Mobile and online trading platform TigerWit has secured a $5m investment from Susquehanna International Group.

Beijing-based TigerWit is an online trading technology platform that enables global consumers to operate in foreign FX markets, indices, commodities and metals. The platform helps to ensure client protection and provides access to global interbank liquidity.

The app provides self-directed trading accounts, general advisory and trade execution to help streamline the client journey and minimise variability.

TigerWit is also authorised and regulated by the UK’s FCA and the Securities Commission of The Bahamas.

This capital injection will be used to support the development of its platform, as well as investing in to new technology which can enhance its client trading experience.

TigerWit Group CEO and co-founder Summer Xu said, “We will be using the investment to build upon TigerWit’s expanding global footprint and offer investors the best trading experience available whilst harnessing new technologies such as blockchain to underpin our innovation.”

The company has a keen interest in implementing blockchain technology, with it being a way to bring greater trust in the market and its brand, the company said.

Last month, alternative investment technology provider Artivest merged with investment research and management company Altegris.

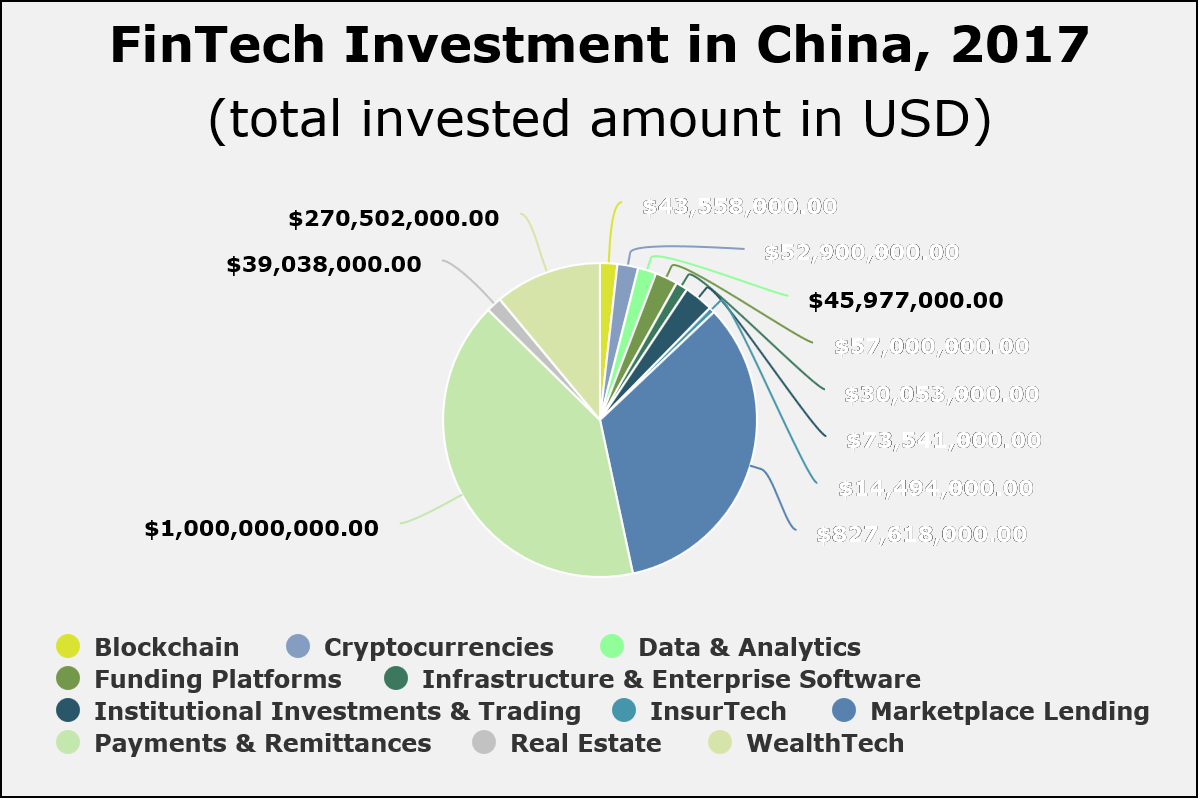

China’s FinTech sector is dominated by payments and remittances, and marketplace lending companies, according to data by FinTech Global. Last year, these sectors raised a combined $1.8bn, which represents 75 per cent of the total FinTech investments in the country.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global