Global online and mobile payments solution YapStone has netted $71m in its Series C led by Premji Invest.

Other contributions to the round came from Mastercard and existing investors Accel and Meritech Capital Partners.

California-based Yapstone provides small and large businesses with a payment processing platform. The technology enables companies and individuals to accept one-off transactions or recurring payments online, mobile, via smartphones or in-person.

Some of the products include global payouts to merchants, instant and deferred funding and split payment solutions. The solution is used in a range of industries including online marketplaces, vacation rental companies, non-profits and property management companies, among others.

This capital injection will enable YapStone to expand its product offering, increase its geographic footprint and seek mergers and acquisitions to fuel growth.

YapStone co-founder and CEO Tom Villante said, “YapStone has grown over 35 percent annually for the past decade and 2017’s growth was exceptional. This funding will help us grow our leadership position in serving global marketplaces and software companies, utilizing new technologies in expanded geographies.”

The payments company has raised a total of $180m in funding, with its last equity round coming in 2015. YapStone secured $60m in a debt financing round from Comerica Bank and Sagemount, to support its expansion across new verticals.

Earlier in the year, Premji reportedly led the $48m Series D investment in to India-based online lending platform Shubham Housing Development Finance Company. The company offers loans for home improvements, development, mortgages, and buying new property, among others.

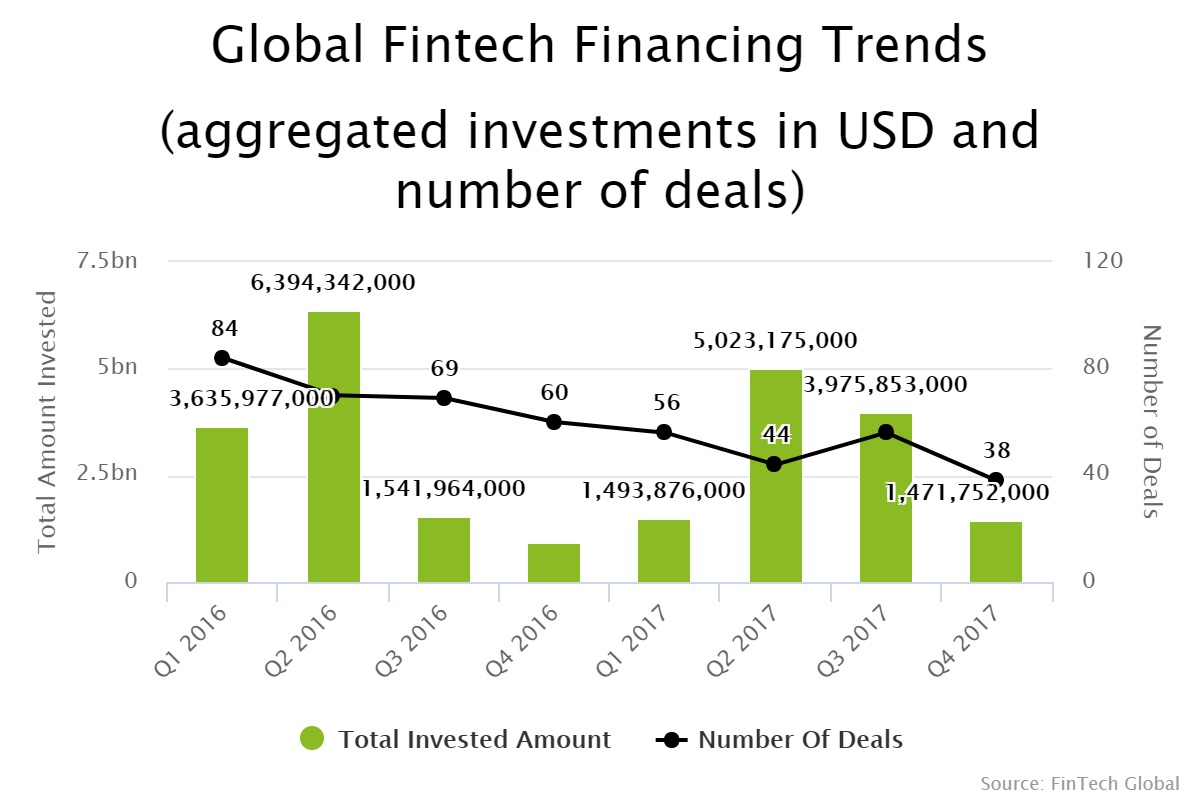

Last year the global payments and remittance sector saw a decline in funding, as the volume of deals continues to decline. In 2016, $12.5bn was invested across 283 deals, while last year, $11.9bn was deployed over just 194 transactions.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global