Acima Credit, a POS financing provider, has collected a £125m senior credit facility from Comvest Credit Partners.

The company provides retail customers with access to access to financing at the point-of-sale.

Consumers get automatic approval decisions regardless of credit scores, and have 12 months to pay it back. Payments can be made at any desired rate, but if a customer pays it off within 90 days they can save 25 per cent on outstanding payments.

Instead of ratings, loans are passed if the borrower has worked with their current employer for three months or has another source of income, whether they have a checking account and deposit at least $1,000 a month, and if the account is free from NSFs, excessive overdrafts, and negative balances.

Using the app also helps to build a borrower’s credit score, with the app reporting payments and loans with credit bureaus.

This credit facility was used to retire existing debt and support its growth plans.

Acima founder and CEO Aaron Allred said, “We are excited to partner with Comvest Credit Partners. They worked quickly to provide Acima with an optimal financing structure and the capital necessary to execute on our growth initiatives.â€

Comvest recently supplied another lending platform with a credit line, injecting a $32m credit facility to Canada-based Cash 4 You Corp. The company helps the underbanked access financing and supply them with pay-day loans of up to $1,500.

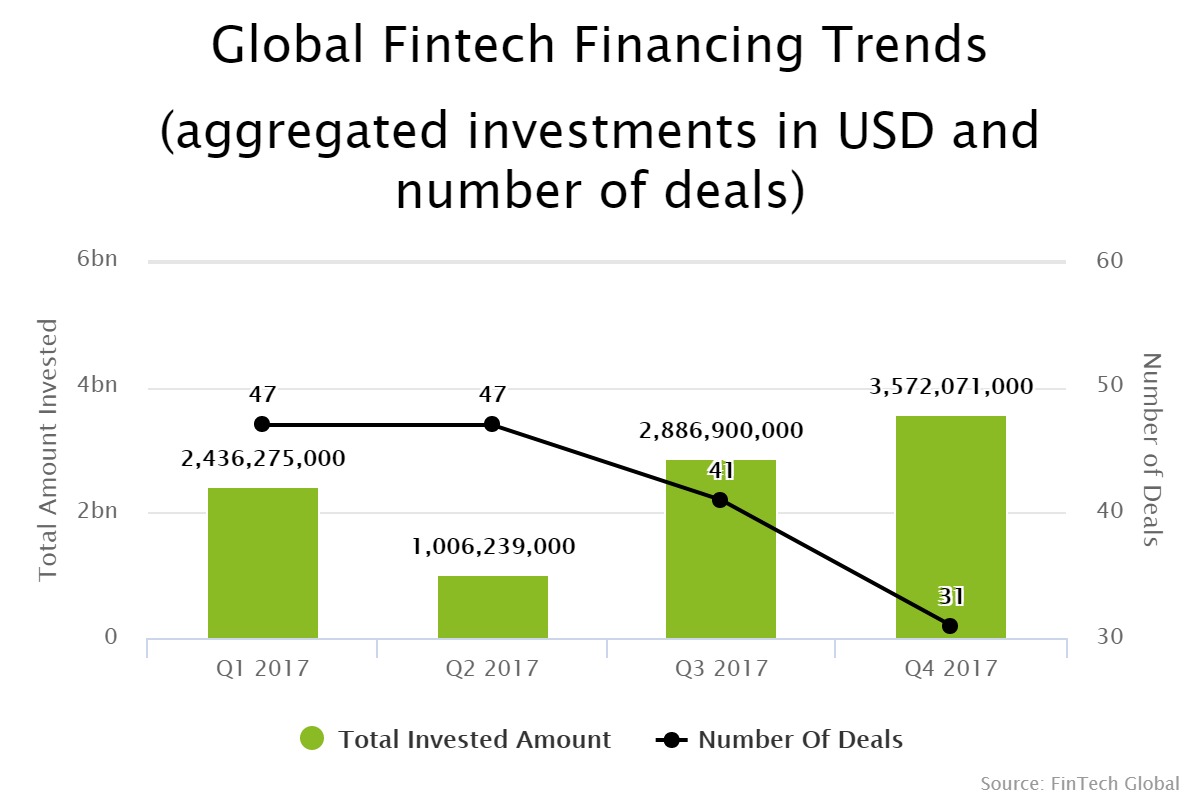

Marketplace lending companies saw a very strong end to 2017 for funding, with H2 seeing $3bn more capital invested than the first half, according to data by FinTech Global. While the funding volume shot-up, the number of deals declined by 22.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global