Australian invoice financing company Skippr has allegedly raised $16m in its latest round of funding, made up of both equity and debt.

The round was split, $1m of equity from ‘high-net worth investors’ and $15m of debt, according to a report from Australian Financial Review. This financing round took nine months to complete, and while the debt provider was not named they are an ‘early-stage financial services business.’

Pepper Group co-founder Patrick Tuttle and SocietyOne co-founder Andy Taylor were among the investors in Skippr, it said.

Skippr helps SMEs to access working capital loans in order to pay off invoices, with flexible repayment terms. The platform, which can be automatically synced with existing accounting and bookkeeping services, provides SMEs with tools to forecast cash flow and carry out scenario modelling.

With this boost of funding, the company hopes to deploy $40m in invoice loans and help more small businesses with cash flow, the article states.

Last week, fellow Australian FinTech company, Tic:Toc raised $11.5m in its funding round to support growth into new markets. The company is a digital home loan platform which offers real-time approvals. The platform has four types of home loans, live-in variable, live-in fixed, investment variable, and investment fixed.

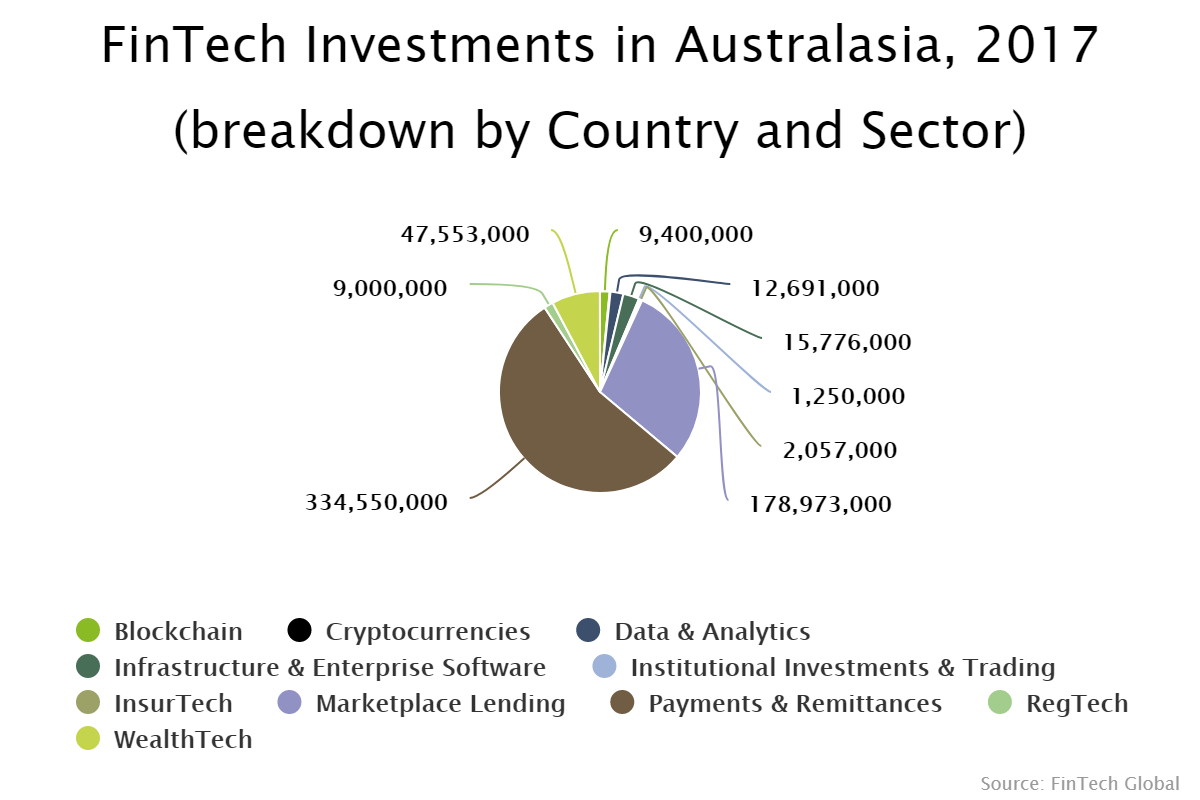

Payments and remittances companies received the lion share of funding in Australia’s FinTech market last year, according to data by FinTech Global.

Marketplace lending companies, which invoice financing companies like Skippr fit in, received the next biggest share of capital, with a total of $178m raised. Of the total $612m that was invested in the country, marketplace lending companies received 29 per cent of the funds.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global