Singapore-based online investment platform CapBridge has secured a partnership with the Singapore Exchange and raised up to $4m in a new round of funding.

Following the agreement, CapBridge will acquire a 10 per cent stake in the company’s online capital-raising service, CapBridge Platform Pte.

The capital raised also supported from a group of early-stage investors which including Timothy Draper.

Founded in 2015, CapBridge helps institutional and accredited investors access to investment opportunities. The platform allows users to contribute in a range of deals including venture capital financing and pre-IPO placement. An investor creates a profile, select deals that appeal to their investment criteria and can then perform due-diligence on the fundraise and company, before pledging capital.

Businesses are also able to set up campaigns to receive funding, detailing the of fundraise it is and then selectively allow investors to commit to the round. Earlier this year the platform helped US-based Nautilus Data Technologies to raised $25m in a Series C round.

Capital raised from the round will help the company to build on its platform’s features, which help companies and investors tap on, engage and exchange content amongst themselves.

SGX senior vice president Mohamed Nasser Ismail said, “CapBridge addresses the funding challenges growth companies face, and adds to the vibrancy of the capital markets here in Singapore. SGX is committed to supporting the development of the CapBridge online platform, and this partnership syncs well with our broader drive to ensure that every company, at each stage of their growth, has access to capital that is efficient, cost-effective and sustainable.”

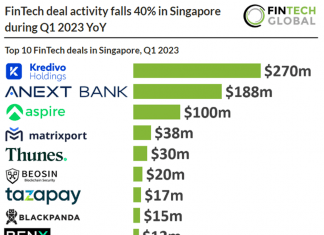

Singapore has already seen a record year for FinTech investments, with H1 2017 having a total of $159m deployed to companies. This funding level is compared to 2016 which saw $107m injected to companies across the whole year.

Copyright © 2017 FinTech Global