Victory Park Capital (VPC) and International Finance Corporation, a member of the World Bank Group, have partnered to launch a new FinTech-focused fund.

This new vehicle will target growth investments in technology companies within the financial infrastructure, products and services space across emerging markets. Through the partnership, the firms hope to boost debt capital access to FinTechs.

VPC has made over 40 investments in to the global FinTech space, with the firm making a £35m debt investment in to digital micro-lender Oakam at the end of last year. The company, which offers consumers that are overlooked by traditional lenders with access to credit, hopes this funding will increase its lending activity.

Chicago-based VPC makes three types of investments, direct lending, distressed investments/ credit opportunities, and through a small business investment company (SBIC). Its direct lending strategy sees the firm normally invest between $25m to $100m.

IFC principal investment officer Kai Schmitz said, “Over the past few years, IFC has become a leading investor in financial technology companies in emerging markets which offer new solutions that expand access to finance. At the same time, we have seen a lack of growth capital available to these companies, both debt and equity financing to support new lending solutions.”

The World Bank member has also been very active in the FinTech space, completing a range of transactions in the space last year. The firm took part in the undisclosed round of commercial and investment bank compression service LMRKTS. Last year, IFC also took part in the $15m Series C round in to Turkish online payments company iyzico.

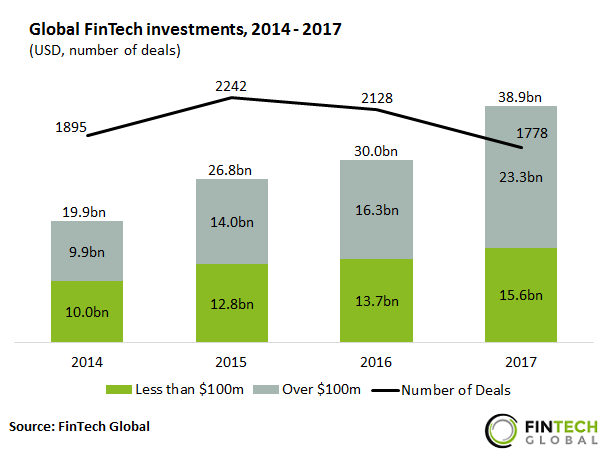

Global FinTech investment has nearly doubled since 2014, with last year there being $38.9bn invested across 1778 deals last year.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global