Entrepreneurs with no financial services background still build superior FinTech startups to those from traditional finance or banking businesses, according to venture capital firm Earlybird’s Christian Nagel.

The partner at the Berlin-headquartered firm told FinTech Global that he was seeing the most-disruptive innovations from people with no prior experience of the finance industry. For many with financial and banking backgrounds, FinTech seems like an attractive area to apply their skills and knowledge, despite the risk associated with startups businesses.

That is especially true right now, at a time when major banks are continuing to reduce their headcounts. A report from Citigroup last year forecast that European and US institutions will cut another 1.7m jobs over the next decade.

That follows the 730,000 jobs Citi says banks have already done away with since they hit their peak staffing levels, as automation and online services reduce the need for human employees.

For VC firms such as Earlybird, however, the types of companies these founders create are not the ones bringing major disruption to the field that can be capable of delivering the sizable return early-stage investor depend upon.

“People with banking backgrounds do come up with interesting ideas or product optimisations,” says Nagel. “But the most disruptive things are driven by people who don’t have a deep rooting in the banking industry.”

The team behind a startup remains the most-important factor for investors and Nagel says FinTech startups need “someone in the team who is able to really code and to manage tech teams”.

He emphasises that EarlyBird aims to invest in companies where the disruptive element is tech-based and where the team has a “tech DNA”.

Too many copy cat startup are making it harder to find the best FinTech deals

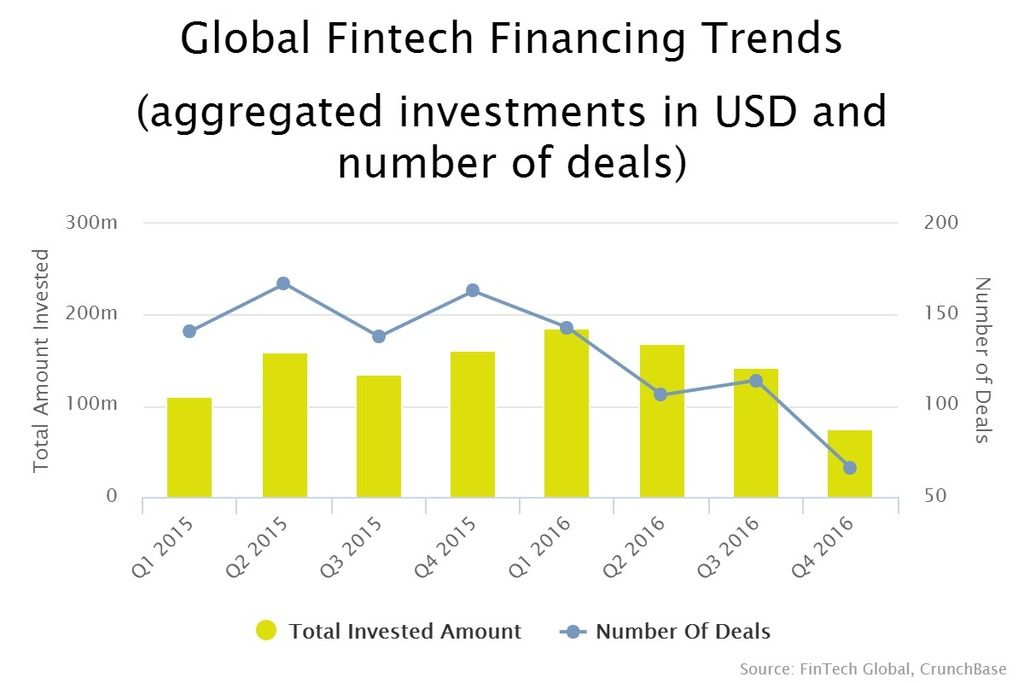

With so many new startups entering FinTech sub-sectors the industry is becoming increasingly crowded, and creating a greater challenge for investors in finding the best deals. Globally more than $1.11bn was raised in angel and seed-stage funding by 1,023 FinTech companies between Q1 2015 and Q4 2016, according to FinTech Global data.

“There are so many copycats out there now that in some areas it is over. You can’t do investments there,” said Nagel, highlighting neobanks as a crowded space with a lot similar companies and many that are “basically consolidating accounts”.

He points to InsurTech as an area of major opportunity for investment and one of the core sectors of Earlybird’s digital tech fund, but Nagel suggests the large number of digital brokers entering the space means it’s already becoming busy.

Similarly, he claims “pure SME lending is quite crowded now” but still sees potential for investment in companies that “go after the specific needs of SMEs like capital financing in reasonable conditions”.

Nagel suggested: “It still has potential because banks will do less and less of this. I see all volumes moving to platforms, leaving all kinds of working capital funds for SMEs and large companies coming up.”

As many of these FinTech verticals become crowded Nagel hinted at a potential shakeout across the sector, and that when it comes to winners in the space said “there can be a few but there will not be many that can make it”.

