Plum, a commercial real estate lending platform, has picked up an undisclosed Series B funding round from hedge fund Elliott Management.

San Francisco-based Plum uses data science and AI technology to help wealth managers and commercial real estate owners. Wealth managers can offer their clients a wide range of loan programs including long-term capital, to help offer the best products.

Real estate owners can use Plum to access a selection of loan policies which meet their individual needs, and a network of experts to help choose the best options.

Plum founder and CEO Bill Fisher said, ?Elliott Management is generally recognized as one of the savviest investors of the modern era, and Plum is proud to partner with them in rapidly scaling our breakthrough business model into a national commercial real estate franchise?.

The company previously raised a $10m Series A in 2015 from Chinese social networking platform Renren.

Earlier in the week, credit provider to underserved customers Tala netted $50m in its Series C led by Revolution Growth. The company raised the capital to support its expansion efforts to Mexico and India.

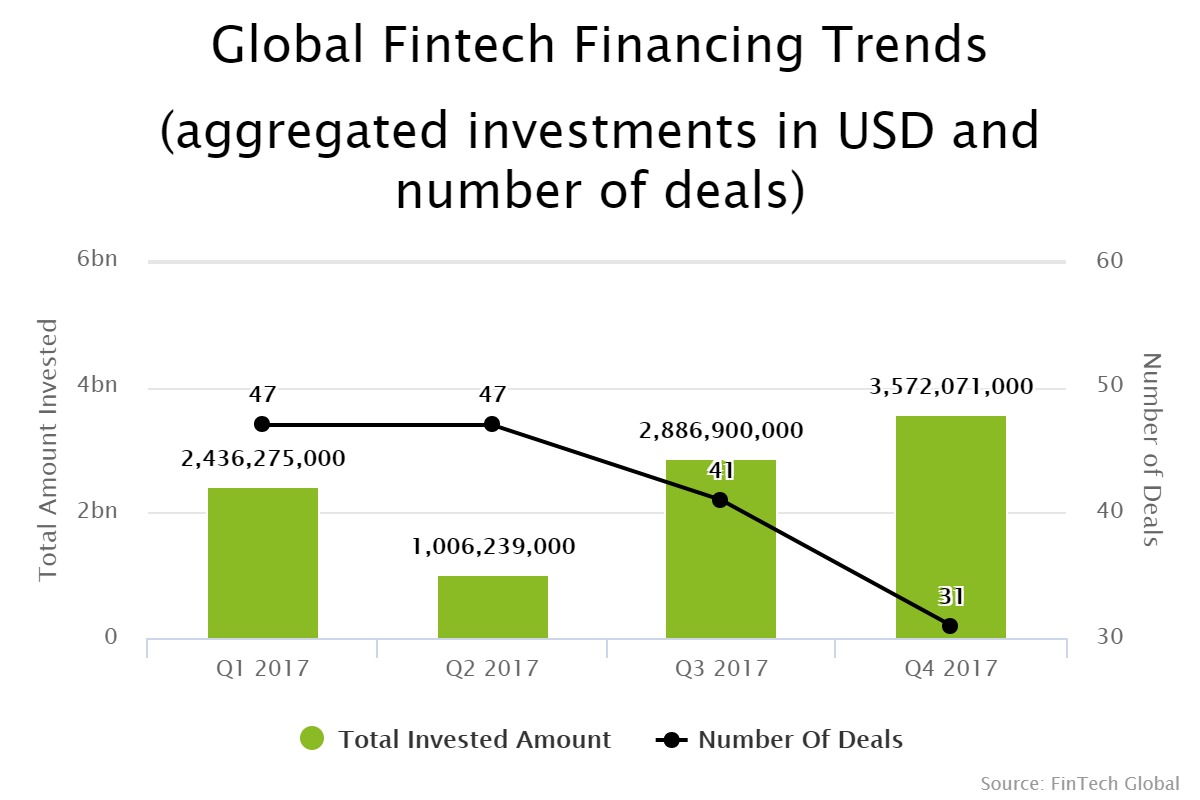

Funding to the marketplace lending sector saw a surge in funding in the second half of 2017, despite a fall in volume of deals, according to data by FinTech Global. The investment volume in H2 hit $6.4bn in 72 transactions, which is compared to the $3.4bn deployed through 94 deals in the first half.

Copyright ? 2018 FinTech Global