Despite investors growing weary, Chime’s new round proves they still have an appetite to invest huge chunks of cash into the right startup.

The American challenger bank has raised $500m in a new Series E round, pushing its valuation to $5.8bn, according to sources familiar with the matter speaking with CNBC.

If true, that means the branchless bank has tripled its valuation since March this year when it raised $200m at a $1.5bn valuation.

DST Global, the venture capital firm that spearheaded the Series D round, led the new Series E investment injection.

ICONIQ Capital, the investment firm, and General Atlantic, the global growth equity firm, also invested in the round.

Chime will use the money to develop new products and to double its staff numbers by the end of 2020. The sources speaking with CNBC also hinted that Chime might be looking to use the new cash influx to acquire other FinTech firms.

The Series E round comes as investors have seemingly become less inclined to invest in companies, following WeWork’s bungled initial public offering and after Uber’s IPO failed to impress.

While some may have speculated that those botched exits have put a hamper on investors’ excitement, the Chime round shows that they are still happy to invest in the right company.

It also makes it one of the biggest challenger bank investments ever.

Nubank, the Brazilian digital bank, seemingly broke the mold this summer when it attracted $400m from investors, including the Chime investor DST Global. Nubank’s investment round reportedly pushed it across the $10bn valuation mark, making it a decacorn.

While Chime did not seem to reach the same valuation levels, the $500m investment still comes with some serious bragging rights.

Moreover, it is also bigger than German challenger bank N26’s latest round. It increased its Series D round to $470m in July, having previously closed it in January 2019 at $170m. The cash injection valued the FinTech unicorn at $3.5bn.

Chime’s new round comes as the US is experiencing a massive wave of new branchless banks setting up shop. Current and Varo are two of the new banks competing with Chime for a slice of the market.

However, Chime will also face competition from international players.

N26 revealed that it was officially launching in the US in August. UK challenger bank Monzo has also announced plans to expand across the pond. Monzo’s native peer Revolut already set up shop in the US in 2017.

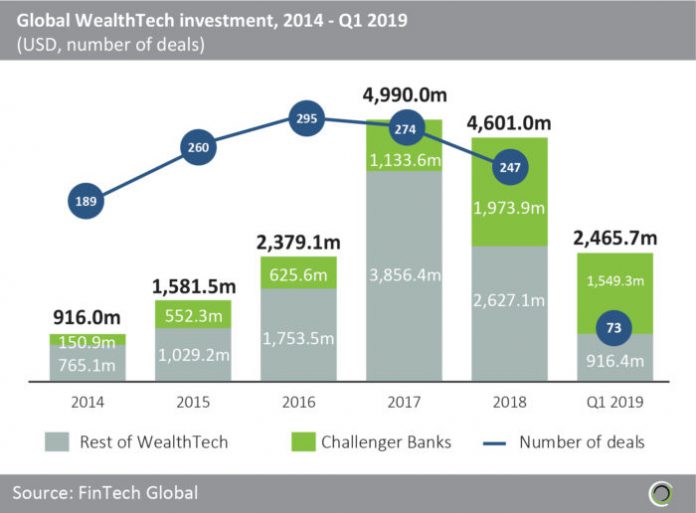

And more might come as challenger banks have annually grown the amount of investment they have attracted. In 2014, challenger banks saw $150.9m injected into them, according to FinTech Global’s data. That figure had grown to $1.97bn in 2018.

Moreover, Chime is facing growing competition from big tech firms that have also been moved into the FinTech space. It is not just Chime that would be affected by it, but incumbent market stakeholders could also face a serious impact as Uber, Facebook, Google and other tech titans are moving into the financial services space.

Chime may also still have some internal technical glitches to sort out. For instance, in October, Chime’s suffered severe service outages, leaving customers unable to access their money.

Chime is by no means alone in experiencing growing pains. Revolut suffered a similar outage in October.

N26 faced a smattering of negative headlines earlier in 2019 as the challenger bank saw the German banking regulator BaFin publish a list of shortcomings on the bank’s behalf that, if left unattended, could open up the doors for the bank’s services being used for money laundering and terrorism financing.

Similarly, Monzo was forced to scrap its premium offering in September, just a few months after it was launched, sparking speculations about the bank being in for some harder times.

ICONIQ Capital led cloud native cybersecurity startup Twistlock’s $33m Series C round in August 2018 and participated in InsurTech startup Hippo Insurance $100m Series D round this summer.

General Atlantic spearheaded Brazilian challenger bank Neon’s $94m funding round in November and became a minority investor in RegTech100 company Axioma in April.

Copyright © 2019 FinTech Global