Financial marketplace Raisin has closed a strategic investment from digital payments giant PayPal.

This investment follows on from the company’s €30m Series C funding round at the start of the year. The previous round was led by Thrive Capital and also saw participation from Ribbit Capital and Index Ventures. The company’s total funding efforts has reached €60m.

Germany-based Raisin is a savings marketplace, helping consumers to find the best terms and interest levels. A user can make deposits into a range of different banking products and manage them all from the Raisin app.

Currently, 40 banks offer savings accounts through the platform, with a range of short-term and long-term products. Raisin also announced it will launch its first retail investment product in the next few months.

The capital from the round will be used to accelerate the platform’s growth within the core European geographies.

Raisin CEO Tamaz Georgadze said, of. “We are thrilled to work with PayPal in making both the products more relevant and more accessible to hundreds of millions of Europeans who can get more out of their savings and investments.”

Earlier in the year, PayPal named the next five FinTech startups to join its incubator program in Chennai. Each of the companies receive mentorship and counsel, together with infrastructure support and networking opportunities, in exchange for a stake in their business.

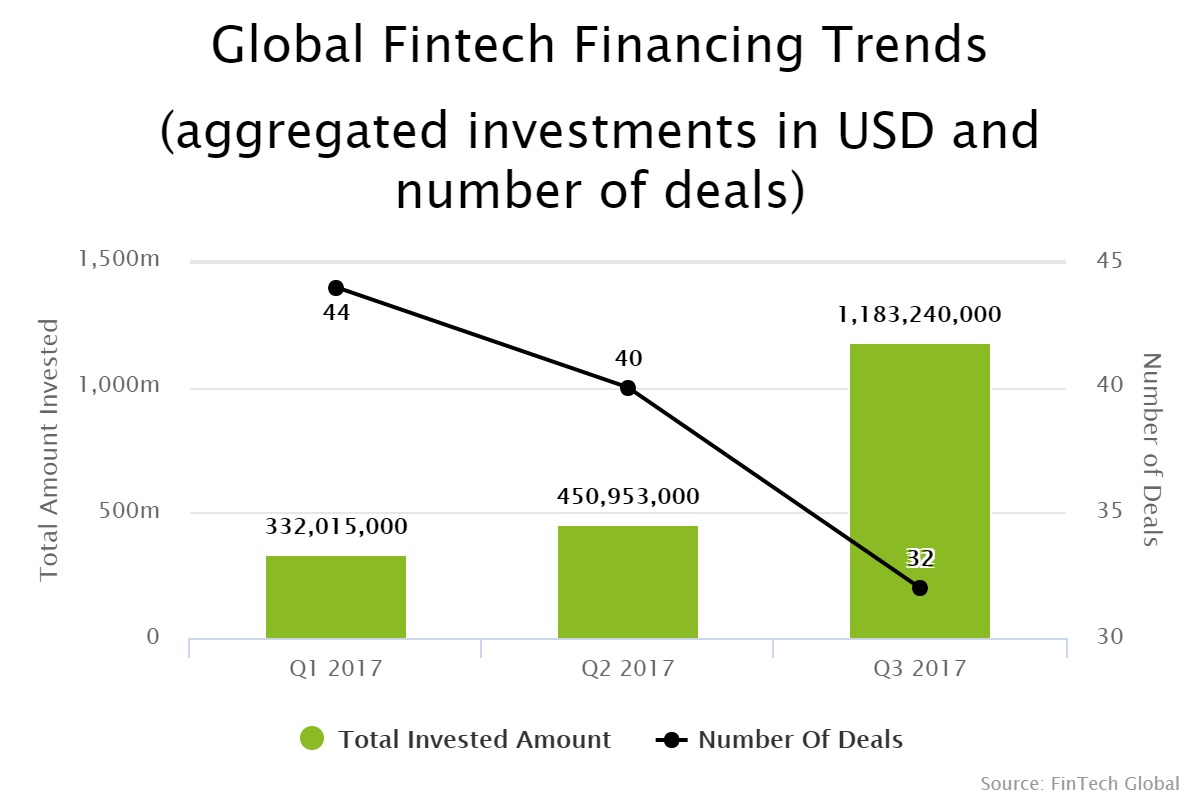

The WealthTech sector has seen a QoQ rise in funding this year, with Q3 seeing three-times more capital invested than the opening quarter. This rise in funding has been accompanied by a decline in transaction volume.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global