UK challenger bank Monese is reportedly set to become the latest FinTech unicorn as it gets close to a £100m investment round.

The round, which is backed by existing and new investors, is expected to close in the first half of the year, according to a report from the Financial Times.

Monese’s chief executive Norris Koppel told the Financial Times that another funding round was going to happen and it will be enough to take it through to profitability.

The FinTech’s last funding round was a $60m Series B back in 2018, which was supported by Kinnevik, PayPal, International Airlines Group and Augmentum. It raised the former round to support its international expansion efforts and product development.

Consumers can use Monese to open a currency account and can access a variety of tools including money management, debit cards, budgeting tools and bank transfers. Users can send money to 32 countries and in 14 currencies.

Its app gives consumers the ability to track their account activity in real-time, get an overview of monthly outgoings, set budgets and puts savings aside from day-to-day spending.

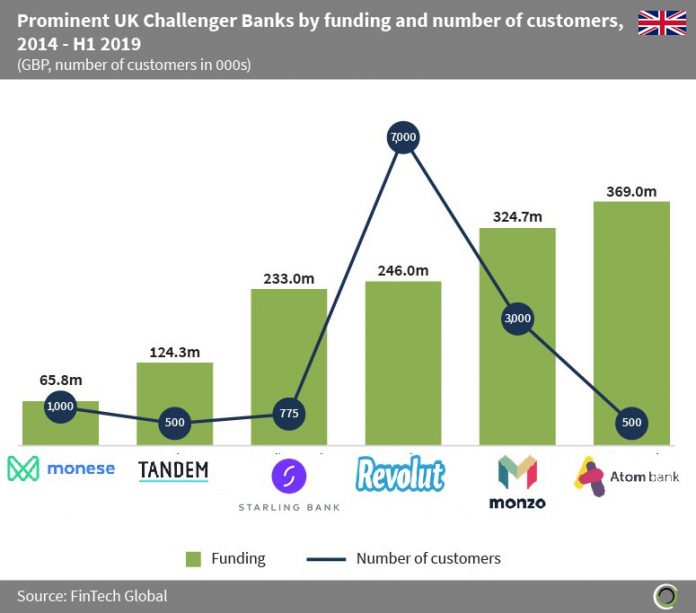

The UK has a number of strong challenger banks, FinTech Global data shows. Since 2014, monese, Tandem, Starling Bank, Revolut, monzo and Atom bank has collectively raised £1.3bn in funding.

Earlier in the year, Revolut was reportedly looking to close a new funding round which would put its total company valuation to £3.85bn. The challenger bank has been a unicorn since 2018, when it closed a $250m Series C round.

Copyright © 2020 FinTech Global