Digital wealth manager Personal Capital has secured a $15m credit extension by Silicon Valley Bank.

Alongside the new line of credit, the company has passed $7bn in assets under management.

California-based Personal Capital is an online wealth management platform which offers users transparency into their finances with help from financial advisors. Through the platform customers are able to optimise risk and return, avoid hidden fees, receive investment advice, financial planning and tax optimisation.

The platform offers free tools to help consumers view their financial life including 401k and 529 plans, checking and savings accounts, investment accounts and other products. Tools are available for data analysis to help a user understand how their portfolio is performing and how changes to financial habits and investing can impact saving goals.

Personal Capital CEO Jay Shah said, “Personal Capital was built on the idea that transparency and a consumer’s ability to have a holistic view of their finances can transform their financial life. Our team has worked hard to make sure Americans have the visibility that is necessary to realize their investing, spending and saving goals.”

Last year, the company secured a $40m Series E extension round, with IGM Financial leading the round. The Series E round was made up of several extensions throughout 2016 and 2017, totalling around $115m.

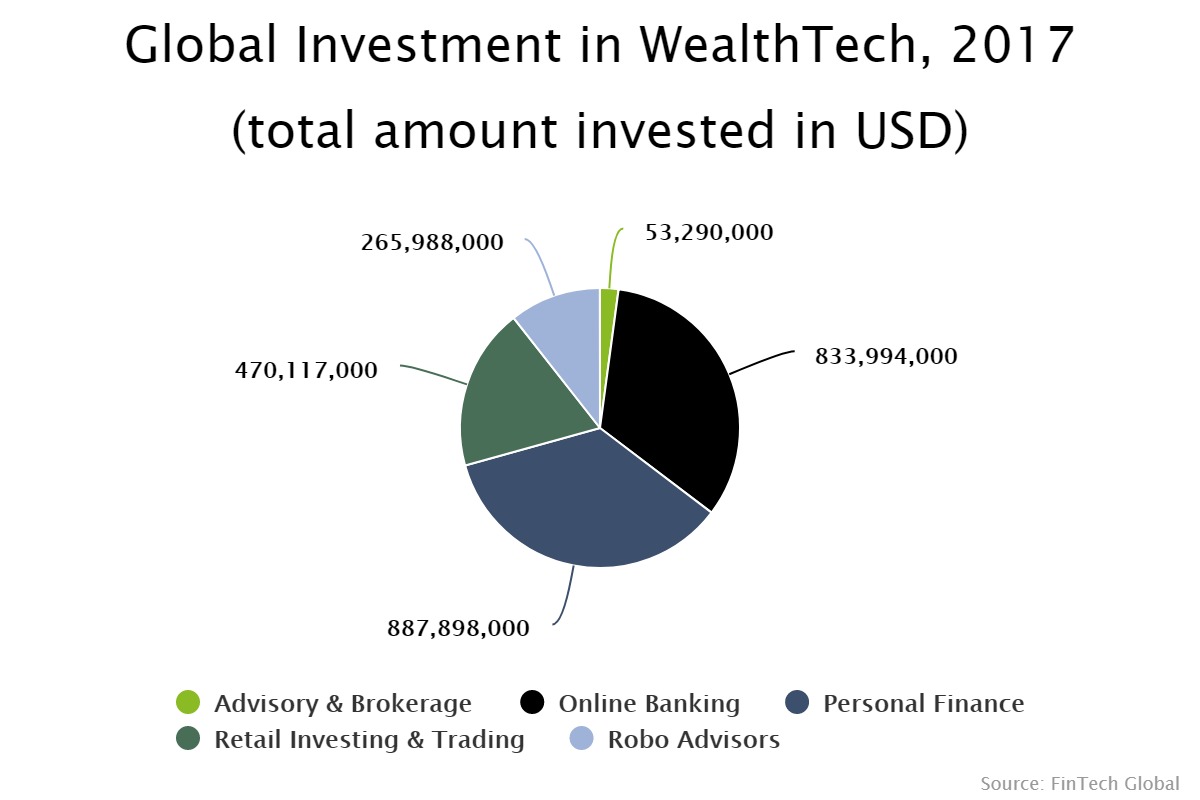

Personal finance companies received the largest chunk of funding in the WealthTech sector last year, according to data by FinTech Global. Of the $2.5bn that was invested in the space in 2017, around 35 per cent was deployed in the personal finance sub-sector.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global