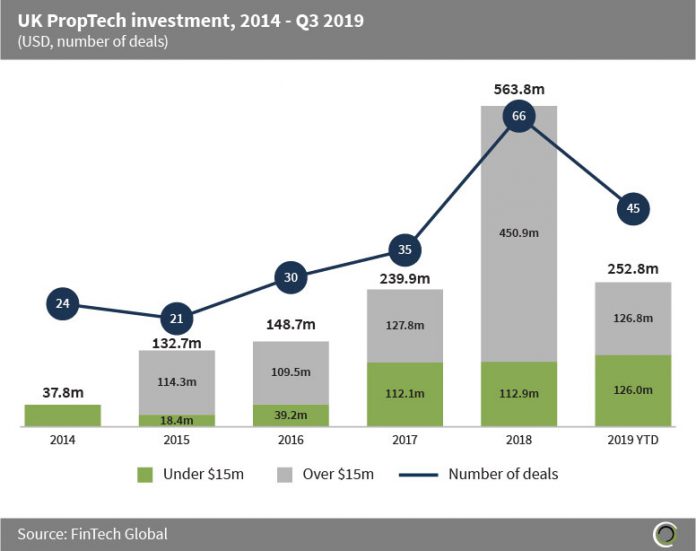

Total funding increased nearly 15-fold between 2014 and 2018

- In terms of investment growth, funding increased almost seven-fold from $37.8m in 2014 to $252.8m in Q3 2019, with the number of PropTech transactions almost doubling during the period. Investment increased almost 15x, between 2014 and 2018, reaching a record $563.8m last year.

- The UK government has played an important role in the expansion of the PropTech industry with initiatives like Geovation, a government-backed accelerator program, which has supported startups such as AskPorter, an AI-driven property management platform. The initiative offers free workspace for up to 12 months, expert software developer assistance, and £10,000 grant funding over six months, with a chance of receiving an additional £10,000 grant after this initial period ends.

- Over the past three years there has been a steady expansion of the industry across the UK, with both deals and capital raised increasing. In 2015, 95% of the deals were completed by startups in London, however by 2019, the number of deals involving startups headquartered in London had fallen to 87%, as investors seek opportunities in other parts of the country.

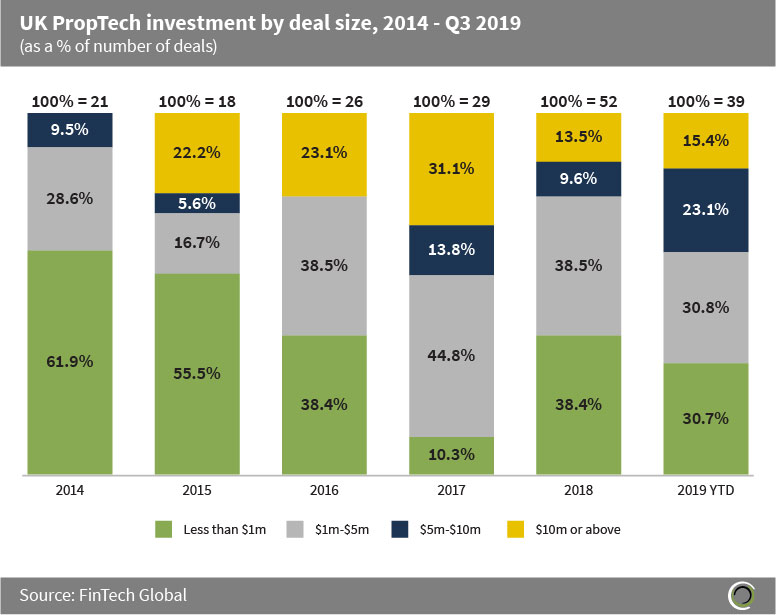

Investment in small-size deals under $1m has halved since 2014

- PropTech in UK is maturing as evidenced by the clear shift in the proportion of deals valued under $1m. In 2014, 62% of the deals were under $1m, with this share declining to less than a third during the first nine months of 2019.

- During the first three quarters of 2019, 38% of investments were valued above $5m, while there were no transactions in this deal size range in 2014.

- The introduction of $50m+ deals occurred in 2018. The first company to achieve this deal size was PurpleBricks, with a record deal of $177m on March 26th, 2018. There was only one investor involved in the transaction, Axel Springer, the German digital media giant.

