Payment solutions platform iZettle has raised €40m in funding, just months after receiving €30m in debt funding from the European Investment Bank.

The new line of equity was led by venture firm Dawn and The Fourth Swedish National Pension Fund. Existing investors also took part in this investment round.

Sweden-based iZettle is a mobile payments solution that helps small businesses to take payments, register and track sales, and get funding. The company has a selection of POS options, with one solution turning any smartphone or tablet into a payment terminal capable of accepting cash, card, mobile and invoice payments.

The capital will be used to support iZettle’s growth strategy and product innovation.

The Fourth Swedish National Pension Fund head of fundamental equities Per Colleen said, “We invest heavily in companies contributing to sustainable economic growth and are impressed by how iZettle has levelled the playing field for small businesses.

“We believe in iZettle’s long-term development opportunity through their data-rich technology platform, built for scalability combined with five years of unique insights about the needs of small businesses, which makes it an attractive investment case.”

In September, the company received a €30m line of debt funding from the European Investment Bank, to be supplied over the next three years. This financing was supplied to help iZettle to fund the research and development of its tools.

These pair of funding rounds follow the company’s €60m Series D, which was also closed this year. At the start of the year, iZettle raised €45m in debt from Victory Park Capital, and €15m in growth equity. Investors to the growth injection included Creandum, Northzone, Index Ventures and MasterCard.

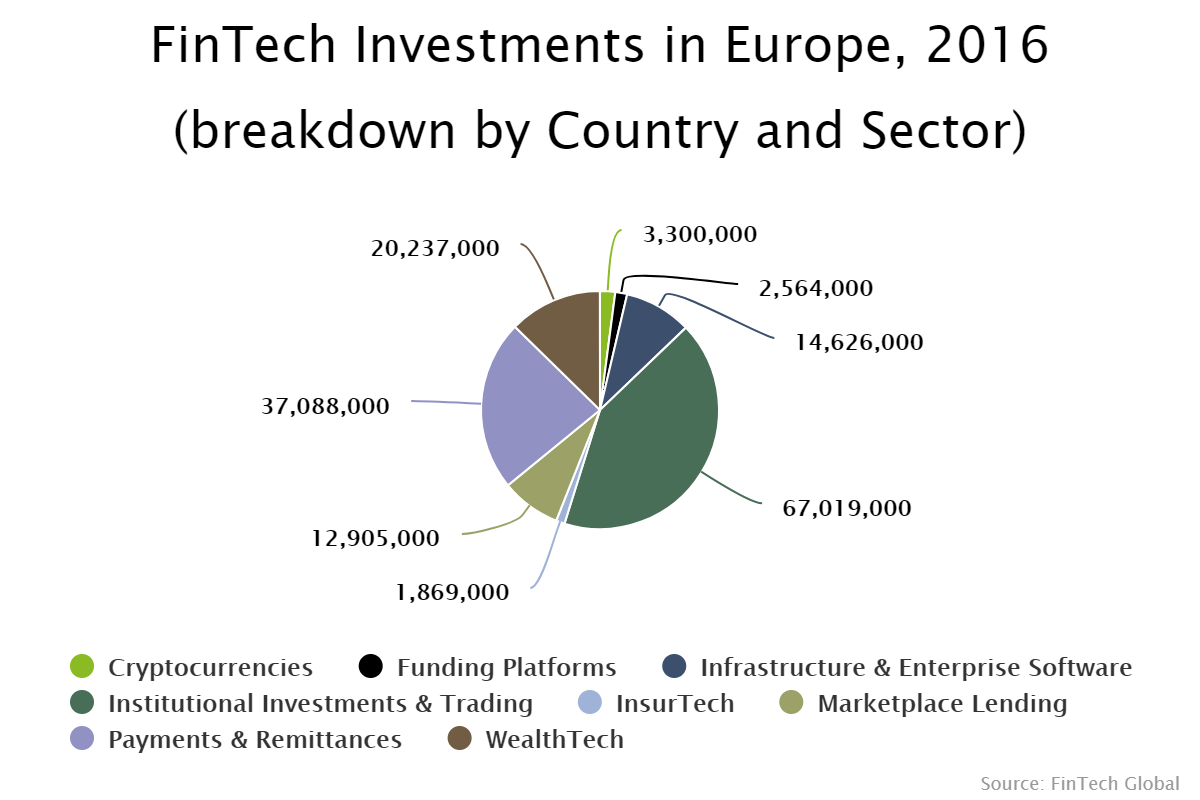

Last year, Sweden represented the fifth biggest country in Europe for funding to FinTech companies. In 2016, the country saw a total of $159.6m invested, of which, $37m was deployed into the payments sector. Institutional investing and trading companies led the way for investments in Sweden, with it seeing $30m more than the next biggest vertical.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global