Brazil-based P2P SME lender Nexoos has reportedly raised around $530,00 in pre-Series A funding.

The capital was raised by four local investors, including Brazilian family office Loyall, according to a report by iupana. As part of the deal, Loyall has an option to acquire a bigger stake in Nexoos once it has registered as a formal financial institution, the article said.

Nexoos is looking to acquire a Brazilian banking license within the next six to nine months, the article states. It will then look to raise a Series A round of funding early next year, which could either be a strategic partnership or an investment round.

The company is a P2P lending platform designed to help SMEs connect with individual investors as an easier and fairer route to credit. Businesses can take out loans of between $6,744 and $134,879, with interest rates starting from 1.3 per cent.

Earlier in the year, the National Monetary Council in Brazil launched a new directive which is aimed at helping FinTechs in the country. Under Resolution CMN 4,656, FinTech companies are now able to apply for a license to become a registered credit company or P2P lender.

There has been a selection of Brazilian FinTechs to raise capital this year, including the two challenger banks Neon and Nubank. Neon recently closed a $22m Series A round from investors such as Propel and Omidyar, while Nubank netted $150m for its Series E which was led by DST Global.

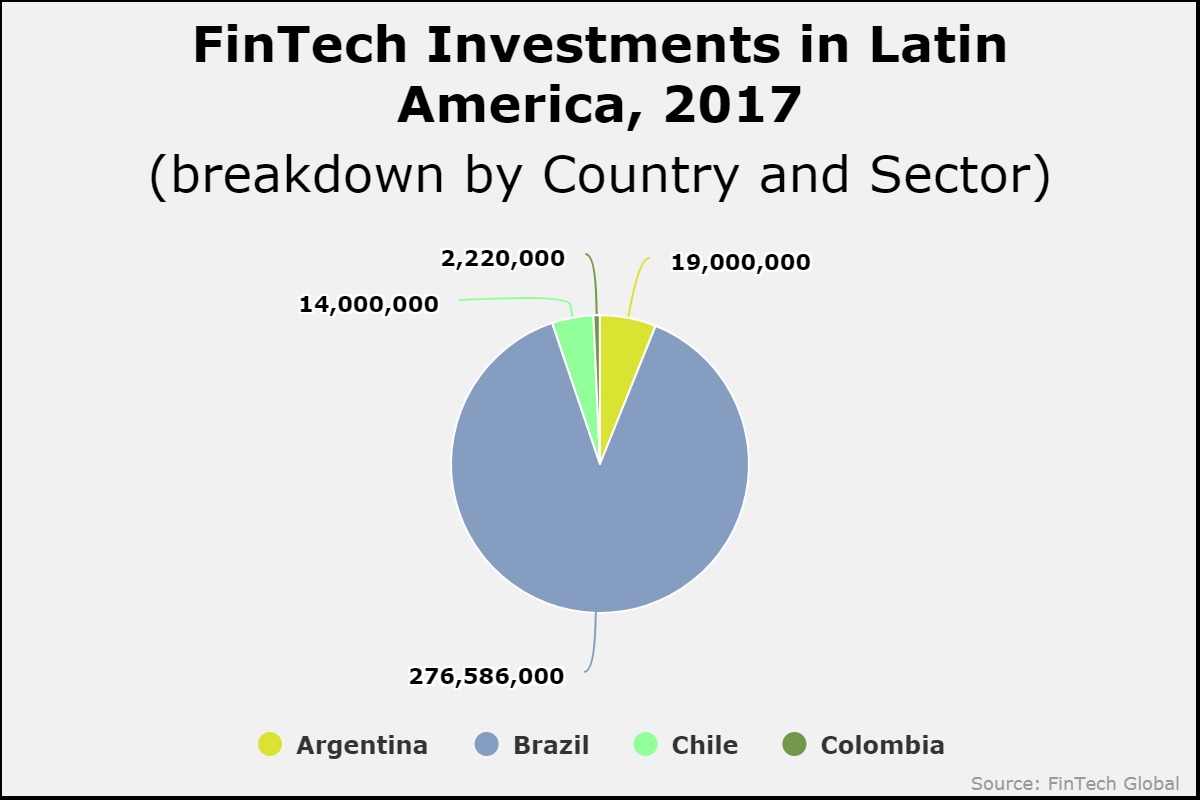

Last year, Latin America’s FinTech market was dominated by Brazil which received 88 per cent of the total capital invested in the region. According to data by FinTech Global, there was a total of $311.8m invested across Latin America in 2017, with Argentina, Chile, and Colombia also seeing some activity.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global