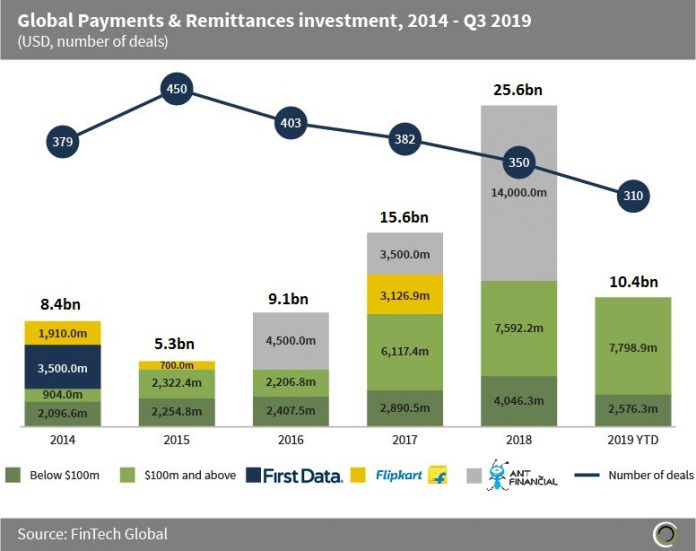

Funding topped $25bn last year driven by Ant Financial’s $14bn Series C round

- More than $74.4bn was invested in Payments & Remittances deals between 2014 and Q3 2019, with 2,274 transactions completed during the period.

- Investment increased at a CAGR of % between 2014 and 2018, which saw average deal sizes grow from $22.2m in 2014 to $73.3m last year.

- Much of the funding can be attributed to large scale investments in companies such as Ant Financial which has raised $22bn since 2015. Ant Financial, based in China, owns Alipay, the world’s largest mobile and online payments platform. The company raised $14bn in a Series C round led by Tamesek Holdings and GIC in June 2018. This is the largest Payments & Remittances deal to date and the transaction valued Ant Financial at $150bn.

Almost a fifth of the Payments & Remittances deals during the first nine months of the year were valued above $50m

- The proportion of deals valued below $5m fell from almost two thirds of deals in 2014 to 43.6% during the first nine months of 2019.

- First Data Corporation provides electronic commerce and payment solutions for merchants, financial institutions and card issuers. The company raised $3.5bn from KKR and Rancilio Cube in July 2014, which is the largest Payment & Remittances deal in North America to date. First Data went public in October 2015 and was acquired by Fiserv for $22bn in January 2019.

- The Payments & Remittances subsector of FinTech has shown continued signs of maturity over the past five years, evidenced by the share of deals valued above $50m increasing from 8.6% in 2014 to 19.2% during the first three quarters of the year.

- Sea, a Singapore-based provider of mobile payment solutions under the brand AirPay, raised more than $1.3bn in Post-IPO equity in March, which is the largest Payments & Remittances deal globally this year. Funding came from Tencent and will be used for business expansion and other general corporate purposes.

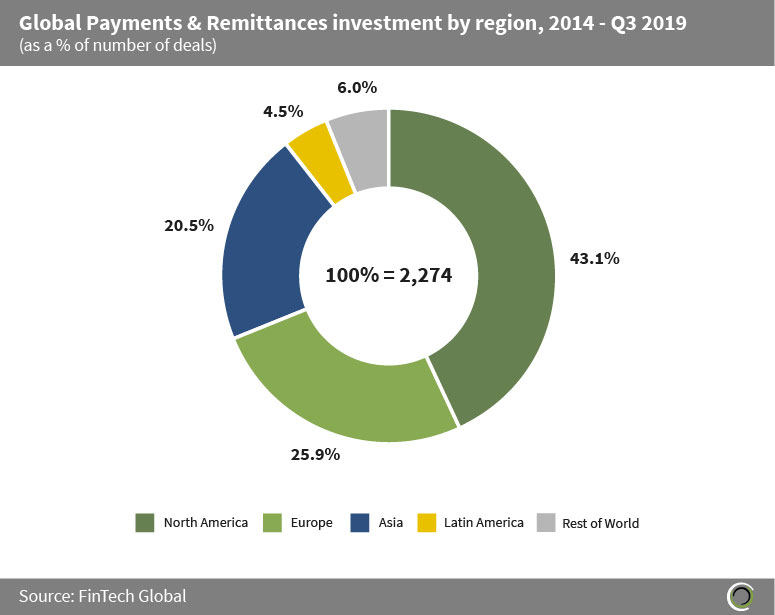

Companies in North America and Europe captured almost 70% of the Payments & Remittances deals globally between 2014 and Q3 2019

- The digitalisation of global payments has led to growth in the Payments & Remittances sector, with companies in North America and Europe at the forefront of this innovation.

- Companies in North America captured 43.1% of deals in the subsector between 2014 and Q3 2019, followed by more than a quarter of transactions during the period involving European Payments & Remittances companies.

- Wirecard, based in Munich, is a provider of white label solutions for electronic payment transactions. The PayTech company raised $1.1bn of Post-IPO equity funding from SoftBank in Q2, which is the largest Payments & Remittances deal in Europe this year. This investment will enable SoftBank to support Wirecard in its geographic expansion into Japan and South Korea.

- Despite involvement in just over a fifth of Payments & Remittances deal activity between 2014 and Q3 2019, companies in Asia captured almost two thirds of the total capital invested in the sector during the period, driven by large investments in companies such as Flipkart. Flipkart, which has been dubbed as India’s answer to Amazon, raised more than $3.1bn across four separate transactions in 2017 from investors such as Axis Bank, eBay, Tencent Holdings, Microsoft and SoftBank. Flipkart was acquired by Walmart for $16bn, with the transaction closing in August 2018.

