E-commerce technology platform CloudSense has closed a $77m growth investment from Vector Capital.

Founded in 2009, the company is an e-commerce platform that allows businesses to sell products digitally within a single solution. Through the solution a client can access offerings for configure price quote, a product catalogue, contract management, e-commerce, mobile app, order management and advertising sales.

Since the UK-based company’s launch it has grown its annual recurring revenue each year by over 60 per cent. The company currently has eight offices within Europe, Asia Pacific and the US.

This capital will enable CloudSense to increase its global expansion, primarily in the North American market. Equity will also be used for product innovation and development.

CloudSense CEO and co-founder Richard Britton said, “For too long, enterprises and their customers have been restricted by the technological limitations of establishment software vendors, and disappointed by the unkept promises and lack of commitment to customer success by the emerging vendors. CloudSense is uniquely focused on building a new, better solution, that combines our leading enterprise-grade cloud products with an unyielding commitment to customer success across our entire organization.”

Other e-commerce transactions closed in recent weeks include open source platform Reaction Commerce closing an $8.5m investment led by GV. E-commerce technology solution Mobify netted $15m in a funding round and Volo Commerce, a multi-channel system business, bagged a £6.2m investment.

The UK is one of the big players in the FinTech sector, and a couple of big value deals have been closed in recent weeks. Challenger bank raised a further £90m only a month after it had closed a £154m equity line from a group of investors. Last week, money transfer platform TransferWise closed a $280m round led by Old Mutual Global Investors and IVP.

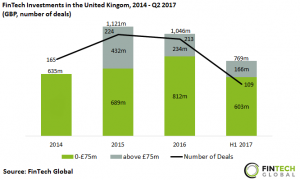

The UK FinTech sector is set to hit record levels this year after a very strong first half. Funding levels in H1 2017 reached $769m, which is over two-thirds the levels hit in the previous year. While the investments levels are seeing a strong year, the number of deals are not, with less than half being completed in 2017 to 2016, so far.

Copyright © 2017 FinTech Global