A breakdown of the top ten shows that six companies based in the US raised almost $1.5bn combined, across seven of the largest transactions in the sector during the first nine months of the year.

- KnowBe4, a Florida-based provider of security awareness training and simulated phishing attacks, raised $300m in a Series D round from KKR, TenEleven Ventures and Elephant in June 2019. This was the largest Infrastructure & Enterprise Software deal of the year to date, and KnowBe4 now serves more than 25,000 organisations and has over $100 million of annual recurring revenue.

- Baiwang Cloud provides full lifecycle invoice management solutions to more than 100,000 SMEs. The Beijing-based startup raised $147.6m across two rounds ($77.1m Series A in Q1 and $70.5m Series B in Q3) this year from Alibaba, Tencent, Shenzhen Capital Group, Oriental Fortune Capital and Shenzhen Guozhong Venture Capital Management. The $77.1m Series A that Baiwang raised in March 2019 was the largest Infrastructure & Enterprise Software deal in Asia this year to date.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global