The greatest opportunities in InsurTech lie in companies digitising the entire value chain

Focusing on the InsurTech space, an area many FinTech investors have signalled intentions to invest heavily in, Nagel suggested any winners “will be fully integrated” like traditional insurance firms rather than concentrating on one part of the value chain.

He said it is unlikely any single InsurTech startup will “become a dominant player” but expects to see new insurance players “completely digitising the entire value chain”.

This will include the digitalisation of the “whole customer experience from signing a contract to claim management” and will create the opportunities for a few major companies to emerge from the crowd.

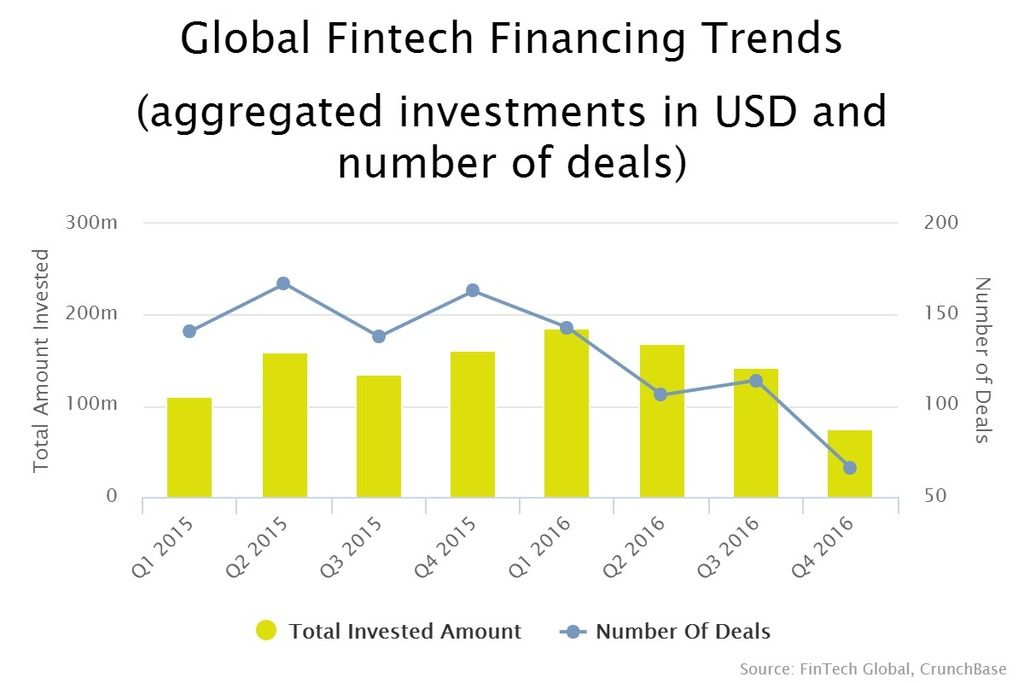

Globally more than $2.1bn was raised by companies across the InsurTech space between Q1 2015 and Q4 2016, according to FinTech Global data, with 147 rounds completed. It’s not just traditional VCs who see big potential for tech disruption in the insurance space though – corporate investors are also a growing presence in the sector.

“It’s natural because they’re waking up and realising they have to act or they will lose out,” said Nagel. “The banks, in many respects, have lost already but insurers had time to see that happen and are now waking up.”

Unlike the teams that Nagel prefers to invest in, he welcomes the opportunities that traditional finance players bring to the FinTech and InsurTech space. He said the strength in traditional insurers is they “already have a customer base. They don’t know anything about the customers but at least they have a customer base and distribution.

“They have something, they can bring to the table when it comes to teaming up with startups and that’s why it makes a lot of sense.”

VCs must adapt to work with corporates engaging with startups

Where corporate firms are changing to engage with startups, Earlybird is also adapting to work with these traditional institutions.

“We’re building bridges for the insurance companies because they can obviously help and can integrate here and there,” said Nagel. “It’s beneficial for both sides.”

This growing corporate interest in the startups across the tech sector is swelling the pool of active investors in Europe and Nagel said this means there is “more competition coming from companies that have never thought about FinTech or have no experiences because everyone wants to invest in that area.”

This creates challenges for founders too who need to find “the right investors who can support them in the right way”.

FinTech requires patient investors and Nagel emphasis that while startups targeting big markets are attractive it is “always a numbers game. You have to be at volume no matter what you do”.

“FinTech typically takes a long time to show real numbers and profitability,” he added. “It’s a long journey to build valuable FinTech companies and for this you need money.”

This interview was conducted as part of FinTech Global’s extensive ongoing research programme with the world’s most active investment firms and financial institutions. More in-depth expert perspectives, articles, data and analytics are available to Fintech Global subscribers.

Copyright © 2017 FINTECH GLOBAL