Asia is leading the way when it comes to consumer FinTech adoption with more than half of adult consumers active online regularly using FinTech services according to a 2017 survey by EY. China and India, the most populous nations in the world, are both underserved in many financial markets which appeal to the rising middle class. FinTech companies are particularly proficient at reaching these tech-savvy, underserved markets hence investment in Asian FinTech is booming.

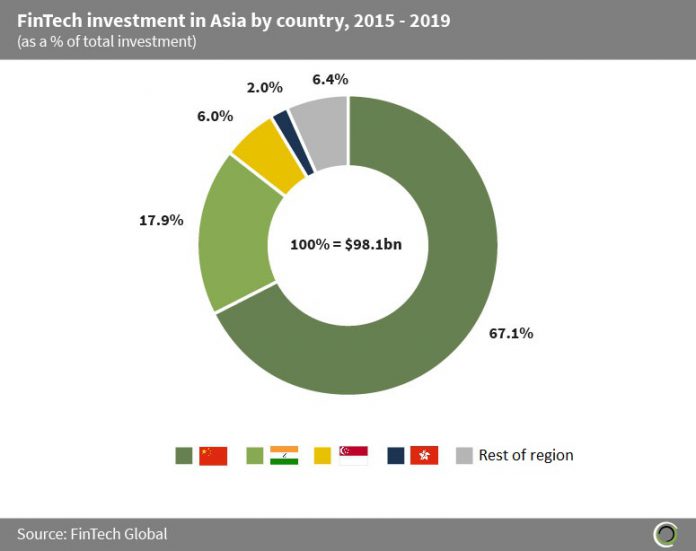

FinTech companies based in China captured 67.1% of total FinTech investment in Asia between 2015 and 2019. This has been driven by large deals valued at or above $1bn, with 15 deals in this size range being completed during the period. As China’s financial landscape has traditionally been poorly regulated with few options for consumers, tech giants in the area such as Alibaba, Tencent and Baidu were able to disrupt the market with their FinTech offerings, making financial services accessible to everyone.

FinTech companies in India also raised a healthy share of investment with 17.9% of FinTech investment in Asia originating here. The FinTech sector in the country was brought into the national spotlight following the late-2016 demonetisation drive by the Indian government, shifting merchants away from cash and allowing FinTech companies in the region providing digital payments solutions to flourish.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global