Financial reporting company Trintech has received a majority recapitalisation by Summit Partners.

Following the transaction, existing investors Vista Equity Partners and Trintech management will continue to hold a minority stake in the company. The recapitalisation will see Spectrum Equity sell their share in the company, after holding a stake since 2011.

The company’s cloud-based software helps finance and accounting teams with the record to report processes. Trintech’s solution is used across a range of industries including retail, technology, restaurants, manufacturing, hospitality, finance, healthcare and more.

Through the end-to-end solution, clients are able to increase efficiency, reduce costs, and improve governance and transparency.

Over the past two years, Trintech, which is headquartered in Texas, has more than tripled its customer base, with it currently serving 3,100 clients in over 100 countries.

Summit Partners managing director C.J. Fitzgerald said, “With innovative, end-to-end solutions, we believe Trintech is truly transforming the finance and accounting operations of enterprises around the world. Trintech is a clear leader in a large addressable market, and we believe there is significant opportunity for continued and accelerated growth – both organically and through opportunistic acquisitions.”

Last year, Summit Partners took part in the $75m Series D round of machine learning cybersecurity developer Darktrace. The company uses its machine learning and AI algorithms to detect and respond to cyber-attacks.

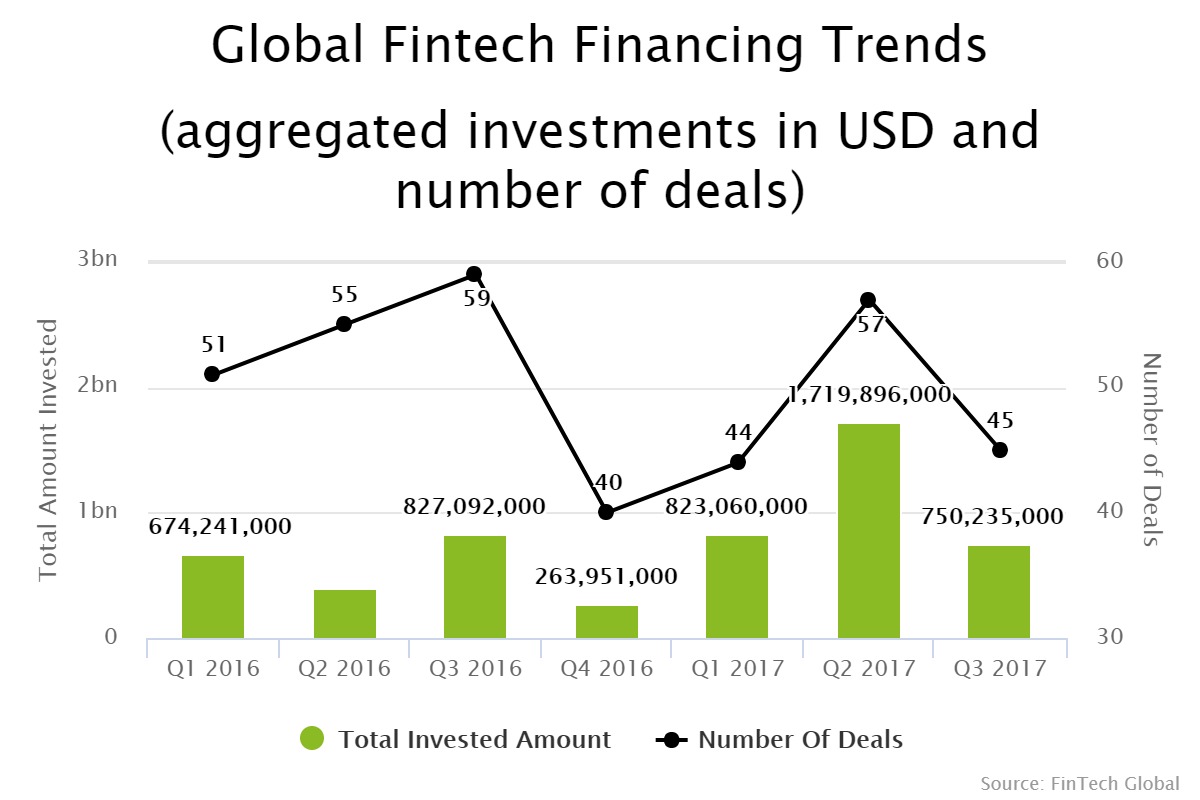

The global banking and infrastructure sector saw a huge rise in funding last year, compared to levels in 2016, with the first three quarters alone seeing over $1bn more invested.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global