Brazil-based Creditas has increased its Series C funding round to $55m, with Vostok Emerging Finance leading the round.

The new funding comes from Amadeus Capital Partners and Santander InnoVentures, marking its first deal in Brazil and its second in Latin America.

The round initially closed on $50m late last year, with Vostok committing $25m to the company. Other participants to the round included Kaszek Ventures, Quona Capital, QED Investors, International Finance Corporation and Naspers Fintech.

Founded in 2012, Creditas is a secured lending platform for Brazilian consumers, which offers loans at affordable rates by using homes and autos for collateral. Using these goods for collateral, allow the company to offer borrowers a lower interest rate, longer repayment term and higher loan amount.

Creditas has grown seven-fold over the past 12 months and hopes to use this new equity to support its expansion plans which include ‘significant investments’ in technology and bolstering its client base. IT is also planning to develop new products and move to new markets over the course of the year.

Creditas founder and CEO Sergio Furio said, “Our goal is to lead the dissemination of secured loans in Brazil, as the main instrument to lower interest rates to consumers, promoting healthy and productive borrowing behaviors. We want to maintain our accelerated growth in the coming years, we are just at the beginning and want to be 30 times bigger in three years”.

This is Santander InnoVentures’ second FinTech deal completed this year, having recently made an undisclosed investment in to online car financing platform AutoFi.

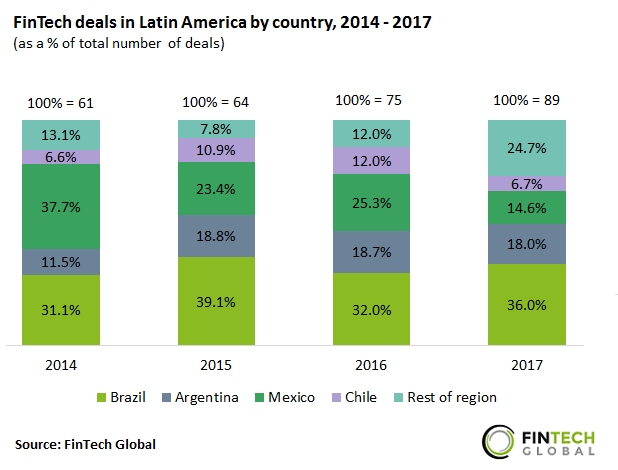

Over the past four years, Brazil and Mexico have dominated the Latin American FinTech sector, according to data by FinTech Global. While Mexico’s share has declined since 2014, from 37.7 per cent to 14.6 per cent, Brazil has retained its share of the market.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global