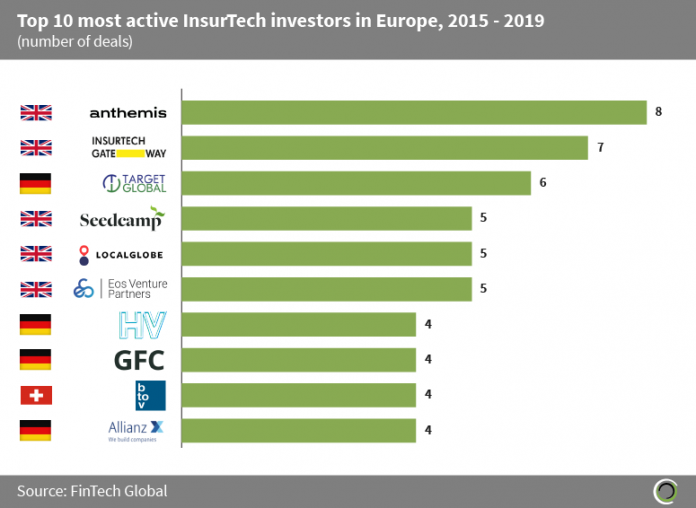

InsurTech companies raised over $4.2bn across more than 300 transactions in Europe since 2015. Specialist venture capital groups such as Anthemis are driving most of the investment into the InsurTech subsector. FinTech Futures stated that there is an increasing amount of activity from foreign investors like SoftBank, however these firms invest in few late-stage deals, which means their deal activity is limited.

Anthemis Group, a leading global venture capital firm, actively funded six companies (Yulife, Flock, omni:us, Quantemplate, Qover, and Kaiko) across eight separate transactions since 2015, making it the most active InsurTech investor in Europe. The largest investment Anthemis Group participated in was a $22.5m round raised by omni:us, an AI powered claims platform, in October 2018. Omni:us planned to use the funding to continue investing in its AI platform and to expand its operations into the US.

Target Global, a German Venture Capitalist based in Berlin has been the most active InsurTech Investor in Germany and the third most active in Europe. The company’s largest InsurTech deal in Europe was a $42m Series B funding round in Zego, a UK commercial insurance company in June 2019. Zego, used the funding provided by Target Global to expand their operations across Europe and to increase the size of their workforce.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global