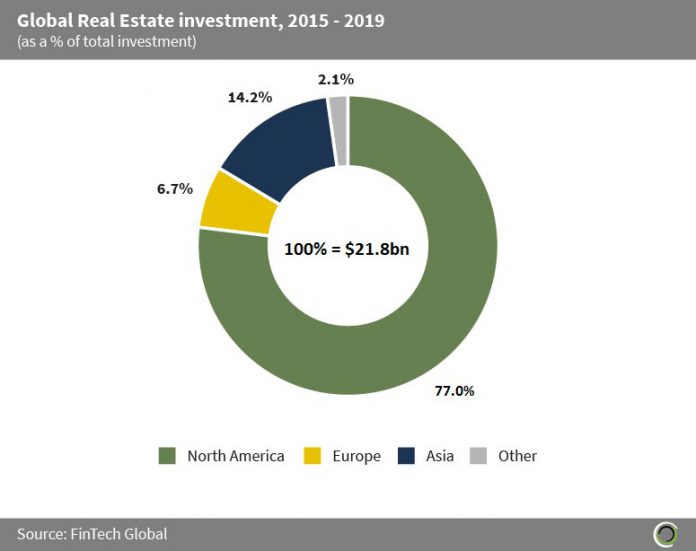

Over 75% of PropTech investment since 2015 has been raised by Real Estate companies based in North America

- PropTech companies in North America have captured 76.9% of the total capital raised in the sector between 2015 and 2019, with 98.8% of this capital being raised by companies in the United States. Given that real estate is the biggest asset class in the US it is unsurprising that investors are looking to back PropTech companies’ innovative solutions while digital transformation in this area is still in its relative infancy.

- PropTech companies in Asia account for a healthy 14.2% of investment in the space with 81.2% of this being raised by companies based in China. As high entry barriers persist in China, the average PropTech deal size in the country is $89.8m, nearly four times the average deal size globally of $24.1m.

- Europe accounts for only 6.7% of PropTech investment globally, however accounts for 27.8% of deal activity in the sector. London is one of the key commercial property centres in the world, driving deal activity in the region, however European companies do not face the same capital requirements to penetrate the market as Asia, and hence investment in the region is lower despite more deals being completed.

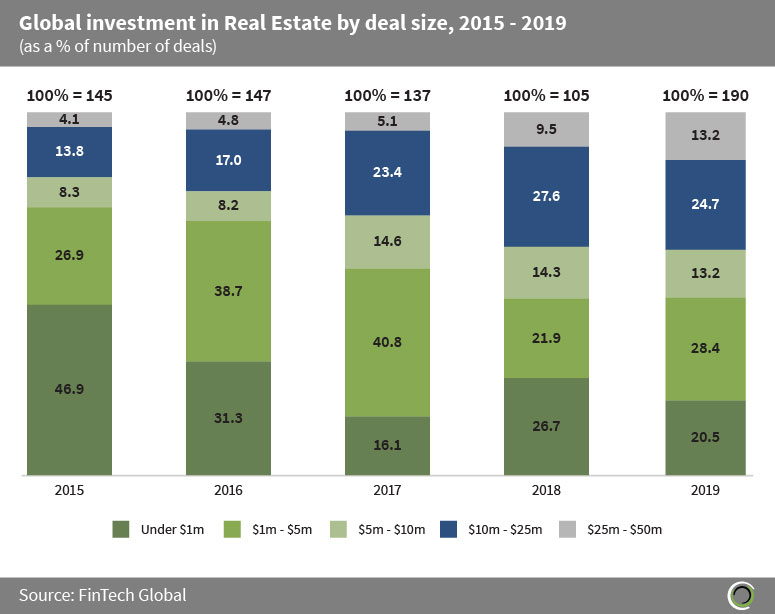

Deal sizes in the PropTech sector have been increasing over the past five years

- Globally the PropTech sector has shown continued signs of maturity, with the proportion of deals valued below $1m falling by 26.4 percentage points (pp) from 46.9% in 2015 to just 20.5% in 2019.

- The growing maturity of the sector has led to a shift in investor appetite from backing predominantly smaller deals towards backing more later-stage transactions. Hence, the proportion of deals valued at or above $50m has increased by 9.1pp from only 4.1% of deals being of this size in 2015 to 13.2% of all deals being of this value in 2019.

- The average PropTech transaction size increased at a CAGR of 70.7% between 2015 and 2019, growing from $7m in 2014 to $59.4m in 2019.

