The European Islamic banking marketplace is still young but there is a need for digital-first online banking services, insha founder Yakup Sezer told FinTech Global.

Sezer said, “In [Germany’s] current market situation, there aren’t any digital opportunities for a Muslim or for someone looking for ethical or moral banking. There are not any kind of services provided, we are the only one in the market.â€

insha has established itself as the first completely digital Islamic banking platform in Germany. It is the spin-off of Turkish participation bank Albaraka and is hoping to bring the Islamic finance world into the new age as well as offering ethical banking opportunities for all consumers. This does not mean its services are only aimed at the Muslim community, it hopes to offer an alternative banking solution for anyone.

So, how does Islamic finance differ from the more conventional finance system? Islamic Financial providers need to adhere to several rules set out in Sharia Law and ensure it does not engage in any activity deemed haram, which translates as harmful. One of the main differences between a Sharia-compliant provider and a more conventional service is around interest, which is forbidden in any Islamic finance offering. Another key differentiator is that an Islamic finance institution cannot invest into certain industries such as gambling, alcohol, pork or pornography.

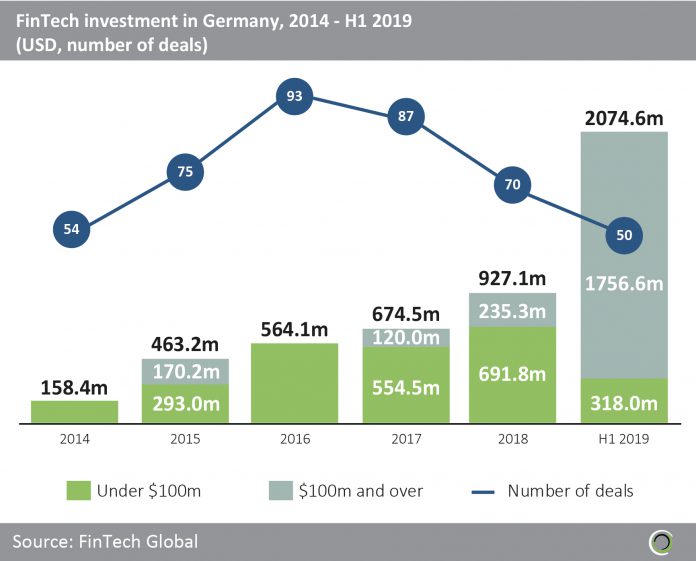

Germany has a bustling FinTech market and there is a lot of opportunity for startups to receive funding. Over the last five and a half years, FinTechs, as a collective in the country, have raised more than $4.8bn. N26, a German challenger bank, is one of the country’s most established players, having closed a $300m Series D earlier this year. Its success certainly hints the German market is open to digital banks.

insha supplies consumers a digital banking app and a Mastercard, which can withdraw money from any ATM around the world. Other offerings from the bank include tools to track savings, manage expenses and the ability to easily donate to charities. As interest is not Sharia-compliant, insha does not add this to loans. Instead of an interest-based loan, insha simply buys the product for the consumer, who then pays the bank back in monthly instalments, after agreeing a fixed profit share.

One of the aspects which is helping insha separate itself from other players in the market is its local feel. insha founder Yakup Sezer said, “Every ethnic group wants to get services from those of a similar background. This is not about business, it’s about the behaviour and culture.†He went on to explain that Turkish people moving to Germany or across Europe want to speak to people with similar opinions and values. Building these links builds trust between the customer and the bank.

It’s much harder to build these connections with Deutsche Bank, for example. Whereas, insha can be like a friend to the customer. It understands their background, their needs and point of views, Sezer said.

Being able to forge these links with the customers is one of the ways insha believes it can compete against the giants in the market. Germany has Europe’s second largest community of Muslims, which Pew Research Survey put at five million back in 2017. This leaves a massive market for insha to capture. Given insha’s Turkish heritage, the bank is well suited to meeting the needs of Germany’s Turkish community, which is approximately 2.7 million, according to ESI Web.

