Financial wellness benefit platform FinFit Ops has closed a $35m senior credit facility from Ares Management.

The company has the option to increase the credit to $70m.

US-based FinFit is a financial wellness platform that provides employees with tools to manage their financial fitness. The platform starts with a financial assessment and workout plan, then offers game-based education and budgeting applications.

Short term loans are also offered by the company, to support Americans that can’t access $400 in emergencies. The application puts accounts, goals and bill reminders in to a single location, helping to control finances and set up automatic budgets.

This facility follows on from the company’s $16m investment from Bison Capital Partners in late 2016. Proceeds from the facility, alongside the capital from Bison, will support FinFit’s expansion of financial wellness benefit programmes.

FinFit president David Kilby said, “We are very pleased with this transaction and partnership with Ares. It will allow us to dramatically expand our reach and assist us in achieving our goal of increasing financial wellness one employee at a time.”

Earlier in the week, LearnLux reportedly picked up a $400,000 investment after it won Sound Ventures’ Perfect Pitch. The company is an education platform that aims to improve a consumer’s financial well-being. The initial prize was $100,000; however, Ashton Kutcher and the rest of the Sound Ventures team doubled the prize, and Salesforce CEO Marc Benioff invested an extra $200,000.

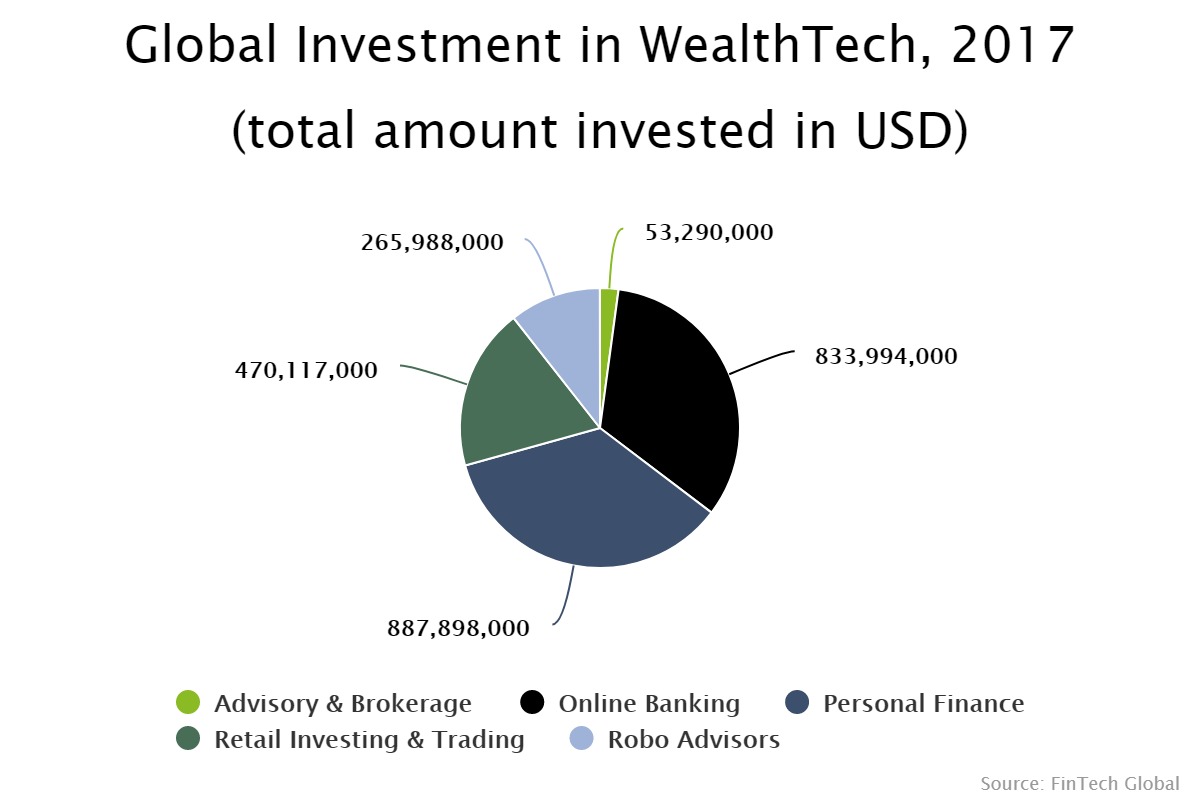

The personal finance sub-sector of WealthTech was the biggest area to receive funding last year, according to data by FinTech Global. The sub-sector raised around 35 per cent of the total capital invested to global WealthTech companies.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global