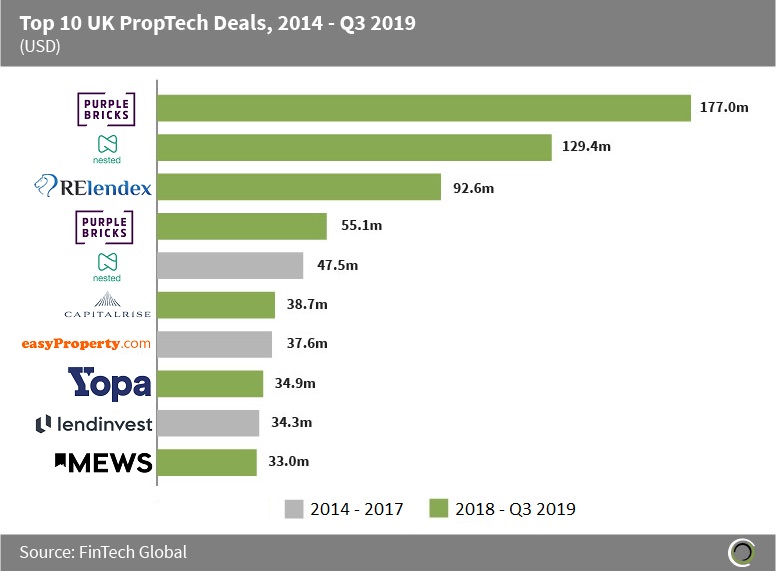

Seven of the top 10 PropTech deals in the UK have occurred in the past two years

- The top 10 PropTech deals in the UK between 2014 and Q3 2019 raised $680m, which is equal to 52% of the total capital raised in the sector during the period.

- A breakdown by year shows that three of the ten largest deals occurred in 2018, while four took place this year, with no deals breaking the $50m mark until 2018.

- Nested, a data-driven estate agency, also has two deals listed in the top 10, taking second and fifth place, respectively. The company raised $47.5m from Picus Capital, Global Founders Lab and an angel investor in a series B round in Q4 2018. Nested also raised $129.4m in debt in Q2 2017, which is the second largest PropTech deal in the UK to date.

- PurpleBricks was involved in two of the top 10 deals, raising $232.1m across these funding rounds. The company is an online real estate agent that helps clients to sell, buy, and let their properties. So far, PurpleBricks has expanded to the US, Canada, and Australia.

- The KPMG Global PropTech Survey, completed by 270 KPMG client firms, demonstrates the mind shift of industry leaders about the importance of technology in the real state sector. The 2017 survey results showed that 92% of participants believed that the digital and technological transformation will impact their business. In the 2018 survey, the number of respondents that agreed with this statement increased to 97%. Similarly, in the 2017 survey results, 17% of respondents did not have a strategy to introduce technology in their business or where planning on introducing one soon, this number decreased to 10% by 2018.

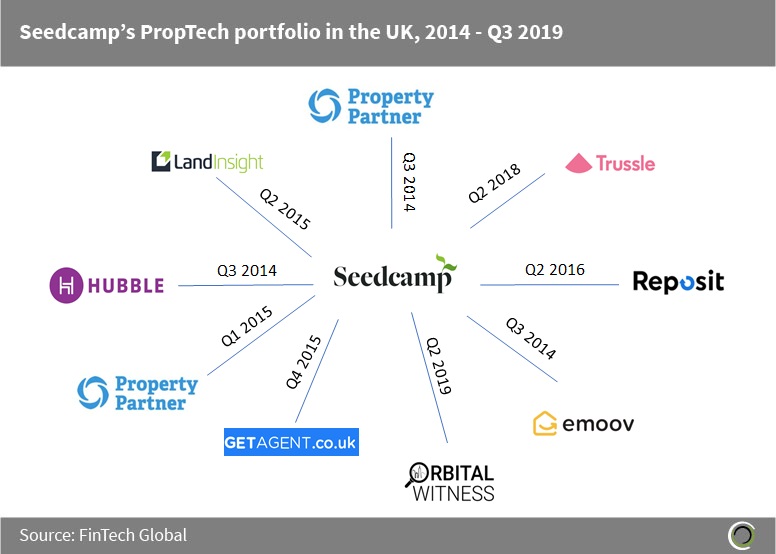

Seedcamp has been the most active investor in PropTech companies in the UK since 2014

- Seedcamp is a European focused seed fund based in London. Half of its 12 investments in UK PropTech companies were made between Q3 2014 – and Q4 2015. Seedcamp has made investments in Hubble, Property Partner (two separate rounds), Emoov, GetAgent, and LandInsight.

- Seedcamp’s largest deal was a participation in the $18.4m Series B funding raised by Trussle, a free online mortgage broker, in Q2 of 2018. Trussle used the capital to continue to scale the business, planning to invest in branding and product development. The deal was backed by three other investors: Propel Venture Partners, Finch Capital, and Goldman Sachs.

- Seedcamp has backed more than 5% (12 deals) of the total PropTech deals in the UK between Q1 2014 – Q2 2019, which is more than any other investor. Global Founders Capital (GFC) is second on the list, with nine investments in UK PropTech companies during the period, and Octopus Ventures (which also has an investment in Seedcamp) is in third place with eight deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global