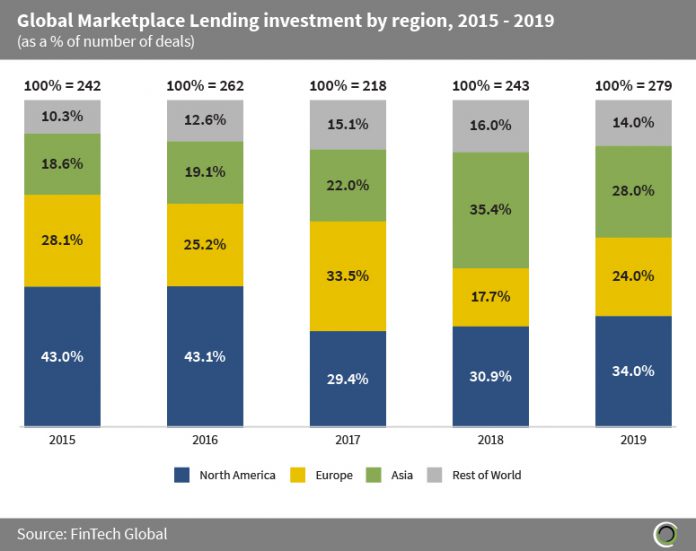

Marketplace Lending companies worldwide completed new record of 279 transactions in 2019

- Originally, Marketplace Lending companies in Europe and North America both captured the largest portion of deal activity in 2015. Since then there has been a marked shift in funding from Europe and North America towards Asia. The Asian Marketplace Lending companies’ share of transactions increased by 9.4 percentage points (pp) during the period.

- As debt levels increase in Asian countries, a larger portion of lending is coming from shadow banks (non-bank), which is raising regulatory concerns about the stability of the financial sector in the region. Kim Yongbeom, a senior official at the Financial Services Commission, which is the financial services regulatory body in Korea, stated that regulated banks normally lend to higher earning individuals investing in the property market, whereas marketplace lenders typically lend to the underserved population.

- In Thailand traditional banks normally lend to the more regulated part of the population like individuals receiving a frequent monthly salary, which leaves a gap in the market consisting of the remaining portion of the population that would not be eligible for loans from traditional banks.

- The Rest of World category comprises of companies based in Africa, Australasia, Latin America, Middle East and Israel, which collectively increased their share of deal activity by 3.7pp since 2015.

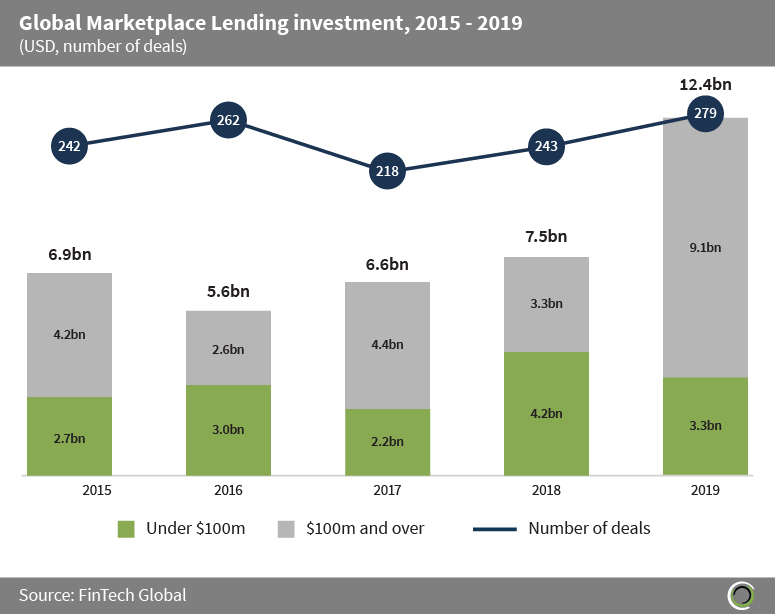

Marketplace Lending deals valued at $100m and above more than doubled since 2015

- Companies operating in the Marketplace Lending subsector raised over $38.3bn across 1,244 transactions since 2015. Deals valued at $100m and above more than doubled, indicating that the subsector has been maturing during the period.

- SoFi, a US leading marketplace lender, raised $1bn in a series E round led by SoftBank in September 2015. The funding was used to speed up the company’s growth rate as their main financial services are offered to clients discouraged with traditional banks. More specifically the investment was earmarked to further the expansion of their disruptive services and products. Following that year SoFi become the first startup non-bank lender to be AAA rated by Moody’s and loaned over $12bn to customers.

- As a consequence of the great financial crisis of 2008, the number of marketplace lenders (non-bank) significatly increased, leading to investors increasingly backing the sector in chase of higher returns which in turn fuelled its growth. The rise of non-bank lenders has lead to traditional banks losing some control over the distribution of capital.

