A lack of later-stage deals meant funding in Q1 2018 reached just 17.8% of last year’s total

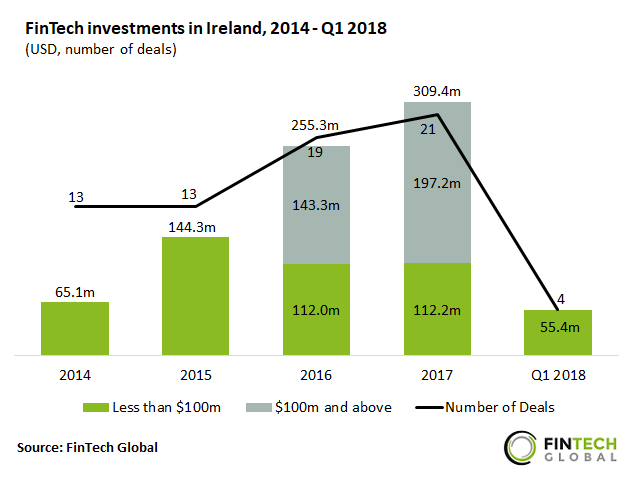

- FinTech investments in Ireland increased rapidly between 2014 and 2017 from $65.1m to $311.6m at a CAGR of 47.6%.

- Last year set a funding record for Irish FinTech with $311.6m capital invested. However, 63.3% of this came from just one deal – SmartBox, an experience voucher and gift card marketplace, which received $197.2m in debt financing from Allied Irish Banks in Q4.

- When funding from this investment is disregarded, the $55.4m raised in Q1 2018 equates to almost half of last year’s $114.4m.

Irish FinTech investments in Q1 2018 increased by almost 30% YoY

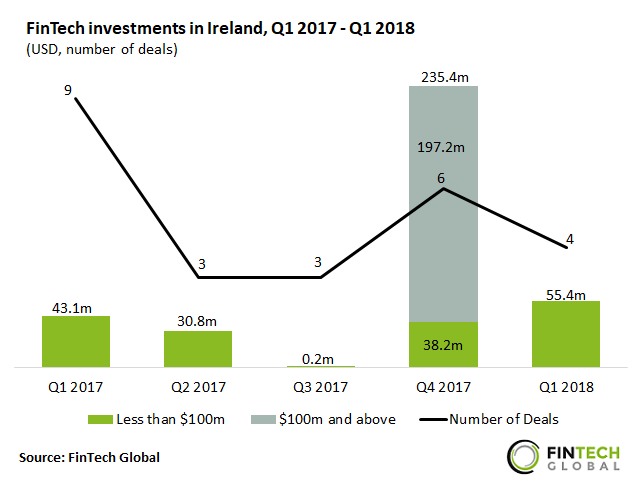

- Irish FinTech funding is still highly variable on a quarterly basis as a result of the sparse deal activity.

- Q4 2017 was the strongest funding quarter to date for the Irish FinTech sector due to the previously mentioned $197.2m investment in SmartBox. Capital invested in Q1 2018 dropped by more than three quarters but was still reasonably high compared to historical figures at $55.4m.

- The largest deal in Q1 2018 accounted for almost 90% of its funding total. This was a $49.4m investment in Future Finance, a student lending platform. The Series C round was led by KCK with co-investment from Fenway Summer Ventures, S-Cubed Capital and Invus.

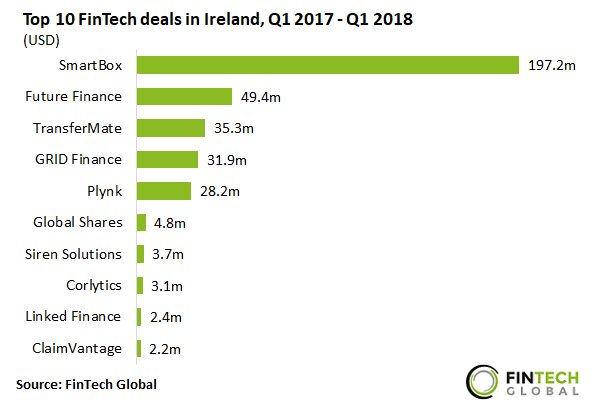

The top ten Irish FinTech deals in the last five quarters raised over $350m

- The combined total of the top ten FinTech deals in Ireland since Q1 2017 reached $358.1m. The top investment, raised by SmartBox, accounted for 55.1% of this.

- TransferMate, a B2B payments company, received $35.3m in venture funding from Allied Irish Banks in the third largest investment.

- All companies on the list are headquartered in Dublin with the exception of Clonakilty-based Global Shares, a financial reporting software provider, and Galway-based Siren Solutions, a big data platform for fraud, risk and compliance.

- The subsectors Payments & Remittances, Marketplace Lending and RegTech all received three deals each, while the remaining deal went to InsurTech company ClaimVantage.

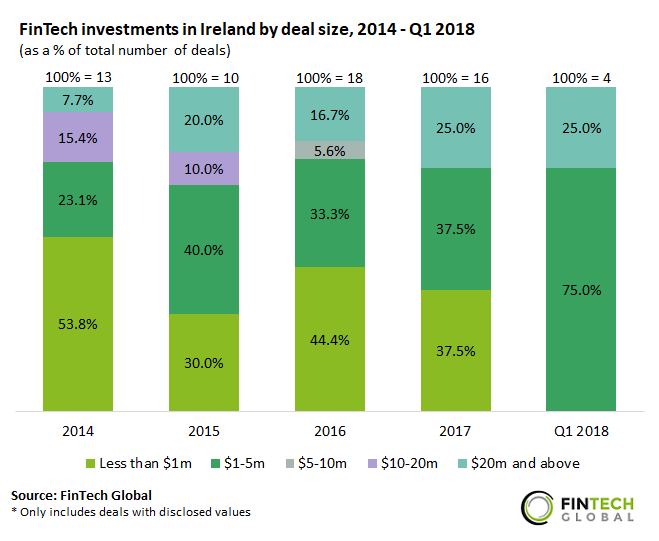

There has been a shift towards larger deals since 2014

- Between 2014 and 2017, deals valued below $1m dropped in share from 53.8% to 29.4%

- Over the same period deals larger than $20m jumped by 21.7 percentage points (pp), while those in the $1-5m category increased by 18.1pp.

- Three of the four deals completed in Q1 2018 were valued between $1-5m. A notable deal among these is a $1m investment in Gecko Governance, a RegTech blockchain solution provider for fund managers and banks. COSIMO Ventures provided the seed funding at a $5m valuation. Gecko recently announced plans to raise a further $20m via an initial coin offering (ICO); the funds raised will be used to develop a new global compliance solution.