US-based cryptocurrency exchange platform Radar Relay has received $10m in its Series A financing round led by Blockchain Capital.

The company operates a wallet-to-wallet decentralised trading platform based on the trading of Ethereum-tokens built on the 0x Protocol. The company never holds the transferred tokens, meaning there are no hidden escrow or exit strategies.

Users connect their metamask account or ledger with Radar and once they give smart contract permission to transfer ERC20 tokens, they are able to transfer tokens with other users.

Since the platform launched in October 2017, it has built a user base of thousands and spans 150 countries. It has onboarded 170 different token types and has helped trade more than $150m in volume.

Its current team is made up of 30 people, but the company hopes to expand this to 100.

Following the financing, Radar Relay will explore partnerships, develop new product opportunities, complete strategic hires and increase global expansion.

In a company blog post about the funding it said, “Tokenisation is shifting asset ownership from analog to digital. Securities, property, art, attention, anything that can be tokenized will be tokenized. The business models, services, and opportunities available here are unprecedented. This massive growth in digital assets means exchange becomes a fundamental infrastructure layer.”

Earlier in the year, Blockchain Capital closed its fourth fund on its $150m hard cap, it largest vehicle to date.

The firm recently took part in the $110m Series E of cryptocurrency payments and investment platform Circle. The company hopes to gain support for its efforts in introducing multiple fiat-backed stablecoins and drive global interoperability.

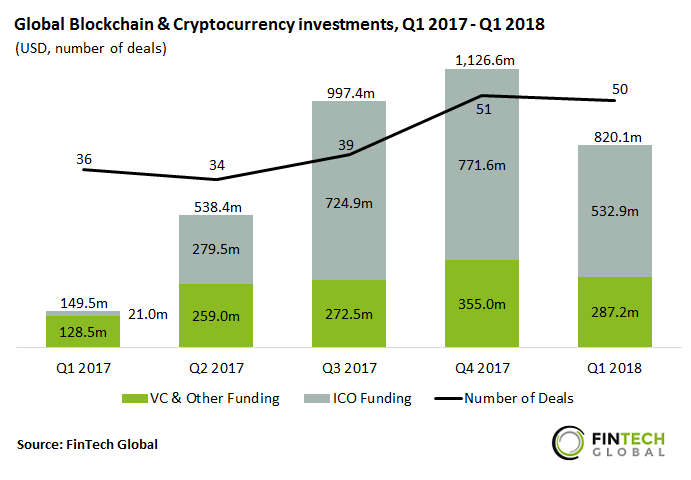

Blockchain and cryptocurrency funding is on track to surpass last year’s record despite the uncertainty around the crypto market, according to data by FinTech Global. In the first quarter of 2018, there was $820.1m deployed across 50 transactions, compared to the same period in 2017 where just $149.5m was deployed through 36 deals.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global