Sezer said, “For Islamic banking in Europe, no one knows nearly enough to meet the needs. insha gives them a good banking experience because we are operating in 17 countries and in almost all Muslim countries. We know the society; we know the people and best of all we know how to be polite.â€

This is not the first Islamic bank in Europe to enter the market, Sezer stated there have been many attempts before but they failed to adapt to the digital needs of consumers. This is why insha was created. Its aim it is not just provide a regular bank account; it wants to become a digital platform for all the consumer’s needs. Whether this is through its own in-built offerings or through partnerships with other players and FinTechs.

insha is the first completely digital Islamic banking platform on mainland Europe. There have been a couple of startups in the UK, but none have yet to launch operations in other areas of the continent. With such a large Muslim community across Europe, it does beg the question of what we are not seeing more platforms sprout up. Sezer said, “Islamic banks are so new in the world and people are just learning about it.†The first type of Islamic banks was formed between 40 and 50 years ago in Asia, which compared to traditional banking, is a very short time.

While this has left a huge opportunity for Islamic banks to establish themselves Sezer believes most are focusing on building their products in the commercial practice rather than building digital services. He added, “I’m sure for the next five years every Islamic bank will open their minds to the digital universe across Germany, the UK and the US.â€

Expansion to the UK

The whole of Europe is ripe for Islamic banking solutions and insha is planning on filling this gap. Initially, the FinTech is looking to move into the Netherlands, Belgium and France, because of their proximity to Germany. However, one of its big targets for 2020 is the UK.

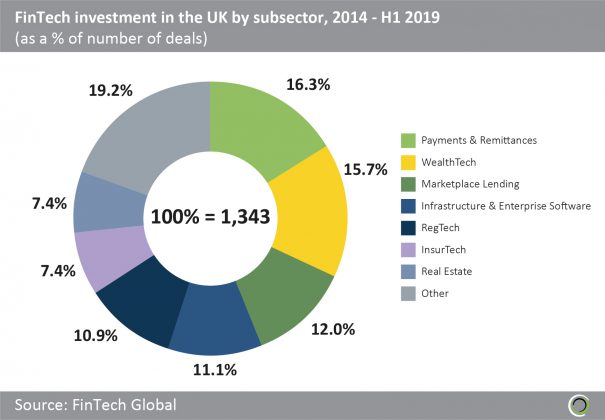

FinTech in the UK is booming. In the past five and a half years, over £12bn has been invested into companies in the country, FinTech Global data shows. WealthTech, which includes challenger banks, is one of the UK’s biggest subsectors of FinTech. Since 2014, 15.7% of the total 1,343 investments in the UK have been to WealthTech companies.

The UK has a well-established Islamic finance scene, with more than 20 banks offering these types of services. There are also several successful Islamic FinTech companies starting to crop up, such as InsurTech platform InsureHalal and crowdfunding platform Yielders. Its only natural for Islamic digital banks to make their move in the market, especially due to the hot marketplace for challenger banks in the UK, with the likes of FinTech unicorns Monzo and Revolut.

While there is this steep competition, insha is excited about launching its services in the market. Sezer explained that while there is a lot of competition, the success of the challenger banks shows how the UK market is already open to these types of services, as opposed to Germany, where there is really only one challenger bank: N26.

However, it is because of this strong rivalry in the market insha has stalled from moving into the market. “We are waiting until we finish all of the products before we make a move because there is an incredibly strong competition in the UK,” said Sezer. “So, for example, just because we can provide you with Islamic finance products will not be enough for UK customers because they have always been available. We need to be as good as Starling and Revolut and then start our operations.

Sezer concluded, “So it really makes us incredibly excited to be the first one and maybe the biggest one in the Islamic society and Islamic banking industry.â€

Copyright © 2019 FinTech Global