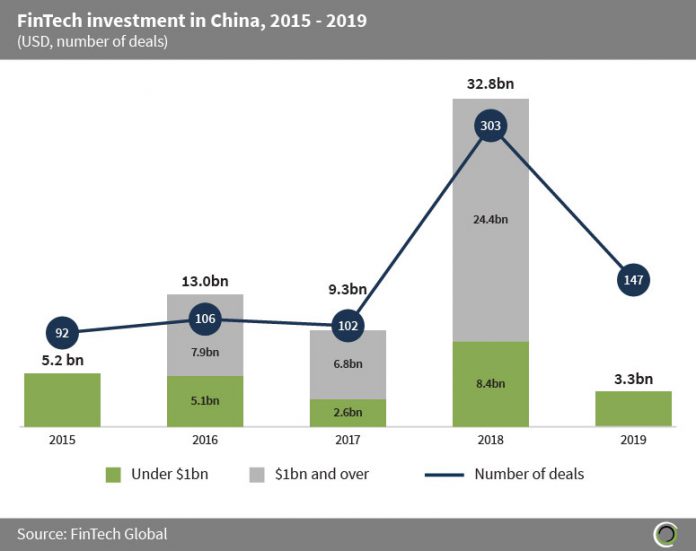

Investment in 2019 equated to only 10% of 2018’s total

- FinTech companies in China have raised over $63bn between 2015 and 2019, across 750 transactions.

- Investment grew at a CAGR of 84.8% between 2015 and 2018, with this growth being driven by Ant Financial’s $14bn Series C mega-round in Q2 2018. Even upon exclusion of this deal, 2018 still raised a record $18.8bn driven mainly by deals valued at or above $100m.

- There was a significant drop in investment in 2019, with only $3.3bn raised by FinTech companies in the country. In 2018, three of the top 10 investors in China were based in the United States, whereas in 2019 only one of the top 10 investors were based in the United States, with the rest being based within the country itself. This could be a result of continued trade tensions between China and the US, hence investors are moving away from injecting capital into the region.

- Deal activity in the region has also dropped with only 147 deals being completed in 2019, less than half the 303 deals completed in 2018.

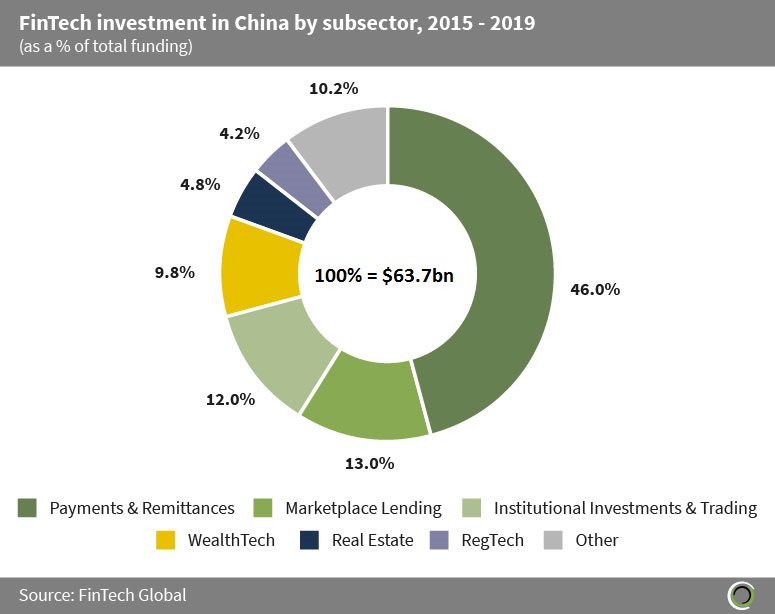

Payments & Remittances companies have been driving investment in China since 2015

- As China contests to become the first cashless society, it is unsurprising to see that the Payments & Remittances subsector accounts for the most investment over the period, with 46% of capital being raised by companies of this type.

- Marketplace lenders also attracted a healthy share of investment, with 13% of total investment since 2015. This comes as FinTech companies in this space look to disrupt the traditional loans market by capitalising on the distrust of mainstream banks which stemmed from the global financial crisis of 2008.

- The Other category consists of companies in InsurTech, Data & Analytics, Infrastructure & Enterprise Software, Blockchain & Cryptocurrency and Funding Platforms, capturing 10.2% of investment since 2015. The largest deal in this category came from ZhongAn Insurance, an internet-based property insurance company which handles claims and distributes its products online. The company raised $937.1m in a Series A round in 2015 which increased its shareholder number from nine to 14.

