From:Â RegTech Analyst

Sweden’s RegTech scene has been slow to emerge. While its starting to wake up, it still has many challenges to overcome.

RegTech is rapidly coming into its own. While still often considered a subsector of the FinTech industry, signs show that it is stepping out of the shadows to become a tour de force to be reckoned with. Nowadays, more and more sectors – from HR to logistics – have begun to recognise the benefits of having solid compliance solutions. Globally, RegTech companies raised over $17.1bn across almost 950 deals between 2015 and 2019. But it seems as if this emancipation has yet to reach Sweden.

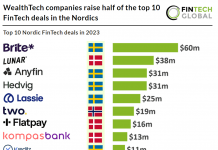

From the outset, the Nordics in general and Sweden in particular should be perfectly placed to leap on the opportunity to establish the region as an international RegTech leader. Its population has a high digital literacy and the individual countries’ finances are booming, which have both contributed to the Nordics having one of the highest number of tech unicorns per capita in the world. The Nordic FinTech scene has attracted more than $3.3bn since 2015, according to FinTech Global’s data.

“Sweden has a history of being innovative and in resent time, becoming digital,†Richard Rosenholtz, chairman of the Nordic RegTech Association, RegTech track lead at Sthlm Fintech Week and co-founder at Compliance as a Service, tells RegTech Analyst. “We have also quickly adopted the mobile society which has made it easy for startups to test their products and with family, friends and like-minded entrepreneurs.â€

But that is not the case for the region’s RegTech scene, which only attracted 7.3% of the FinTech investment made between 2015 and 2019. “I’m still surprised that RegTech is not more prominent due to the law-abiding mentality in the Nordics and the large amounts that have been spent on compliance consulting since the crisis,†Rosenholtz says. “There are RegTech companies in the Nordics, don’t get me wrong, but I’m saying that I’d expect there to be more of them and that they would have gained more traction in their home market. Both with investors and with clients.â€

So why has the Swedish RegTech sector been so slow to emerge? One reason is because Sweden endured the great recession comparatively better than many other western countries.

This, in turn, was due to Sweden having suffered a huge economic crisis between 1990 and 1994. Afterwards, Swedish lawmakers introduced massive economic reforms, including putting a cap on public spending. The measures were backed across the political spectrum and have yielded impressive results, with the national debt having dropped from 69.5% of GDP in 1996 to 35.1% in 2019.

The result of these efforts was that the Swedish economy was and still is very stable, with the World Economic Forum having ranked the nation as the seventh most competitive country in the world.

The strong economy has been great for Swedish tech entrepreneurs in general, but not necessarily for the RegTech sector in particular. “For good and bad, this did not put as much pressure on Swedish banks in terms of regulatory blowback,†says Rosenholtz. “New regulations were the same all over the EU and needed to be implemented, but Swedish banks did not see the same number of fines and court cases that happened in other countries. This did not spark the same need for innovation around regulatory and compliance handling – the growing grounds for RegTech was not as fertile in Sweden and the Nordics as in the UK and US. The RegTech field has therefore been slower to take off here than one could expect.â€

In other words, incumbent banks and insurance companies had no real incentive to look for compliance and risk solutions. “But they are starting to reach out and look at regional and global solutions,†says Rosenholtz. “It has simply been a matter of time before they would follow the global trends where risk and compliance are handled in a better, simpler, quicker and cheaper way through RegTech.â€

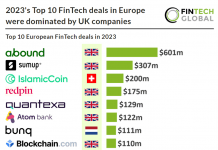

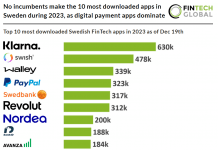

Sweden’s strong financial health and high digital literacy has been one of the key drivers behind the nation attracting 78% of the FinTech investment going into the Nordics. Both iZettle and Klarna have flourished as a result.

However, the success of these FinTech unicorns could also explain why Nordic RegTech has been slow to get off the launchpad. “I believe it helps with attracting attention but at the same time I see that other tech fields have suffered by how the payments field have overshadowed them,†Rosenholtz says. Indeed, 20.9% of FinTech investment went into payment and remittances companies between 2015 and 2019, according to FinTech Global’s data. Moreover, 20.5% went into the marketplace lending sector. “Entrepreneurs have been drawn to these hot fields without seeing what else is out there and possibly missing out on developing the next innovative RegTech or LegalTech product,†Rosenholtz.

The combination of there being less demand for the services and that local investors have so far been hesitant to invest in the market has meant that the RegTech industry has been slow to emerge in Sweden.

Yet, Rosenholtz is bullish about its ability to grow into something great. “There are still so many different areas of compliance where technology can be applied and I believe the Nordics should be able to grab a large slice of the global RegTech cake,†he says.

Before that can happen, though, Nordic RegTech entrepreneurs must still tackle many obstacles. Firstly, Rosenholtz would like to see more RegTech sandboxes run by the government, which could try their solutions. “The Swedish FSA, Finansinspektionen, has started an innovation centre with the aim to follow the development of innovations, but, unfortunately, they are not tasked with actually developing the financial industry and therefore they can’t operate like the FCA in the UK that is able to be closer to the market and who has a history of working together with the financial industry and tech startups,†he explains.

“The second challenge is finding a speaking partner at financial institutions in the Nordics,†Rosenholtz continues. “Often a role has been created around open banking, payments or FinTech but that person doesn’t have the interest, capacity or mandate to also handle the wide-spanning field of RegTech. It’s also not clear that it should be someone in compliance as they don’t own the risk or any regulation, nor the technology that handles it. Without the interest and clear function at financial institutions in the Nordics I see that Nordic RegTech companies often find their first customers elsewhere in Europe where banks have realised the potential with RegTech and created such speaking partners.â€

That being said, Rosenholtz is bullish about where Nordic RegTech scene is going. “I hope that through the work the Nordic RegTech Association in Stockholm and the Nordic Legal Tech Hub in Copenhagen is doing RegTech and LegalTech will be the next big growth areas,†he concludes. “The technological developments in the fields globally in recent years have created great opportunities for existing and new companies in the fields to grab the interest of reginal financial institutions as well as of FinTech’s that see the need to handle the high demands of risk and regulations without growing the number of staff exponentially.â€

Copyright © 2020 FinTech Global