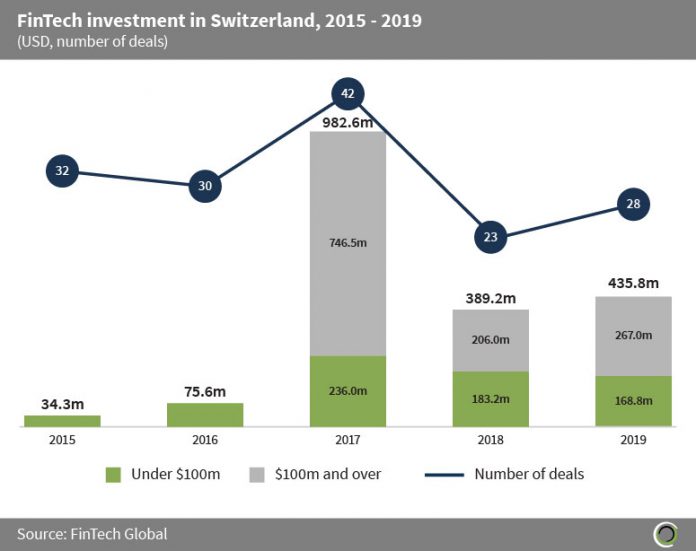

FinTech companies in Switzerland have raised nearly $2bn between 2015 and 2019, across 155 deals. Of this investment, 63.6% has been raised in deals valued at $100m or above.

Investment grew at a CAGR of 435.2% between 2015 and 2017, to a record of $982.6m across 42 deals. The record year was driven by four deals valued at over $100m which accounted for 76.0% of the total investment that year. Investment proceeded to drop significantly in 2018 to just $389.2m with just two deals valued over $100m being completed. However, funding appears to be on the up again with $435.8m raised in 2019.

Average deal size has increased over 14-fold from just $1.1m in 2015 to $15.6m in 2019 as total investment increases at a higher rate than the number of deals closed. The largest deal of 2019 came from Acronis, a cybersecurity company that offers safety, accessibility, authenticity, privacy and security services. The company raised $147m in a round led by Goldman Sachs in Q3 2019 and plans to use the funding to grow through acquisitions, accelerate business growth in North America, build additional data centres and expand its engineering team. Upon closure of the deal, the company reached a valuation of over $1bn giving them unicorn status.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global