The Brazilian decacorn Nubank has been raking in achievements lately. Having announced its first ever acquisition in January, it now boasts of having over 20 million customers on its books.

To celebrate, Nubank has declared January 20 as its official Purple Day, named after the colour of its credit cards.

“Reaching the 20 million user mark, a huge contingent that is larger than the population of many countries, shows that we are succeeding in this intention to reinvent a traditional market,” said Cristina Junqueira, co-founder of Nubank. “We created a true purple nation with 20 million customers who are now free to control their money.”

The news comes after the FinTech firm reached the coveted decacorn club in July 2019 when it raised a $400m investment round which pushed Nubank’s valuation over the $10bn mark. That was on the back of the challenger bank raising $150m in a Series E round in 2018.

The investment it has attracted as well as the 20 million customers on its books make the digital bank bigger than many of its international competitors.

For instance, UK-based Starling Bank celebrated having one million customers in November. The FinTech unicorn also raised £30m in October. It has now raised roughly £263m in total.

Revolut is another British challenger bank. It had about seven million customers last summer and is reportedly eyeing a new investment round that would take it past the $5bn valuation mark.

The German challenger bank N26 celebrated having 3.5 million customers across Europe in June 2019.

Competition in the challenger bank market is only expected to increase. The sector is estimated to be worth $301bn by 2025.

Of course, Nubank is not the only Brazilian FinTech enterprise to raise a lot of money.

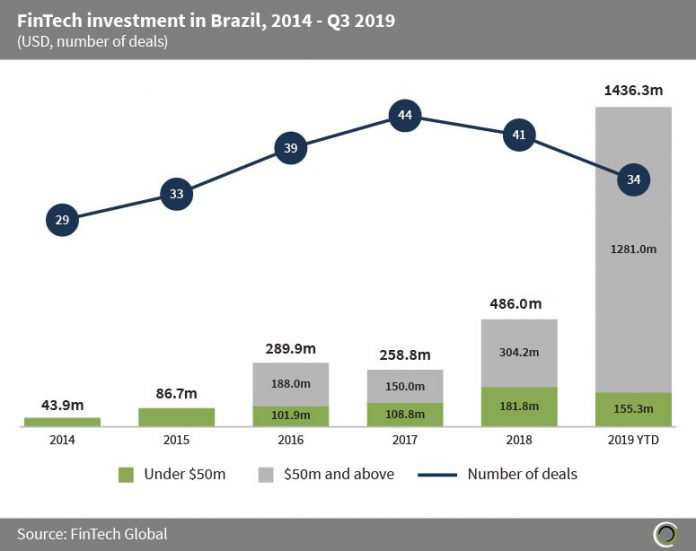

The country has become a hotbed of FinTech innovation, having attracted over $2.6bn since 2014, according to FinTech Global’s data.

Investment grew at a compound annual growth rate of 82.4% between 2014 and 2018, going from $43.9m to $486m in annual investment in that period.

The news about the 20 million customers comes after Nubank bought software developer PlataformTec in an acquihire in January, making it the challenger bank’s first ever acquisition.

Copyright © 2020 FinTech Global