Quote-to-cash and contract management platform Apttus has added former Cisco Systems EVP and CMO Sue Bostrom and Veeva Systems CFO Tim Cabral to its board of directors.

US-headquartered Apptus is a quote-to-cash and contract lifecycle management technology company, supporting processes between buyer’s interest and realisation of revenue. The AI solution helps with businesses critical processes to help simplify the entire sales process, contract and customer relationship.

The company’s offerings include support for e-commerce, revenue management, contract management, incentives, and workflow approvals, among others.

Bostrom is already part of the board of directors at ServiceNow, Nutanix, Varian Medical Systems and Cadence Design Systems. She has gained 14 years of experience working at Cisco, with positions including EVP/CMO and senior vice president of internet business solutions group.

Cabral joins the company after attaining almost 30 years of FinTech experience. Prior to his CFO role at Veeva Systems, he served as the CFO and co-founder at employee management service company Agistics.

Apttus CEO Kirk Krappe said, “Sue and Tim are both extremely qualified and visionary executives with decades of technology experience… As board members, their direction and leadership will progress our unified vision for Apttus and the long-term success of our customers and partners.”

The current board of directors includes Sumeru Equity Partners co-founder George Kadifa, K1 CEO Neil Malik, Apttus founder Kirk Krappe, and Apttus founder Neehar Giri.

Earlier in the year the company raised a $55m Series E funding round led by Premji Invest. The round also saw commitments from Salesforce, K1, and Iconiq. The round of funding brought total capital raised to around $329m.

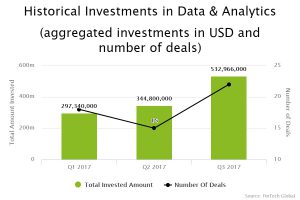

The North American Data and Analytics sector has seen a rise in funding over the year, with Q3 seeing $532m in 22 deals. The investment level from the last quarter was up by $235m, in just four more deals.

Copyright © 2017 FinTech Global