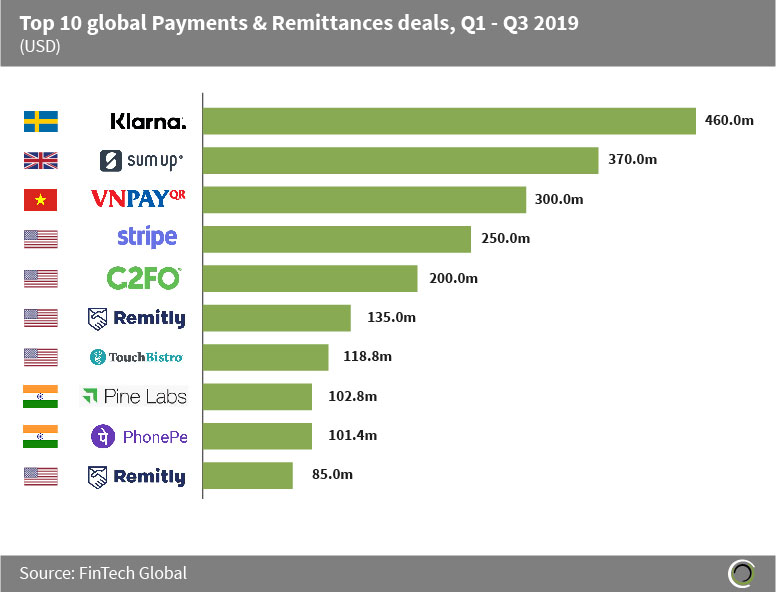

European companies lead the list of largest Payments & Remittances deals globally last quarter

- More than $2.1bn was raised in the ten largest Payments & Remittances deals globally last quarter, which is equal to more than three quarters of the total capital raised in the subsector during the three-month period.

- A geographic breakdown shows that five deals involved North American companies, three deals involved companies based in Asia and the largest two transactions involved European-based Payments & Remittances companies.

- Klarna, an e-commerce payment solutions platform for merchants and shoppers, raised $460m in a funding round led by Dragoneer Investment Group in August 2019. This was the largest Payments & Remittances deal globally last quarter, valuing the Swedish FinTech at $5.5bn.

- London-based SumUp is a provider of card payment and point of sale solutions to merchants and competes globally with Square. The company raised $370m in July 2019 from investors such as Goldman Sachs and Bain Capital Credit to accelerate its growth and acquire new merchants in its 31 markets across the globe. This was the second largest deal in the subsector last quarter. SumUp was named Europe’s fastest-growing company in the ‘Inc. 5000’ in 2018 and has over 4,000 companies joining the platform daily.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global

![Flutterwave teams up with Acquired.com to streamline outward remittances in EU and UK Temenos (SIX: TEMN) today announced that National Bank of Iraq (NBI), part of the Capital Bank Group, has successfully gone live with Temenos core banking and payments. NBI, which has 27 branches across Iraq, offers a comprehensive range of services to individuals and businesses in the country. Since 2005, NBI has been majority owned by Capital Bank, one of the top financial institutions operating in the Jordanian and regional markets, with assets of approximately JOD 7.6 billion[1]. With this implementation, NBI moved from its legacy systems onto the same core banking platform as other entities in the Capital Bank Group. This will enable NBI to operate more efficiently and integrate seamlessly with other systems to develop new products faster and deliver an improved customer experience. Capital Bank Group is a long-standing Temenos customer with other entities in the Group including Capital Bank of Jordan, Bank Audi, Société Générale Bank Jordan and NBI Saudi Arabia, already on the Temenos platform. NBI also becomes the first part of the group to adopt Temenos Payments, which enabled the bank to process more than 100,000 transactions of incoming and outgoing domestic and international payments in the first 15 days of operation, with a 99% straight-through processing rate. The migration to the Temenos platform for core banking and payments at NBI was completed in under 12 months thanks to Temenos’ pre-configured banking and payments capabilities and APIs which reduced the need for complex customizations, as well as close collaboration between Temenos, NBI, Capital Bank and delivery partner ITSS. This success was recently recognized in the IBS Intelligence Innovation Awards, with Capital Bank winning ‘Best Implementation of Core Banking Services'. The implementation at NBI follows several other successful transformation projects with Temenos for Capital Bank in the last few years, including the launch of NBI’s branch operations in Saudi Arabia in just 45 days, as well as the integration of Bank Audi and the former Jordanian operations of Société Générale, each of which was achieved in under four months. Collectively, these projects helped Capital Bank to increase operational efficiency by more than 50% within three years, bringing significant cost savings and an improved customer experience. With faster, more accurate processing and immediate service requests, the bank has maintained high customer retention rates and a reputation for service excellence. Izzidin Abusalameh, Chief Operations Officer, Capital Bank Group, commented: “This achievement marks a significant milestone in our digital transformation journey and positions us as a leading player in the banking industry. We have seamlessly transitioned the National Bank of Iraq to a cutting-edge core banking system which will not only enhance operational efficiency but also support providing our customers with a superior digital banking experience. Our continued partnership with Temenos has not only provided us with an advanced technological platform but has also facilitated a culture of flexibility and adaptability, enabling us to execute our ambitious growth plans.” Lee Allcorn, Managing Director, Middle East & Africa, Temenos, said: “Congratulations to National Bank of Iraq and the Capital Bank team on this successful implementation that gives NBI business agility and the same modern technology platform and ability to deploy fast with pre-configured banking capabilities as the rest of the group. With Temenos, Capital Bank Group is future-ready, and we are proud to support them as they continue to innovate and leverage our platform to grow sustainably and enhance the banking experience for customers.”](https://fintech.global/wp-content/uploads/2024/04/rupixen-Q59HmzK38eQ-unsplash-2-100x70.jpg)