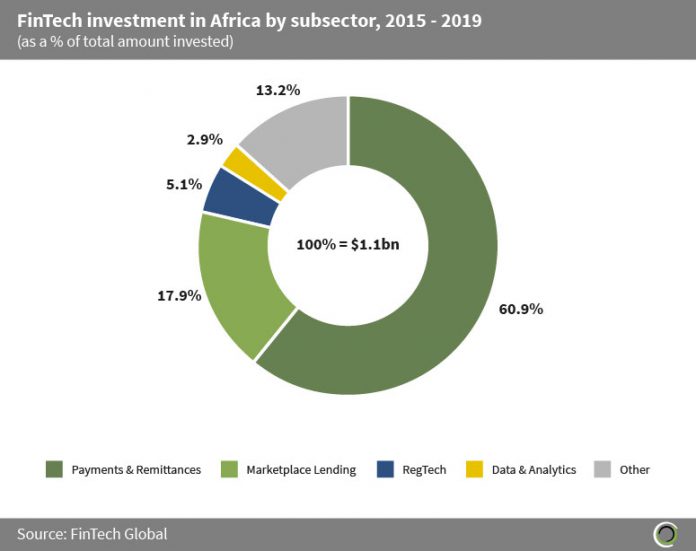

The FinTech companies based in Africa raised over $1.1bn across 122 transactions since 2015. The Payments & Remittances subsector received 60.9% of African investment amounting to $699.5m in funding during the period.

Sub-Saharan Africa has an extremely large unbanked population of around 350 million adults falling into that category. The prospects of introducing digital payments to Africa has attracted foreign investment, leading to most of the funding being concentrated in the Payments & Remittances subsector.

Jumia Group, an African e-commerce company, raised $326m in a series C round led by MTN Group Limited and Rocket Internet in March 2016, the largest FinTech deal on continent to date. The idea behind the funding was to allow the Jumia Group to provide online commerce services early in the African market. Then as internet access increases and the middle class grows in the region, both the company (Jumia Group) and investors (MTN and Rocket Internet) will profit in the future. Rocket Internet has used this strategy in other regions around the world such as Asia and Latin America.

The Other category contains InsurTech, Blockchain & Cryptocurrencies, Institutional Investment & Trading, WealthTech, Infrastructure & Enterprise Software, Funding Platforms, and Real Estate subsectors collectively capturing 13.2% of African investment since 2015.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global