FinTech funding in Singapore looks set to soar this year as H1 2017 sees over $150m worth of investment already

- Until the close of Q2 2017, 2015 was the year that FinTech in Singapore saw the largest amount of funding across a single year with $140.2m. But the first half of 2017 has already surpassed that value by 13.4% with $159m-worth of investment.

- The $159m invested in 2017 thus far is more than seven times the amount of funding 2014 received.

- 2016 saw a downturn in both figures compared with 2015, with investment falling 23.6% and deal activity falling 9.4%.

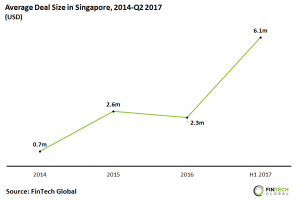

- Funding has reached record breaking levels in 2017, despite deal activity being on track to near the levels seen in the last couple of years. The average deal size for H1 2017 is $6.1m, whereas for 2016 and 2015 they are $2.3m and $2.6m 37.7% and 42.6% of H1 2017 average, respectively.

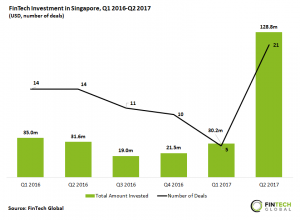

Q2 2017 was a record quarter for FinTech investment in Singapore with over $125m invested

- Q2 2017 was the largest and most active quarter for FinTech investment in Singapore there ever been, with a total of $128.8m invested across 21 deals. $128.8m is over 90% of the total investment the sector saw in the previous 5 quarters combined.

- After a continuous QoQ fall between Q1 2016 and Q1 2017, deal activity rose sharply in Q2 2017. The 21-deal haul brought an increase of investment that reached more than four times what the opening quarter of the year received, in what was a 50% rise on what was seen in the second quarter of last year.

- The largest deal in Singapore record-breaking quarter was received by local life insurance provider Singapore Life; the investment was led by Impact Capital Holdings with collaboration from London-based holding company IPGL and came in form of a $50m-valued Series A round in late April.

Over $200m has been invested across Singapore top 10 FinTech deals since 2014

- $220.8m was invested across the top ten deals to Singapore-based FinTech companies since the start of 2014, the largest of which was the previously mentioned $50.0m Singapore Life funding round. That deal was followed by the $36m Series C round received by AI and Big Data powered monetisation platform Metaps back in 2015.

- Also in the top ten is smart-contract on the blockhain company Qtum, whose $15.6m funding round came in the form ICO. Qtum used multiple cryptocurrency exchanges/crowdfunding portals to conduct the ICO these included Bizhongchou, Yunbi, and ICOAGE, among others.

- Another notable inclusion includes trading platform Singapore Diamond Investment Exchange (SDiX), which claims to be the world first commodity exchange using physical diamonds as capital. They raised a $10m Series B in Q2 2017, in a round co-led by the firm own co-founder Alain Vandenborre and domestic VC Vertex Ventures.

- Half of the companies featured in the top ten received Series B or later stage funding rounds. The crowdfunding financing of Qtum along with Series A rounds for Singapore Life and Quoine, were the only early stage funding rounds on the list. MatchMove and WB21 funding round stages were undisclosed.

Over 25% of the FinTech companies in Singapore focus on Payments & Remittances innovation

- Payments & Remittances companies occupy 26.8% of the company share in Singapore FinTech sector as of the close of Q2 2017 equivalent to 33 active companies. Examples of companies include online payment service provider?Red Dot Payment and online inventory and order management company TradeGecko.

- FinTech companies in Singapore are well distributed across the sector, with WealthTech being the only other sector to have more than 10% of the share with 22 companies. One of the most prominent Singaporean firms in the sector is OOjiBO. The company claims the solution they provide works as a full stack retail banking system on a mobile phone.

- Sector comprising of less than eight companies occupy the Other category, which include Institutional Investments & Trading, Blockchain, and RegTech, among a few others.