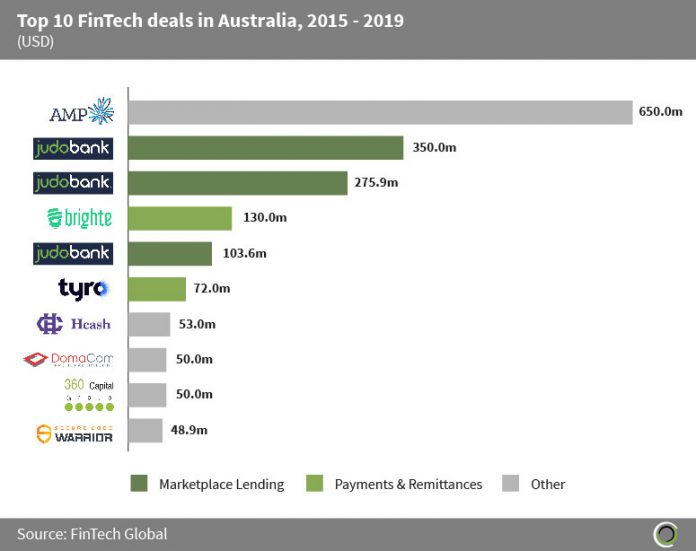

The top 10 FinTech deals in Australia collected over $1.7bn in funding since 2015, with three of these transactions being raised by Marketplace Lending company Judo Bank. Australian real estate sector has experienced market lenders filling the gap left by incumbent banks. The traditional banks’ lending frequency is subsiding due to the strict regulatory standards and higher operating costs.

AMP, an Australian wealth management company, raised $650m in a post IPO equity round in August 2019. The funding will be used to insert a new business strategy to simplify the business, increase internal growth, to result in increased revenue. The business strategy will include selling their AMP life insurance business and restructuring the core wealth management operation making it more cost effective.

Judo Bank, an Australian SME challenger bank, raised $350m in a debt financing round led by Credit Suisse in November 2018. Judo Banks co-CEO, David Horney, stated that the capital raised will be used to increase the company’s funding capabilities to Australian SME’s. The investment is the largest transaction raised by an Australian Marketplace Lending company since 2015.

Brighte, an Australian credit platform company, raised $130m in a debt financing round led by the NAB (National Australia Bank) in July 2019. The company’s CEO Katherine McConnell said that the funding will go towards further expansion, as there is a large demand for their services.

The Other category contains two companies from Real Estate (360 Capital Group & DomaCom), one company each from RegTech (Secure Code Warrior), Blockchain & Currencies (Hcash), and WealthTech (AMP) subsectors.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global