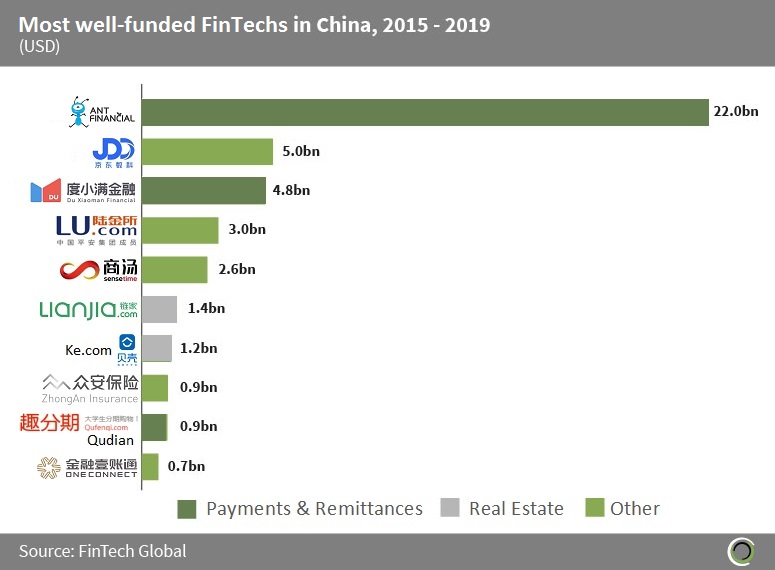

Ant Financial is the most well-funded FinTech in China between 2015 and 2019

- The most well-funded FinTech in China between 2015 and 2019 was Ant Financial which raised $22bn during the period. Ant Financial is an online payment services provider that enables businesses and individuals to execute payments online in a secure manner. Its platform Alipay is the world’s largest online and mobile services platform. The company raised $14bn in a Series C mega-round in Q2 2018 which is the largest single funding round in history.

- JD Digits is the second most well-funded FinTech in the country having raised $5bn since 2015. JD Digits connects financial and physical industries with digital technology to provide consumer credit, supply chain financial services, crowdfunding, wealth management, insurance agency and third-party payment services. The company’s largest funding round was a $2.1bn Series A in Q2 2017.

- Payments & Remittances and Real Estate companies make up half of the most well-funded FinTechs in China since 2015, with the Other category consisting of companies in Infrastructure & Enterprise Software, Institutional Investments & Trading, InsurTech, RegTech and WealthTech.

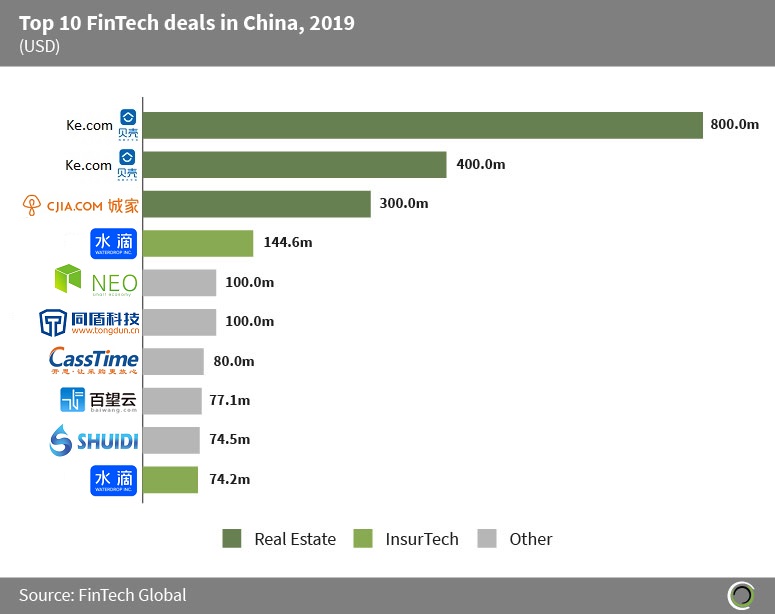

Over $2.2bn was raised in the top 10 FinTech transactions in China in 2019

- Over $2.2bn was raised in the top 10 FinTech deals in China in 2019, with companies in the Real Estate subsector leading the way in terms of investment.

- The largest round of the period went to Beike, a housing rental transaction platform enabling real estate agents to list new, second-hand and rental property. The company is responsible for the top two transactions on the list having raised $800m in a Series D round in Q1 2019 followed by a second Series D of $400m in Q3 2019, led by Tencent Holdings. The latest funding round pushed the company to unicorn status.

- The largest round raised by an InsurTech company was raised by Waterdrop, an insurance platform that aims to solve the problem of high medical fees for those with critical illnesses. The company raised $144.6m in a Series C round led by Tencent Holdings, Gaorong Capital, China Capital Investment Group and Boyu Capital.

- The other category consists of Funding Platforms, Infrastructure & Enterprise Software, Payments & Remittances, RegTech and Blockchain & Cryptocurrency companies with the largest round being raised by NEO. The company, which utilises blockchain technology to automate the management of digital assets, raised $100m in a Series A in Q2 2019 in order to develop its infrastructure and enhance its support to DApps.

- While Real Estate companies in the country lead the way in terms of both the largest deals in 2019 and the most well funded FinTech companies overall, there has been a shift towards InsurTech companies in 2019, with two of the top 10 deals coming from companies in this sector in 2019, compared to just one of the most well-funded FinTechs in the country being in this category.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global