Online payments company Ant Small and Micro Financial Services Group has received an investment from Alibaba Group, which will see it acquire a 33 per cent stake.

As part of the transaction, Alibaba has re-arranged its partnership with the acquisition of newly-issued equity through certain intellectual property rights owned by Alibaba. The deal will see no cash impact on Alibaba.

Founded in 2014, Ant Financial was operates across a range of financial services including Alipay, Ant Fortune, Zhima Credit and MYbank. The group aims to help financial services around the world through its online payments, wealth management, online banking, and credit scoring businesses.

Ant Financial CEO Eric Jing said, “We are pleased to strengthen our strategic relationship with Alibaba. This marks the next step in our collaboration to generate more strategic synergies and deliver tremendous value proposition to our customers. We look forward to continuing to work with Alibaba as we pursue our mission to bring the world equal opportunities.”

Last year, Ant Financial made a $200m investment in to the South Korean mobile giant Kakao’s finance subsidiary, Kakao Pay. The investment came months after the group acquired US money transfer company MoneyGram in an $880m transaction.

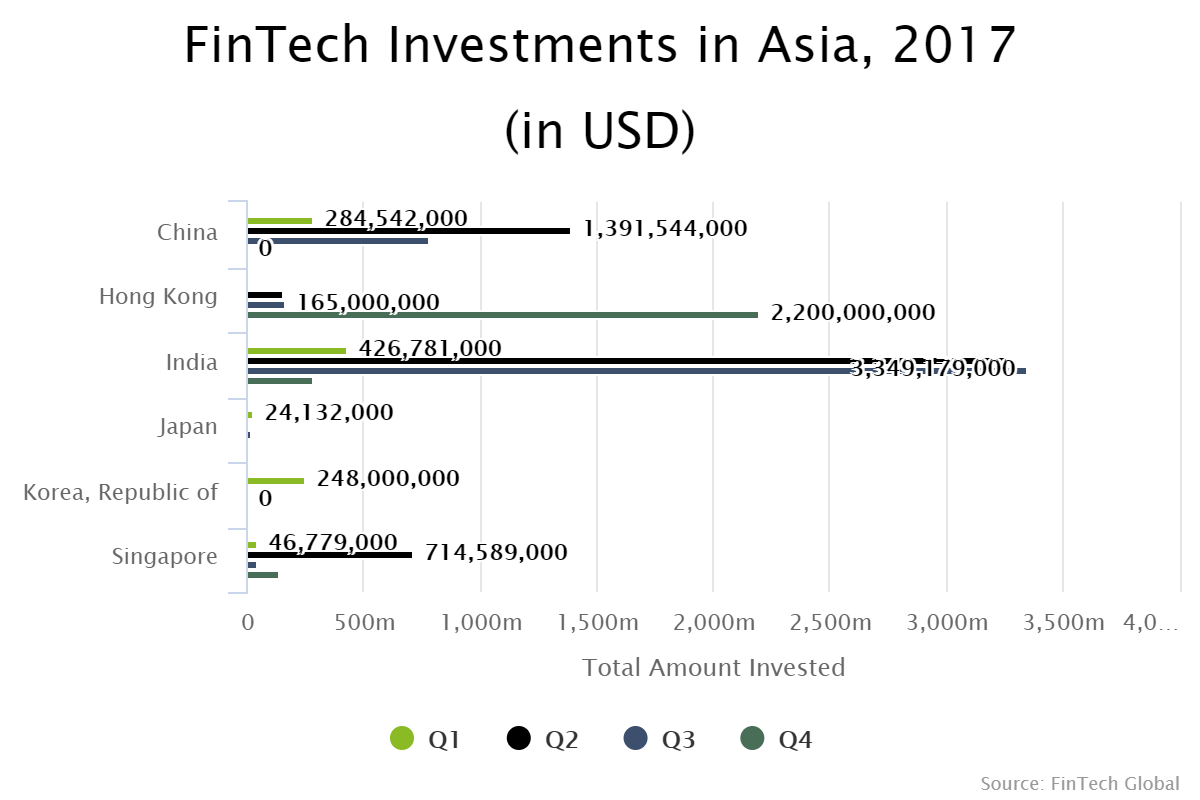

The Asian FinTech sector was dominated by the Indian market last year, with $7.3bn being deployed to the country. The second biggest market for funding was Hong Kong, following a colossal Q4, where $2.2bn was invested.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global