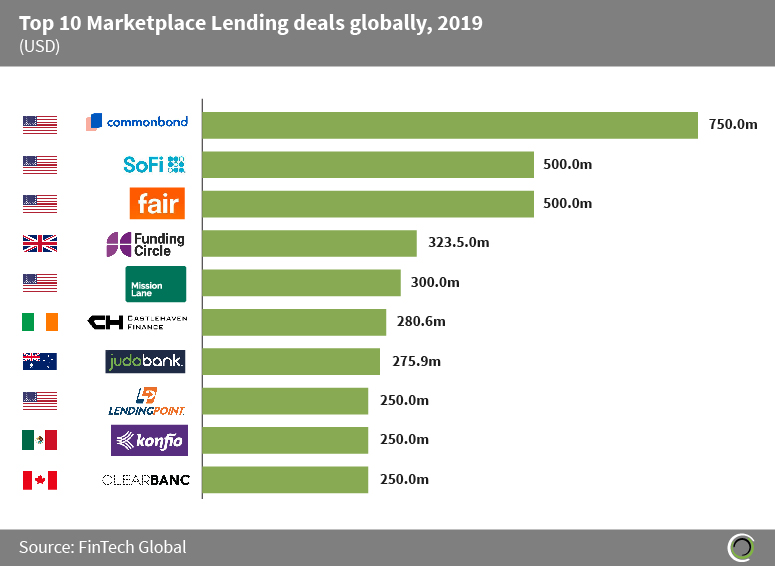

The top 10 Marketplace Lending deals globally raised over $3.6bn in 2019

- Marketplace lenders are moving into the banking sector and challenging traditional banks’ dominance in the industry. The Marketplace Lending companies are utilising technology effectively to provide better and faster services to the underserved market, which has given them competitive advantage ahead of the incumbent players.

- CommonBond, a US online lender, raised $750m in a debt financing round from Citibank, Barclays, BMO, ING, and Goldman Sachs in February 2019 which was the largest deal that year in the subsector. The funding will be used to increase the company’s lending capacity for their largest market consisting of graduates and students.

- The highest European deal was raised by Funding Circle, the UK’s leading SME loans platform, raised $323.5m in a post IPO debt round led by Waterfall Asset Management in December 2019. The funding will be used to broaden the spectrum of potential investors like insurance firms and pension funds for the small business loans asset class.

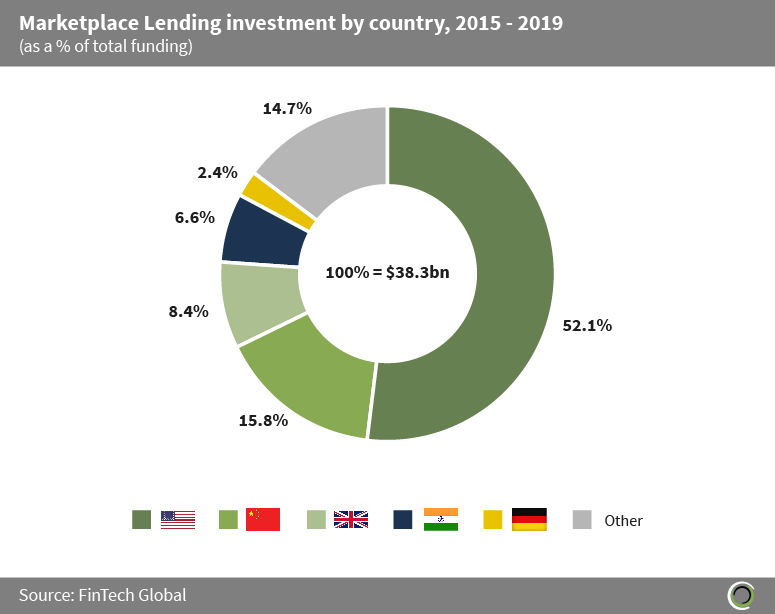

US Marketplace Lending companies captured over 52% of global funding in the subsector since 2015

- US Marketplace Lending companies received 52.1% of global investment since 2015 amounting to over $19.9bn. The FDIC report stated that the upward trend in the Marketplace Lending subsector will continue in the US. The forecast is based on the fact that traditional banks are under heavier regulation and are experiencing much higher regulatory expenses, whereas marketplace lenders significantly cut their expenses through the utilisation of technology.

- In second place Chinese companies raised $6.1bn, which accounts for 15.8% of global funding since 2015. CGTZ, a Chinese investment and lending company, raised $359.3m in a series D round led by Geo-Jade Petroleum in June 2018.

- The Rest of World category captured 14.7% of global investment amounting to $5.6bn raised by companies in other countries such as Brazil, Australia, etc.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global