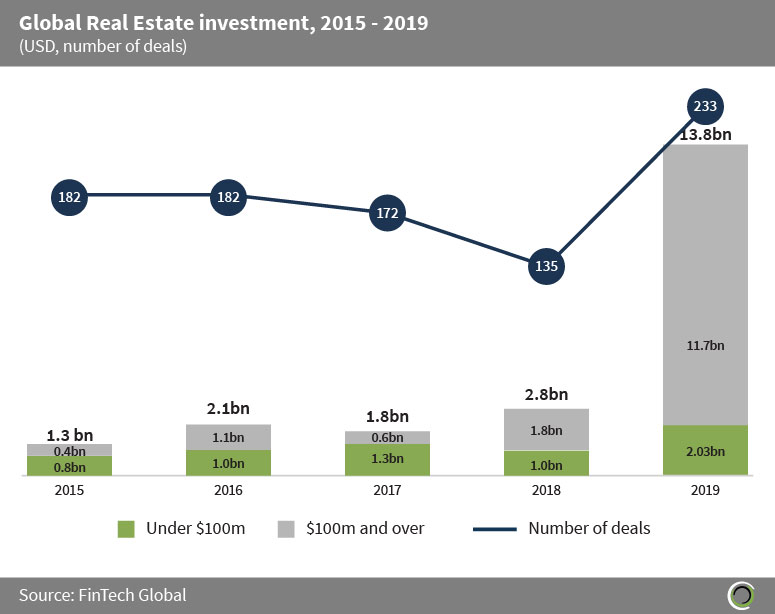

Over $13bn has been raised by Real Estate companies globally in 2019 alone

- Since 2009 real estate prices have been rising in most major advanced urban centres which has led to the emergence of new startups looking to disrupt this market through digital transformation of the traditional real estate business model.

- PropTech companies globally have raised over $21.8bn between 2015 and 2019, across 903 transactions, with 71.8% of this capital being invested in deals valued at or above $100m

- Funding increased at a CAGR of 80.5% during the period to a record of $13.8bn in 2019 across 232 deals. Of this, $11.7bn was invested in deals of $100m or above. One notable deal was raised by Knock in Q1 2019. The company, which offers and home trading platform, raised $400m in a Series B led by Foundry Group and used the capital to further its expansion across the US and boost development of its technologies.

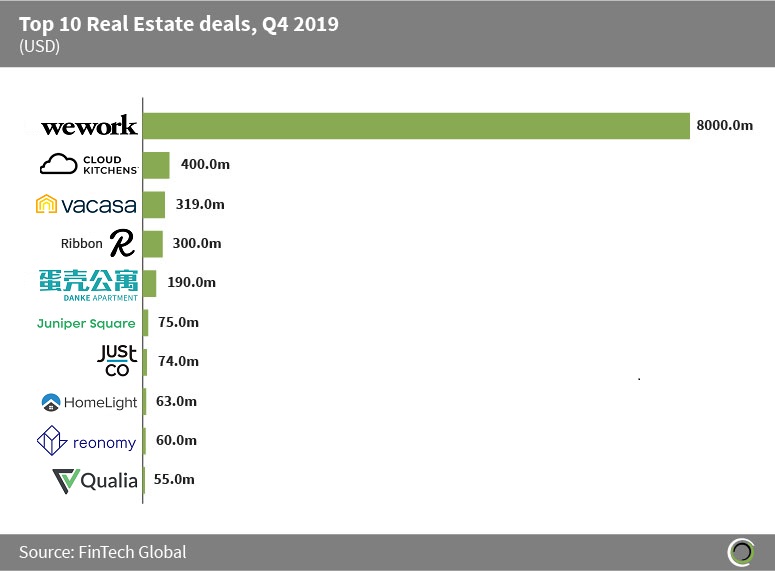

Over $9.5bn has been raised in the top 10 deals in the sector last quarter

- Over $9.5bn was raised in the top 10 PropTech deals globally in Q4 2019, which is equal to 98.3% of the total capital raised in the sector last quarter. All of the top 10 deals were raised in the United States.

- The We Company, also known as WeWork, is a platform for creators that transforms buildings into furnished, collaborative workspaces for small to medium businesses. The company raised $8bn in a combination of debt financing and secondary market funding in October 2019. The funding from SoftBank Group provides WeWork with significant liquidity to execute its business plan and accelerate the company’s path to profitability and positive free cash flow.

- Ribbon is a PropTech company which aims to transform real estate transactions by delivering a better experience for both customers and realtors by offering an open platform. The company raised $300m in a debt financing round led by Goldman Sachs in Q3 2019 and will use the capital to expand into new markets and accelerate its product development efforts.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global