Working capital financing provider BlueVine has picked up a $200m credit facility from Credit Suisse.

This financing will be used to expand its selection of credit products, as well as furthering its ‘momentum’ in the sector.

Alongside funding, the company is raising the business line of credit limit to $250,000. BlueVine had already raised the limit earlier in the year from $150,000 up to $200,000. It also doubled the size of its invoice financing service to $5m.

California-based BlueVine provides SMBs with flexible working capital financing options by providing quick access to capital needed to buy inventory, cover expenses or expand operations. The company offers access to lines of credit of up to $250,000 and invoice financing of up to $5m.

BlueVine founder and CEO Eyal Lifshitz said, “We continue to grow stronger as a technology-enabled financing provider for small businesses addressing their everyday funding needs. We’re helping thousands of entrepreneurs reach their business goals with an easy-to-use platform that gives them fast and convenient online access to working capital.”

Earlier in the year, BlueVine partnered with blockchain-based B2B payments company Veem. The partnership was formed to support Veem’s clients with financing their cross-border and domestic payments, as well as accessing working capital for business expenses.

Prior to this credit facility, the company had received $130m in debt financing from Silicon Valley Bank, Bank Leumi, TriplePoint Venture Growth and BDC Corp. This funding came just months after another round with Fortress Capital suppling a $75m credit line.

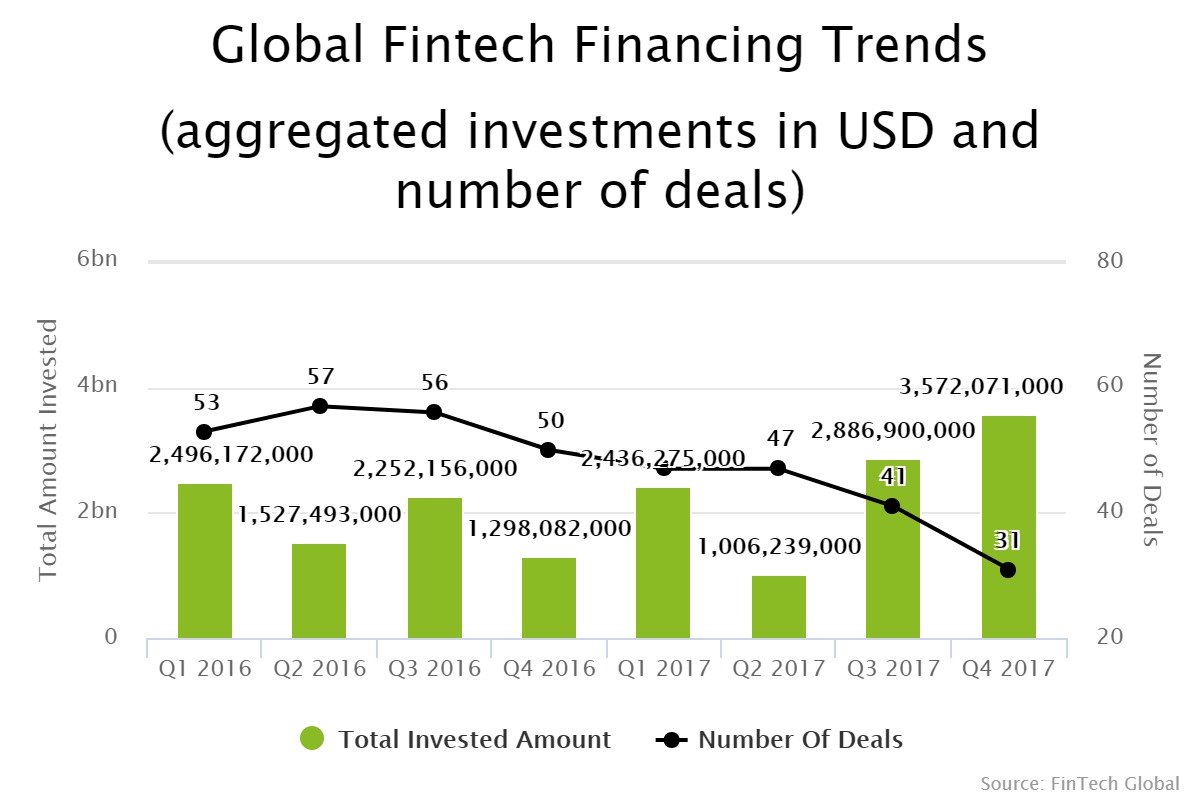

Funding into the marketplace lending sector last year increased by $2bn, compared to the levels reached in 2016, according to data by FinTech Global.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global